This is the ideal moment for loan lending app development for a number of reasons. Due to the unstable state of the market economy, numerous investment-related projects have been shelved or delayed. We're not talking about institutional investors here; a lot of everyday people can lend money to businesses or people in need. This is peer-to-peer lending.

Peer-to-peer lending websites and apps have made it feasible to lend money while relaxing in your recliner. These apps are starting to gain some traction in the Fintech sector. Would you like to know how to start a P2P lending app development business? Continue reading!

What Are P2P Loan Lending Apps?

Peer-to-peer or "person-to-person" loan lending are other names for P2P lending. This expression describes lending and borrowing that takes place directly between people as opposed to via conventional financial middlemen. Often, peer-to-peer lending occurs through specialized websites where users can take on the roles of both lenders and borrowers.

The loan lending app works like a credit card and allows users to get an instant loan. The only things customers need to do are install one of these apps and create an account. Customers then have to input their financial and personal details and verify their eligibility.

Categories for Developing Loan Lending Apps

The intended audience is the primary factor influencing the loan lending app development process. Many customers decide to take advantage of the many loans available. Collaborate with the top loan lending top mobile app development company that provides a variety of loan options.

1. Loans For Students

If you wish to provide the services in your location, take into account that this group has a big influence on loan lending mobile app development services. In order to pay for their graduate studies, students take out loans. All you have to do is accept yourself, show your documentation, and the loan will be granted.

2. Mortgages

If you're ready to assist with mortgages, all you need to focus on is how to start a loan application. Hiring top app developers will provide you with innovative, useful, and user-friendly solutions. These apps let you reach a larger audience and increase the likelihood that users will tell others about your app because of how user-friendly they are.

3. Auto Loans

You can enable your users to savor the small pleasures in life by providing quick loan services. Finding the most reasonably priced loan lending android app development and entering the market with a product that can make things easier for you are all that is required to obtain quick car loan services.

4. Individual Credit

These are the loans that have specifically been taken out for individual usage. Because these loans are unsecured, their interest rates are usually higher. If you're interested in providing consumers with personal loans where you may charge higher interest rates and make a profit, get in touch with mobile loan app development service providers who can lessen your workload.

5. Loans For Businesses

As a result, you want to help startups and entrepreneurs grow and succeed, but you're not sure how to create a lending app. Then, all you need to do is contact the developer of the loan lending app and provide him the data.

Why Invest in P2P Loan Lending App Development?

