Technological advances and fast-rising consumer demand for digital financial services have propelled the financial technology industry. Therefore, creating fintech applications becomes vital to companies that intend to innovate and remain competitive within the financial sector. The present guide shall list the key features, types, and central processes of fintech app development.

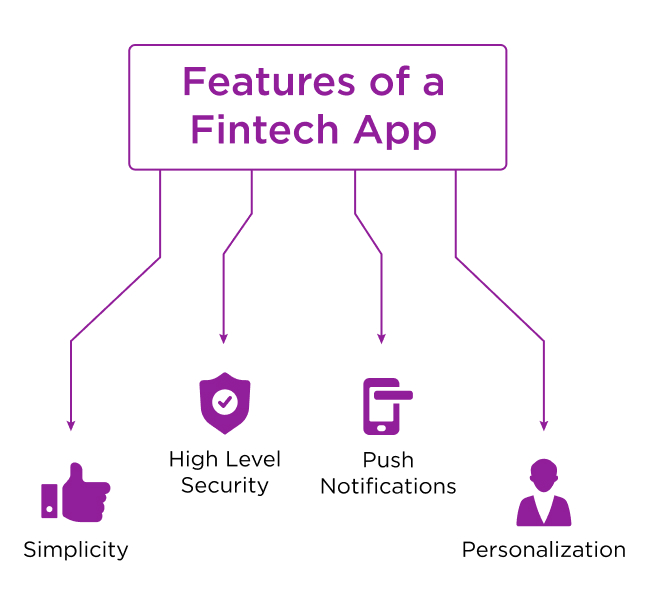

Key Features of Fintech Apps

Fintech applications aim to facilitate and make users' lives much easier regarding financial services, with good features that best fit user needs. Some of these include:

1. User Authentication and Security

Biometric Authentication:

Regarding security, most fintech app development uses biometric features, such as fingerprints or facial recognition. This brings a very high level of protection but also provides convenience in user experience.

Two-Factor Authentication:

This is an added layer of security. Before one is given full access to a site or gadget, one has to confirm through another form of identification, such as a text message or an email appraisal.

2. Real-Time Transactions

Instant Transfers:

The latest fintech apps built by mobile app development company Dubai make it possible to achieve real-time transactions, allowing one to send money instantly. It is one of the most critical features for applications dealing with cash and payments.

Transaction Tracking:

It allows users to access live, minute-to-minute tracking of all transactions for improved transparency and better management of one's finances.

3. Integration with Financial Institutions

Bank API Integration:

The application is integrated with banks and other financial institutions so that accounts, balances, or transaction details can be accessed quickly and without disruption within the application.

Credit Score Monitoring:

Some apps offer this feature, which customers can use to manage and monitor their credit score, boosting their financial health.

4. Advanced Analytics and Reporting

Expense Tracking:

Most fintech applications offer facilities for tracking and categorizing expenses. Such facilities could be beneficial for users to manage their expenditures and finances more effectively.

Financial Insights:

This offering can provide customized financial insights based on user spending. This might help users make informed financial decisions.

