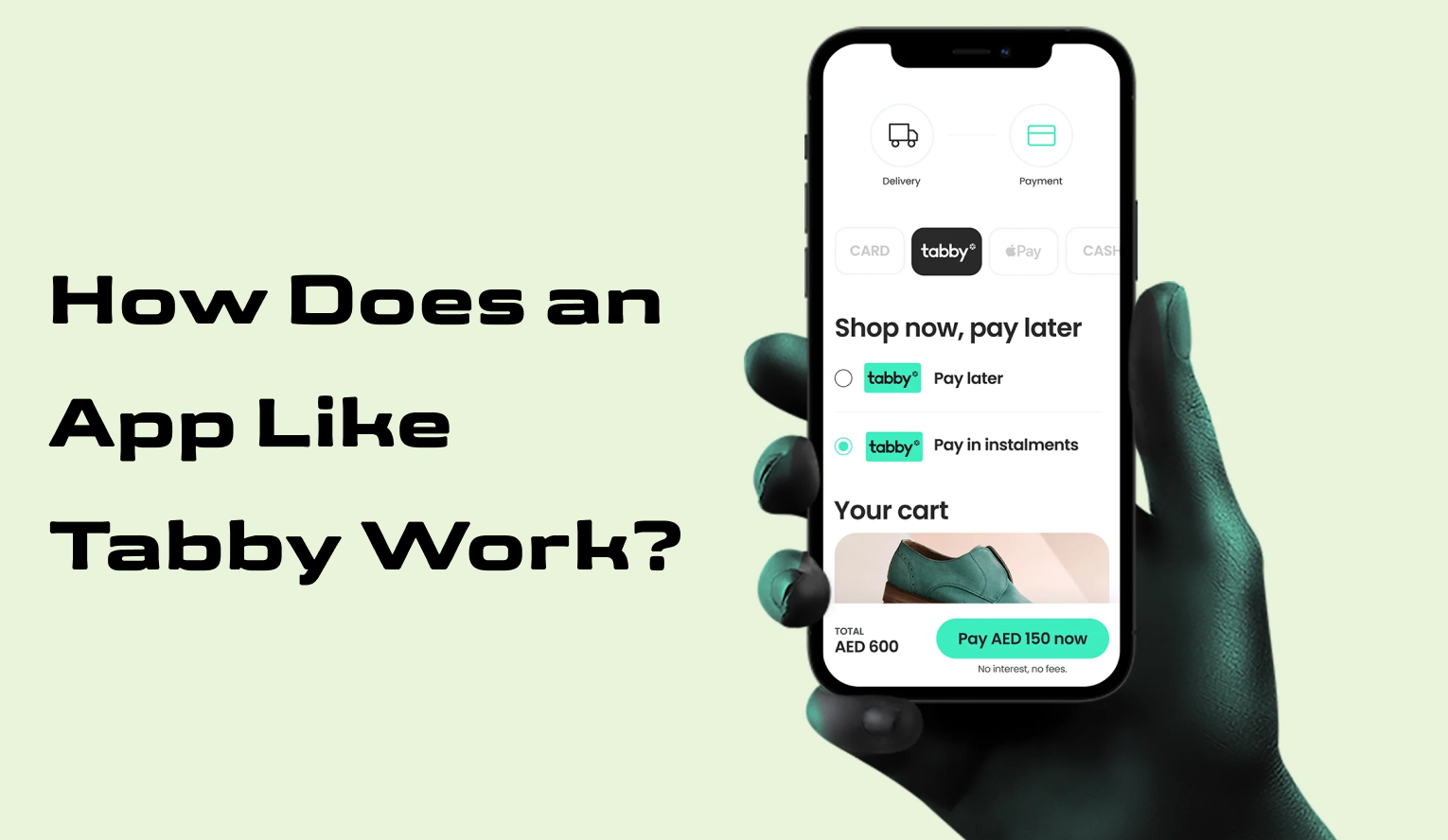

This system has led to new schemes, such as the buy-now-pay-later applications, which are common in the UAE. As a versatile and easy-to-access online app, the tabby application is ideal for many consumers who wish to purchase and pay later without being charged interest. This post describes in detail how the business model of the tabby app functions, explaining the benefits that result from its use for both the user and the merchant, as well as the broader impact it causes on the market.