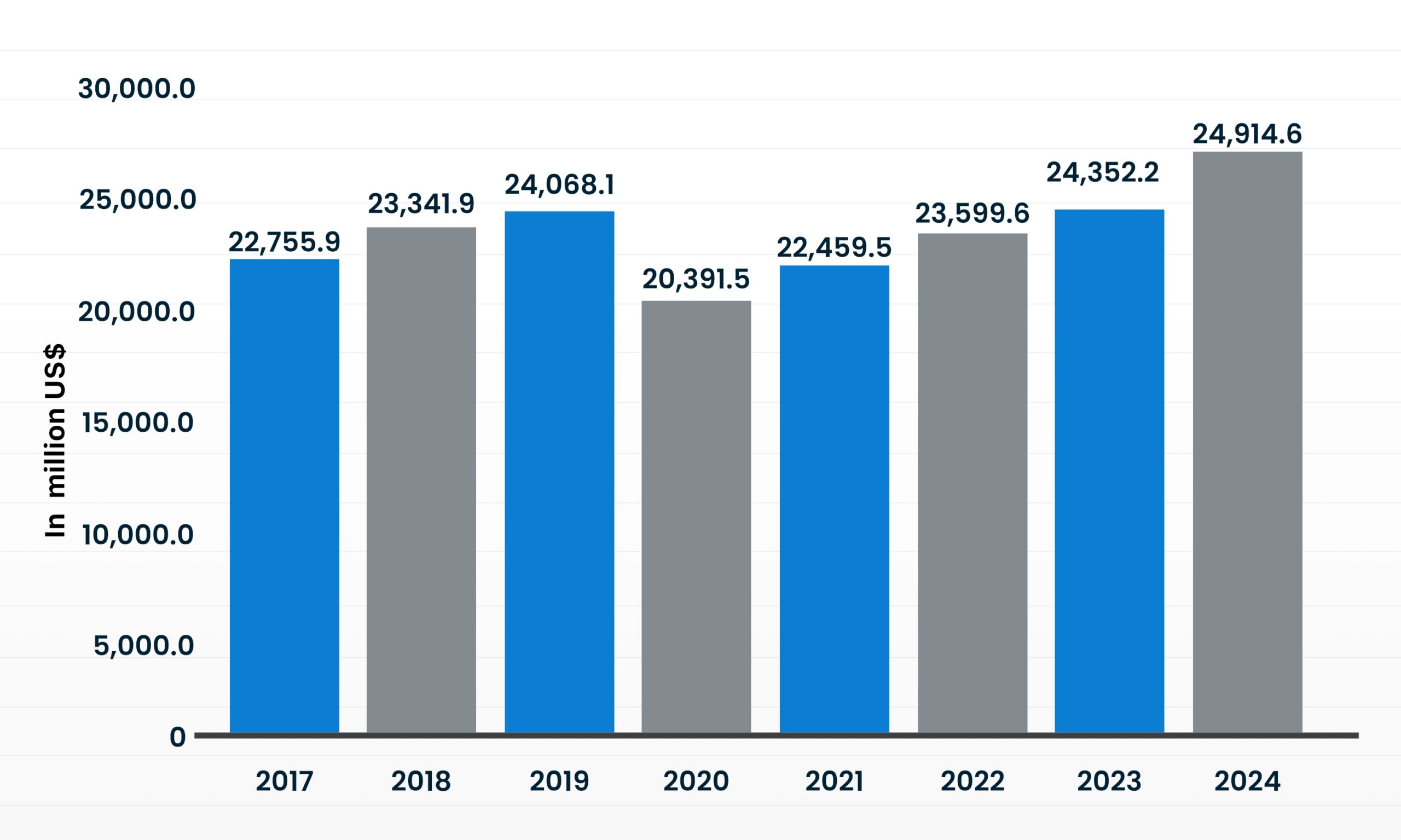

According to a Statista estimate, this year will see a gradual expansion of the loan lending sector, with the marketplace lending category's transaction value expected to reach USD 20,391.5 million this year alone. This market will grow to be worth USD 24,914 by 2024.

View this graphical representation of the same thing:

It's clear that there are more and more smartphone apps available for lending loans. This was fairly evident from the research that was done in the US in 2015. The results of the survey showed that 31% of participants wanted access to these apps because they would facilitate quick and simple loan applications.

Things You Should Know About Encryption & Legal Compliance

These topics need to be discussed individually since they are crucial to conducting business legally and avoiding difficulty. To avoid hackers, you also need to secure your website and loan application.

Guaranteeing Tolerance for Errors

Developers must take fault tolerance into consideration if they are developing P2P loan lending software. It means that even under extreme strain caused by multiple simultaneous actions, it will keep working. Because of this, developers need to use a special tool that can handle fault tolerance.

2. Prioritize Security

Both your mobile application and website should have adequate security against common threats such as SQL injections, XSS (cross-site scripting), exposing of private information, improper authentication, etc. All user and lender personal information that is acquired from a third party must be encrypted using the most recent encryption techniques and signature technology.

3. Adherence to the GDPR

You have to make sure that your lending application complies with GDPR if you design software for the EU market. On May 25, 2018, the General Data Protection Regulation, or GDPR, came into effect.

4. Adherence to CCPA

You have to follow the California Consumer Privacy Act (CCPA) if you develop a lending app for Californians. The main goal of this legislation is to give consumers more control over their personal data. If the CCPA takes effect on January 1, 2020, and California is your target market, you will need to make your P2P lending app development CCPA-compliant.