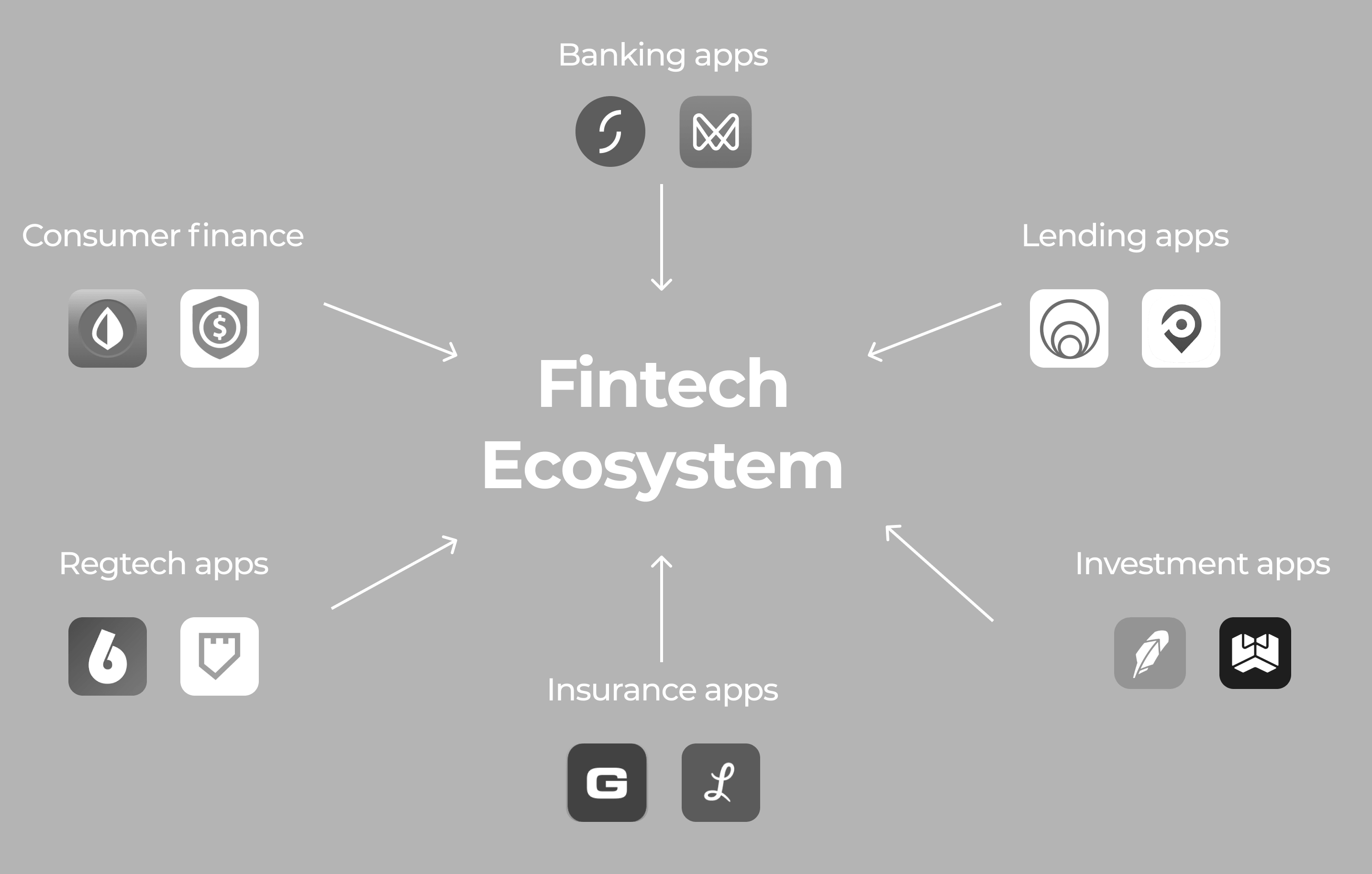

Types of Fintech Apps

Fintech apps come in various forms, and each one tackles some of the needs of the financial ecosystem. Here is an array of the fintech app developments which are now available:

1. Payment Apps

Peer-to-Peer Payments:

The services of applications like PayPal and Venmo are much easier for sending and receiving money. Most of these applications come with features, including storing transaction history, creating payment reminders, and integrating bank integration.

Digital Wallets:

These applications, like Apple Pay and Google Wallet, keep payment information safe, enabling easy and fast mobile transactions.

2. Investment Apps

Robo-advisors:

Some famous examples include Betterment and Wealthfront. In this app, investment management is done automatically; the users’ investments are rearranged according to the user’s preference and reinvestment pattern.

Stock Trading Apps:

Social media platforms such as Robinhood and E*TRADE have made purchasing and selling stocks simple, and they can monitor the market and invest simultaneously.

3. Lending Apps

Personal Loans:

Companies like LendingClub and Prosper connect borrowers to lenders willing to borrow at some very competitive personal loan rate.

Microloans:

This application gives short-term, tiny financial credit to persons or companies with relative ease compared to more formal financial institutions.