The Business Model of Tabby App

Tabby works on a BNPL model, which has massively grown over the past few years. Compared to the traditional credit model, with buy now pay later apps in uae, users can purchase and then pay later without interest if they can pay off within the agreed duration.

How Tabby Works?

When a user buys something via Tabby, the app charges the merchant for the full amount on their behalf. Users, in turn, make repayments to Tabby in small amounts over time frames varying from a few weeks to several months in installments. No interest is charged if the user repays Tabby within the prescribed time frame; otherwise, Tabby will pay a small fee.

Revenue Streams for Tabby

One of the most critical aspects of Tabby's business model is its revenue streams. Tabby generates income primarily through the following methods:

Merchant Fees:

This is the fee paid by the merchants to Tabby concerning every transaction. As a percentage of the sale, this standard fee is a trade-off for the increased volume and customer satisfaction that Tabby brings.

Late Fees:

Though Tabby claims zero interest, it still charges its customers a small late fee. This is the secondary revenue stream—though not the core strategy- as the company strives to ensure disciplined spending.

Affiliate Marketing:

Tabby uae earns money in affiliate marketing, too. For every purchase a user makes while using the Tabby app, the company earns a commission from the many merchants it works with for the traffic and sales it provides.

The Appeal of Tabby to Users and Merchants

It is advantageous equally for the customers and sellers in the marketplace. The ability to make purchases and not necessarily pay cash at the time of sale is a key factor from a user’s perspective, more so in the current world where financial freedom is everything. For the merchants, association with Tabby would mean additional sales and customer satisfaction since shoppers are more likely to travel down the purchase funnel if offered the option to pay in instalments.

Interest-Free Installments:

Payers can shop interest-free if they make payments as agreed upon in the payment plan, wooing them away from traditional credit cards.

Seamless/Convenient:

The tabby dubai app is user-friendly and easily integrates with other offline and online shopping apps with which a customer might make a transaction. It also seamlessly integrates with the merchants' POS systems.

Financial Control:

The Tabby app for iOS eases money spending, as users can afford to break the payments without draining their pockets.

Benefits for Merchants

Apparent Increase in Sales:

Merchants typically experience increased sales as customers are more likely to complete a purchase; otherwise, they might drop without the BNPL option turned on.

Better Customer Retention:

The availability of flexible payment options, for instance, with Tabby, enhances customer satisfaction and their probability of returning.

Lower Cart Abandonment Rates:

The option to defer payments can considerably reduce cart abandonment, which almost touches 80% of e-commerce.

Empowering Purchases, One Installment at a Time

How Can You Develop A Buy Now Pay Later App Like Tabby?

Building a BNPL app like the tabby app for mac requires strategic planning from the front of technological expertise and an in-depth understanding of the target market. Here is an in-depth look at significant steps on how to build a successful BNPL platform:

1. In-Depth Market Research

Thorough market research is required before the development stage, considering the target market's refined details, potential user demographics, and possible consumer behaviour patterns. For example, BNPL services have been quite popular in the UAE among young, tech-savvy consumers who value financial flexibility.

Some of the elements which have to be considered in market research are:

Consumer Needs

Competitive Analysis

Regulatory Environment

2. Technology Development and Integration

Technology is the heart of a BNPL app. Implementation doesn't involve just setting up an app interface; the app should be secured and tuned to process as many transactions as possible in the shortest possible time.