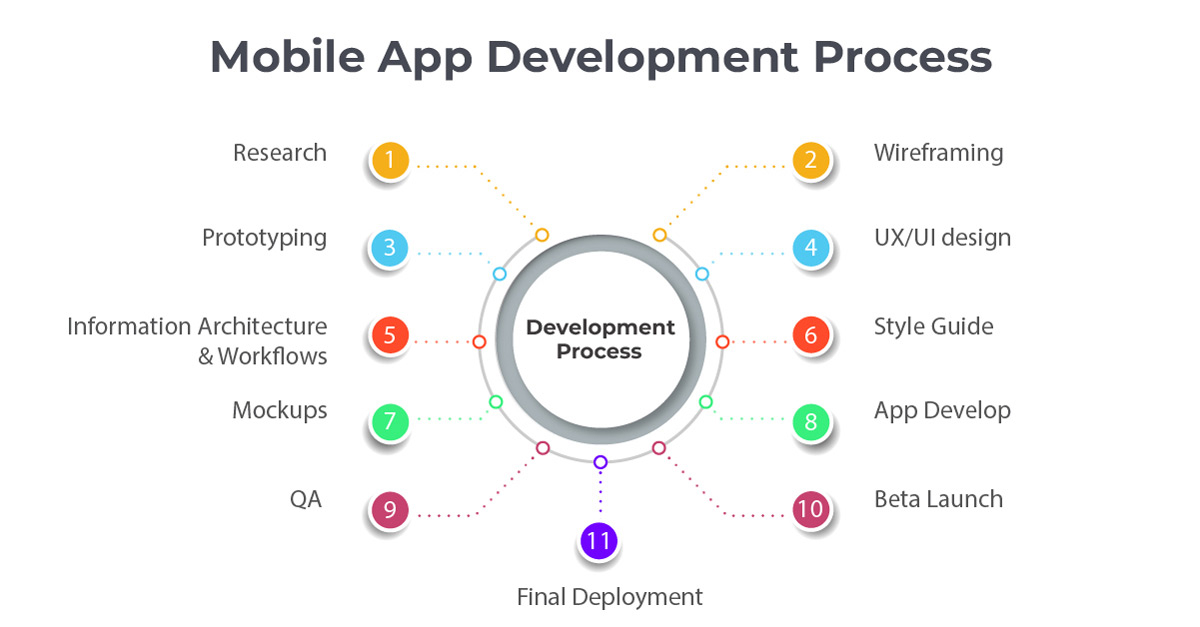

Important Phases of Loan Lending App Development

This is the basic process that experts follow while developing a loan lending app. In addition to helping you generate enormous earnings and keeping you continuously engaged in the growth process, it is also quick and inexpensive.

1. Concept

In order to establish a company, you or we will need to come up with an incredible idea. The loan app's creator will take into account any suggestions you may have and combine them with expertise to produce a popular lending tool that will bring in a sizable profit.

2. Idea

R&D is crucial for a company's initial launch. A precise market analysis and user interface design are essential for developing a loan application that benefits your business. There is more pressure on UI/UX Design team to differentiate themselves from the competitors.

3. Put into Practice

Follow the stages as instructed by the clients. It's crucial to be flexible and take the route that best utilizes the capabilities and functionalities provided. Including the features and capabilities that the clients seek is the focus of the custom solution.

4. Assurance of Quality

We use state-of-the-art methods to test the application. The experts in software testing and quality analysis make sure your program is error-free. You can be certain that the program will be bug-free after extensive testing.

5. Assistance

One year of free support may be offered following the delivery of a particular project to the client. This increases your convenience when utilizing services.

How Much Will It Cost?

A lot of factors might affect how much a loan application costs. The price of the app is determined in part by the mobile app development team that was hired to create it, but there are other factors to take into account as well, like:

- The intricacy of the application

- Integrated features

- The architecture of the application

- Where the loan lending app development business is located

- The length of time an app is developed

- The program can cost anywhere from $30K to $100K, depending on the features you choose to incorporate, such as payment methods and banks.

Choose DXB APPS For Your Successful Web Development Project

DXB APPS is one of the top website development company Dubai. In addition to having a wealth of experience in the development of Fintech apps, we provide a wide range of services, including maintenance and legal assistance for custom mobile apps.

Concluding

There are chances for entrepreneurs to invest in loan lending apps as there aren't many of them at the moment. People are rapidly moving away from bank loans and toward quickly accessible loans through mobile apps, so if you can create a winning application for yourself, you may have an opportunity to differentiate yourself from the competition.

FAQs

Which laws and regulations must I follow in Dubai when creating a loan lending app?

In order to build a loan lending app in Dubai, one must adhere to rules established by organizations that oversee financial transactions, like the Central Bank of the United Arab Emirates and the Dubai Financial Services Authority (DFSA).

How can I make sure that my loan lending app protects users' financial and personal information?

Answer: Use strong encryption methods to protect sensitive data in order to guarantee the security of users' data. Use secure payment gateways and multi-factor authentication for user accounts. In order to remain ahead of potential dangers, regular security assessments and updates are also necessary.

What are the usual timelines in Dubai for creating and releasing a lending app?

In response, the length of time needed to create and release a loan lending app in Dubai can vary based on the features, complexity, and productivity of the development team.