4. Insurtech Apps

Insurance Management:

Such applications fall under Lemonade and Root and provide for managing insurance policies, claims, and customer services.

Usage-Based Insurance:

These have apps built by app development companies Dubai that implement telematics solutions for deriving insurance plans from either the driver's behavior or any other metric.

Development Process of Fintech Apps

Planning, launching, and maintaining in major steps of the fintech app development is done as follows:

1. Ideation and Research

Market Analysis:

Your mobile app development company has researched trends and the target audience. Knowing your competitors and what would set you apart is about understanding the product in detail. Identify gaps and areas of innovation within the Fintech space.

Set Objectives:

Provide a brief description in clear and concise language of what your app is and does, who it's for, and the top features.

2 Design and Prototyping

UI/UX Design:

Clearly define user interfaces and experiences for easy navigation and interaction. Prototyping tools will be used in addition to creating low-fidelity wireframes and high-fidelity mockups to present the app layout and how it works.

Prototype Development:

This prototype will demonstrate the app's primary capabilities, and for that purpose, it is being built, tested, and shared with stakeholders and potential users. It allows for fine-tuning design and functionality before implementing full-scale mobile app development.

3. Development and Integration

Frontend development:

Develop the app UI. It includes working on many aspects, such as responsiveness and usability while keeping design elements within the bounds of user experience.

Back-end Development:

Build the server-side infrastructure—databases and APIs, and implement safety features to ensure effective real-time transactions and data processing on the app by mobile app developers.

API Integration:

Financial institution, payment gateway, and third-party service integrations that are relevant to the support requirements for smooth data transactions.

4. Testing and Quality Assurance

Functional Testing:

It involves testing the features and functionalities for the desired level of functioning. Analyze bugs, performance hang-ups, and compatibility on varied devices.

Security Testing:

This identifies vulnerabilities and protects sensitive user data. This is most critical in Fintech apps that deal with financial information by mobile app development company in Dubai.

Usability Testing:

Test real users to find usability issues and areas for improvement. Make necessary adjustments based on feedback first before the launch.

5. Launch and Marketing

Launch the app:

Plan a successful launch by submitting the app to the app stores and having all your marketing materials ready.

Marketing Strategy:

The final step is to promote an app that displays your app through various media outlets, social networks, and other opportunities like online advertising and sponsorships. Promote the specifics of the app to get more people to download and use it.

6. Maintenance and Updates

Regular Updates:

Keep the app progressively updated by incorporating new features, fixing bugs, and optimizing performance.

User Support:

Keep supporting user problems and collecting feedback for further improvement in the future.

DXB APPS - A Trusted Name For Fintech App Development

At DXB APPS, we specialize in developing fintech apps for modern financial industries. Our team, headquartered in Dubai, creates innovative and secure fintech solutions to power efficiency and give users a good experience. We provide concept design all through full-scale development and then provide constant support. Our profound knowledge of financial regulations and employing the best technologies secure not just a fantastic functioning app but a compliant and sound app.

Conclusion

Fintech app development is one such dynamic and complex process, which requires sound planning and a creative approach in terms of designing and implementing solid technologies. But yes, if one takes care of the critical features of these apps and the structured app development Dubai process, one can develop a successful app that meets user needs and is outstanding in the competitive market.

FAQs

Q. What is meant by the development of a fintech app?

Developing a fintech app means developing mobile and web applications to facilitate enhancement and streamline financial services such as payments, investments, lending, and insurance.

Q. How much might it cost to develop a Fintech App?

The actual cost of developing a fintech app differs greatly depending on the set of features, the degree of the application’s complexity, and the unique team that works on the app. This could aptly be a figure ranging from fifty thousand to two hundred and fifty thousand US dollars – or higher.

Q. How long does it take to build a Fintech application?

Again, it depends on how complex an app is and what features it includes. Regular apps can be developed in 3-6 months, but the challenging ones can take up to 12-18 months.

Q. Which technologies are used in the development of fintech applications?

Standard technologies are Cross-platform software, secure APIs, biometric authentication, and cloud computing. In this case, the type of technology used depends on the app's requirements and the target platforms.