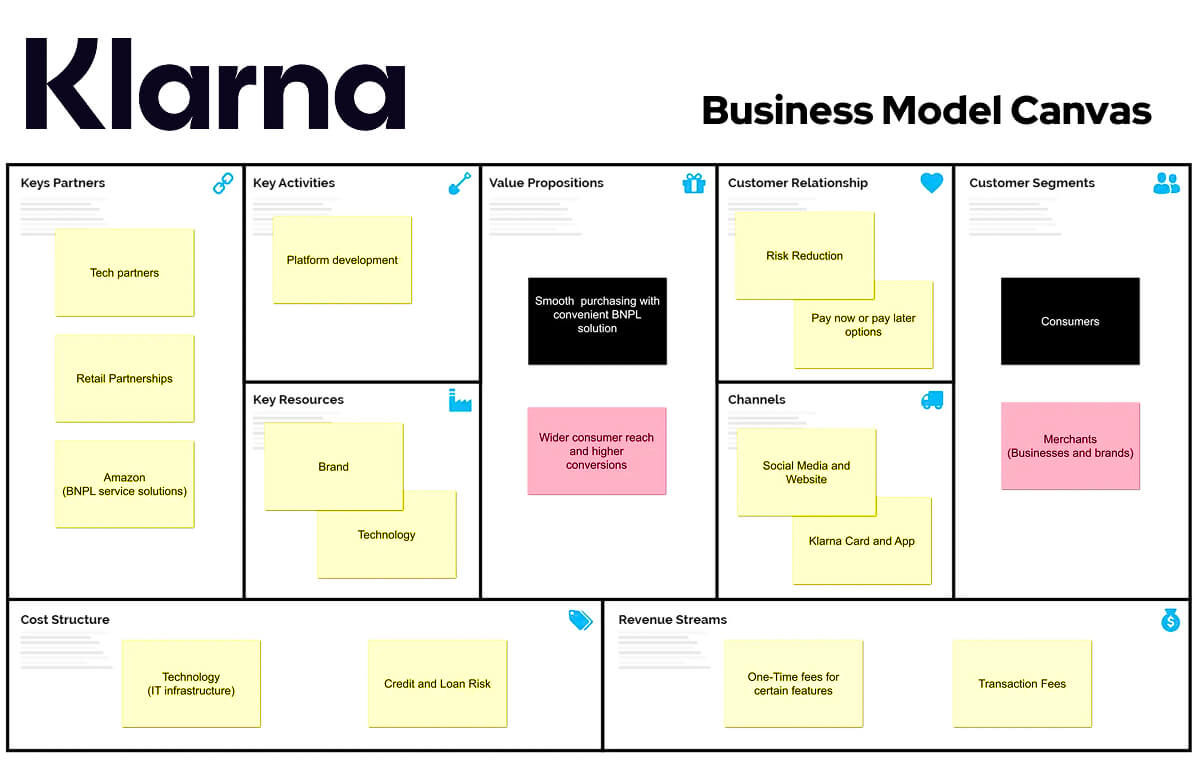

To support this statement, Klarna, one of the earliest movers in the sphere of Buy Now Pay Later, was made to empower consumers to buy at all times without immediate payment. Established in 2005 in Sweden, Klarna has prospered immensely and stands as one of the major global BNPL services. Through very flexible and convenient consumer payments, Klarna offers three types of disruptive changes that disrupt consumers' shopping behaviours and reconstitute the financial services industry.

This article will cover Klarna's business model, its implications for companies, and future growth in the sector. Simultaneously, we will detail what a Klarna UAE move consists of and how a company can use it to enhance its sales quotient and customer satisfaction levels.

What is Klarna and How Does It Work?

Klarna has a trendy shopping fad with this online service that allows customers to pay later for today's shopping. It is, therefore, based on flexible payments, in which people pay their purchases in instalments or sometimes are allowed to pay a month later without attracting interest or paying fees, provided payment is made within time.

Basically, Klarna provides three services:

Pay Now:

This will allow consumers to pay when they check out, thereby completing the purchase transaction immediately. There will be no delayed payment; you will get it now it's paying full price.