These steps are involved in technology development:

Selection of Platform

Backend Development

Payment Gateway Integration

Security

3. Building Out Strategic Partnership With Merchants

Hinging the success of a BNPL tabby app for android to its network of merchant partners, these partnerships are imperative as they influence the type of products and services that will be exposed to users.

Strategies for Building a Strong Network of Merchant Partners:

Targeted Joining

Negotiation Terms

Seamless Integration

4. Ensuring Regulatory Obligations Are Met

One is the inability to handle all the local regulation requirements for a BNPL service operation. Since BNPL is a financial service, one has to abide by all the country's regulatory laws.

The means to ensure alignment with all of the regulations include:

Legal Consultation

Data Protection

Anti-Fraud Measures

5. Strategic Marketing and Launch

After the apps have been developed and tested, a strategic marketing plan is in place to generate buzz and draw in users. The market for BNPL is tight with competition so a well-done launch can ensure the success of your app.

Key components of a successful marketing strategy include:

Digital Marketing Campaigns

User Incentive

Partnerships

Ongoing User Engagement

How Much Does It Cost To Build An App Like Tabby?

Below are a few aspects that affect the cost of developing a BNPL service app like the tabby app in uae:

Development Team:

The senior and junior developers, IT engineers, designers, and project managers who will manage the project must be hired. There is also the cost of development depending on the scale of the app.

Technology Stack:

The technology stack chosen, programming languages used, and other items such as databases and cloud services will also affect the cost of developing the tabby app download.

Compliance and Legal Fees:

Meeting the regulatory requirements for the app can increase the development cost, especially in regions with strict financial regulations.

Marketing and User Acquisition:

Launching and marketing an app requires significant budgets, especially in a very competitive market like BNPL. This will include online advertising, promotions, and partnerships.

Maintenance and Upgrades:

Upon its launch, the system needs regular maintenance and updates to run and ensure new features are uploaded. This recurrent cost could run into thousands of dollars per year.

"Flexible payment solutions are the future of shopping and Tabby is the pioneer championing this revolution in the UAE market"

BNPL Apps' Rise in the UAE

Tabby's successful phase in the UAE opened up numerous options for tabby buy now pay later (BNPL) apps that different consumers could apply to manage their finances. Other apps similar to Tabby meet different needs and preferences of the consumers but have the same objective of making shopping more convenient and accessible with installment-based payment schemes.

Top Tabby Alternatives

1. Postpay

Postpay, a well-known BNPL app in the UAE, has followed the same approach as apps like Tabby, where purchases can be split into convenient interest-free installments. The big highlight of Postpay is its partnership with a big retail network that spreads online and offline, specifically to reach the consumer's favorite brand and store.

2. Spotii

Another huge player in the UAE BNPL landscape is Spotii. With apps like Tabby in uae, it offers interest-free payment plans over some weeks to an average of two months. What sets Spotii apart is that it tries to empower the user and give a feeling of shopping inclusivity and reach. It has partnered with different merchants, from fashion and beauty to electronics, giving users various options to shop and pay later.

3. Tamara

Tamara is a severe compliment, indicating the BNPL concept in a quick and intuitive way for the UAE shopper. It brings flexibility to the payment plans where one can break purchases into three equal installments over some time and incur no interest. This tabby alternative in uae is also focused on security, ensuring that no users' financial data is breached.

How These Alternatives Stack Up Against Tabby?

The popularity of BNPL apps in the UAE is growing, and with it, the competition between the platforms, each one trying to bring more value to the users. Tabby remains a frontrunner, while Postpay, Spotii, and Tamara are fast-growing because they offer similar services but with their unique benefits.

User Experience and Interface

All of these tabby alternatives are very smooth and easy to use. Postpay and Spotii are designed to be intuitive, making it a breeze for users to navigate through the application and enabling them to take care of their payments.

Merchant Partnerships

The merchant spread is another vital aspect to users when choosing a BNPL app. Tabby is much ahead in this and has multiple partnerships across several sectors. Postpay and Spotii are catching up and have many partnerships across most merchants.