Pay Later:

This facility offers consumers a 14 or 30-day grace period during which they can pay for any purchases they might have made. In this sense, consumers receive their goods first and thereafter pay for the products, thus forcing the consumer to enjoy free testing of his commodities. If it is within this time period, then there is no interest involved.

Slice It:

This is a pay-by-installment option, which splits the total purchase into smaller, manageable payments over a fixed period, usually between 3 to 36 months. This option does not have Pay Now or Pay Later, and interest is usually charged, although some promotional offers waive it.

These are automatically integrated into checkout on the partnering websites, such that when the consumer is directed to checkout, they can have Klarna be their preferred form of payment. Consumers also receive control over the payments, and they can track purchase history through their Klarna UAE application, which would provide them with better transparency and more convenience.

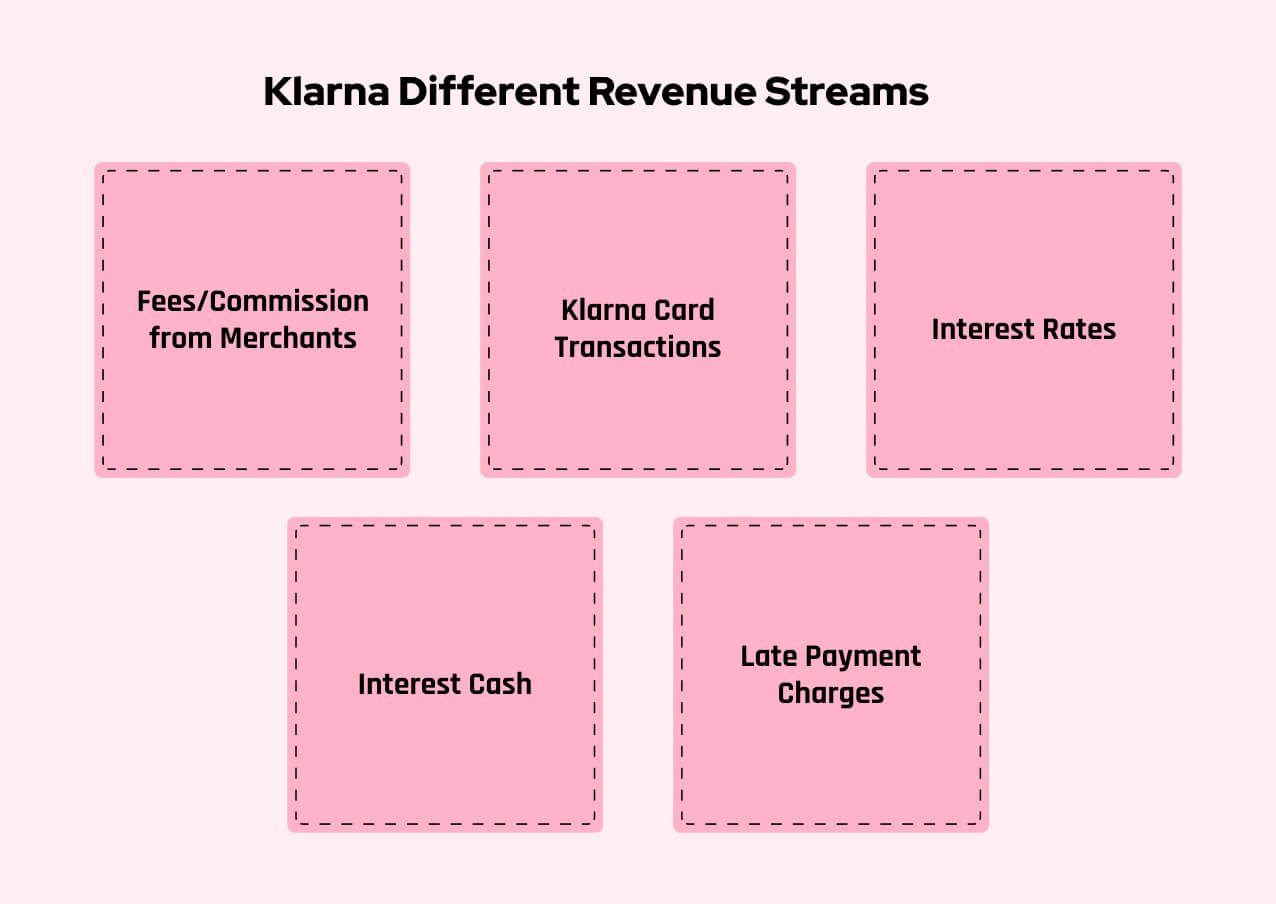

Streams Where Klarna Generates Its Revenues

There are three main sources through which Klarna app generates income:

Merchant Fees:

Klarna takes a fee from the merchant each time a customer uses Klarna's service to purchase. It typically is a percentage of the transaction value but fixed. And key in its favour: merchants pay Klarna because it helps them increase conversions and reduce cart abandonment.

Consumer Fees:

Klarna provides consumers with several free options for paying their dues, but if customers miss a payment or fail to make timely payments, they face late fees or interest charges. While Klarna does its best not to penalise its consumers in terms of payments, this fee structure is one crucial area of revenue generation for Klarna.

Installment Interest:

Klarna earns revenues whenever consumers select Slice It to pay in instalments. The interest rate varies with the payment schedule and relies on consumers' credit history, which can be as low as 0% and as high as 29.99%. Interest rates charged are part of Klarna's means of generating income from instalment payments.

Klarna International Presence: UAE and Middle East Market

Klarna's growth hasn't only brought it into reach of its home country, Sweden. It has, since its days of infancy, cautiously expanded, extending its wings to over 20 countries, including the US, the UK, Germany, and many others. The development that has most recently become obvious is expansion into the Middle East, particularly to the UAE.

Klarna has worked well in the UAE, notably among youth audiences, since more and more prominence is given to digital payments. Industry reports said that ever since Klarna debuted in the United Arab Emirates, it saw increasing transaction volumes alongside businesses opting for the BNPL model. It is no surprise that the company is witnessing such growth in the UAE, where more and more customers are embracing e-commerce and digital payments, not to mention an increasingly fast-expanding fintech ecosystem in the region.

Klarna's Middle East expansion is designed to seize a bigger share of BNPL's increasing space, which could continue to gain pace in the coming years. Based in the UAE, Klarna competes with much better flexibility in shopping payment options designed to share a better proportion of consumer spending, particularly for those who want an easier way to access online shopping platforms.

"The flexibility in payment options that Klarna has provided has created new avenues for businesses in the UAE to be able to address a more diversified and dynamic consumer base"

This success in the UAE and even the wider Middle East region corresponds to increased demand for buy now pay later services in the region. Klarna is riding out the growing regional demand for online payment solutions even as it helps customers regain financial control.

Klarna Statistic and Fact: Klarna's Market Reach

Klarna is unquestionably a household name in BNPL. Of course, its market statistics list some of these facts.

- Klarna has managed to cover more than 100 million active users by 2024.

- More than 250,000 retailers have been connected with Klarna, and as such, this operator is indeed a BNPL service worldwide.

- Services provided by Klarna have helped merchants increase sales by up to 20%.

- Klarna processed over 250 million transactions across the world in the year 2023.

- Klarna's valuation since 2024 is about $45 billion because of its excellent growth and penetration across the markets.

These numbers show how phenomenal Klarna's success has been in changing customers' behaviour and how far it has changed the e-commerce market worldwide.

Klarna for Business: What Retailers Get

Klarna encourages higher sales and conversion for retailers. The Klarna app is fully integrated into most e-commerce applications, allowing merchants to offer consumers an easy checkout. Klarna's flexible payment options will most likely motivate customers to complete the purchase, meaning there will be fewer abandoned carts and more successful transactions.

Increased Conversion Rates:

Converting a higher number of customers due to the fact that customers have the option of paying after a certain period and splitting their buying into installable parts.

Attracting More Customers:

It caters to a larger percentage of customers, the ones who, although not in an economical position to purchase the items on hand, still wish to buy them. That equates to a higher probability of buying at the retailer.