Payment Terms

Each app has its respective features regarding payment flexibility. While Tabby and Spotii feature agreements in four installments, Tamara has agreements with three installments; otherwise, most have this in common: they are not laden with interests.

DXB APPS- Your Partner In App Development Dubai

DXB Apps is an innovative mobile app development company in uae, actively involved in developing friendly apps for customers in the UAE according to the business needs and aspirations of the customers. With DXB Apps, you can leverage its team of expert mobile app developers Abu Dhabi to turn your BNPL app idea into life.

If you want to develop a BNPL app like Tabby, DXB Apps is the perfect match. Contact us with your project details today to learn how you can excel in the competitive BNPL market.

Conclusion

Tabbay has redefined the shopping experience for its consumers across the UAE by allowing them to shop now and pay later, with a 0% surcharge. Its business model is based on monetizing merchants through late fees and affiliate marketing, and it has shown resounding success in the blistering BNPL market. Businesses willing to develop a tabby shop now pay later must know the market dynamics, technological requirements, and regulatory landscape.

FAQs

What is the Tabby app?

Tabby is an e-commerce enabler that allows shoppers to make purchases and pay for the products in simple, flexible, and interest-free installments. It will enable consumers to shop with a flexible payment solution, easing shopping behavior and empowering better financial control, whether in-store or online.

What is tabby payment?

Available on Tabby, Tabby payment is a user's financing option. They may pay for their purchase over a lengthened period in small installments with no interest. These were created to allow users financial freedom, which would not disallow incurring the burden of extra costs at that particular moment.

How does Tabby make money?

Tabby makes its money from merchant fees, whereby the consumers do not incur any costs, while the retailers pay them to Tabby to provide the BNPL option to their consumers. Additionally, Tabby might make money from the late payment fees and partnerships with integrated banks and other businesses.

Is Tabby interest-free?

Yes, indeed, Tabby is interest-free for all repayments made on time. If you follow the dues schedule correctly, no interest or additional charges are incurred.

How does Tabby benefit?

This means that the consumer spends more with the Tabby partner merchants. Merchants benefit from better conversion ratios and larger average order values, while Tabby makes money by charging the merchants fees.

What is the business model of tabby?

Tabby is based on the Buy Now, Pay Later business model. It works with various retailers/shops to provide installment plans to their customers. The company operates on merchant fees, late payment fees, and other financial service partners that charge additional fees.

How to get tabby plus?

To be eligible for Tabby Plus, the user must meet certain criteria. These criteria could include maintaining a positive repayment history, using the app regularly, and other criteria the platform sets.

What is the difference between Tabby and Tabby Plus?

Tabby Plus is an upgraded version of the regular Tabby service, entailing higher spending limits, exclusive offers, and potentially more payment convenience kind of like the premium service that gives thanks to the large user base.

How do I increase my tabby balance?

You can build a better Tabby balance by maintaining a good repayment history, using the app for purchases as often as possible, and ensuring that all the payments you have to make are timely. In doing so, Tabby will also consider other factors, such as the overall creditworthiness it finds.

Who is eligible for tabby payment?

Eligibility for Tabby payment typically requires users to be of legal age, reside in a region where Tabby operates (such as the UAE), and pass a basic creditworthiness assessment. Additional criteria may include having a valid ID and a supported payment method.

How does Tabby work in UAE?

In the UAE, Tabby partners with a large base of merchants to offer the Buy Now, Pay Later option. Shoppers can pay for their purchases online or in-store and select to divide this into installment payments at 0% interest through the Tabby app. It is frictionless and entirely nonintrusive to the shopping process.

How do I pay my Tabby installment?

You can pay your Tabby installment right through the Tabby app with any payment method, be it a credit or debit card. The app will also notify you of the following installment dates. You can control and monitor all your installments from here if needed.