More Customer Retention:

Klarna is clear and easy and offers hassle-free payment methods, making shopping convenient for customers, which is tantamount to a better chance of customer retention.

Sales and Revenue:

Klarna services increase the average order value by up to 30%. This, in turn, becomes a massive sales booster because it generates more revenue for retailers.

Klarna actually provides businesses with insights into consumer behaviour when it comes to shopping, which companies can use either to stock up or to employ marketing strategies accordingly.

What are the Advantages of Klarna for Consumers?

With its purpose of improving the legibility and accessibility of consumer shopping, Klarna allows its users to shop now without having to worry about the financial hardship they might face when trying to pay upfront through flexible payment options. There have been some valid contentions regarding whether consumers will end up paying hidden finance fees.

Here's a closer look at how Klarna for consumers works:

Pay Now:

This is a very simple payment method. Consumers pay the full amount for their purchase directly. There are no hidden fees or interest charges.

Pay Later:

Klarna allows consumers to delay payment by up to 30 days in order for them to test the product before effecting the payment. This feature is highly alluring for any consumer buying their goods online; it enables people to see and check what they are purchasing or even question whether an outfit will fit them.

Slice It:

Consumers can divide large purchases into smaller instalments, which is easier to budget and thus spreads the cost of expensive items. Though interest may apply based on the repayment plan, this option is more flexible and convenient.

Klarna login allows customers to view and track their purchases, see upcoming payments, and be capable of changing the payment schedule. Klarna is also accessible through a mobile app, making it quite convenient, and users can view and access their payments instantly.

Role Klarna Playsin BNPL Market Growth

BNPL services, such as Klarna, have been part of a more significant wave of change in the sphere of Fintech App Development. The overall rising trends that were to be given flexibility and ease in the payment process have been answered by BNPL services from businesses. Klarna is one of the very many BNPL services companies that have led the charge in changing these patterns, and thus, its success has inspired many other companies to join the race of buy now, pay later apps.

Consumers have been asking for BNPL services because of the increased control of finances. A consumer will split his payment instead of paying it all at once for a purchase because the splitting of a hefty bill makes shopping less of a burden on one's pocket.

Klarna has exploited the great opportunities that lie in the UAE market, where the adoption of fintech is rapid. Consumer and business services by Klarna have ensured dominance in the market because most people embrace buying now and later services in UAE.

DXB APPS is Your One-Stop Solution for Fintech App Development

DXB Apps specialises in Fintech Mobile App Development Dubai, providing state-of-the-art solutions to empower businesses to thrive in the Middle East. To build and obtain the needs of people with mobile app development in Dubai, Mobile App Development Abu Dhabi, or mobile app development company in Saudi Arabia, our expert team designs your fintech app, conforming to the latest industry trends to offer maximum value to your customers.

Our Mobile App Development Company uses the latest technologies to design intuitive, user-friendly apps that provide seamless payment experiences, like Klarna, and make your business stand out in the competitive fintech market.

Conclusion

Klarna has transformed the way people shop and pay for the things they buy. The flexibility in payment offers created by this company has redefined a more accessible, transparent, and consumer-friendly experience when shopping. The services from Klarna support consumers and retailers by helping increase sales for the latter while ensuring a seamless way of managing payments for the former.

Continued growth into newer markets, such as the UAE, means Klarna will gain more influence in those markets. In fact, Klarna's innovative payment solution has now changed the game for other fintech firms, and this BNPL market is continuously shifting; hence, Klarna's influence in that field is likely to remain the same.

"The future of shopping is about giving consumers more choice and more control over how they pay."

FAQs

1. What is Klarna's payment method?

Klarna offers flexibility in payments with Pay Now, Pay Later, and Slice It, which is an instalment. This makes shopping easier and cheaper.

2. Does Klarna charge interest on payments?

Klarna charges interest in Slice It payment plans; however, for Pay Now and Pay Later, no interest will be charged if payment is made before the agreed period.

3. How does Klarna benefit merchants?

It benefits from increased conversion, average order value, and customer satisfaction, which in turn increases revenue.