Here's a fantastic place to start if you're an entrepreneur having trouble creating P2P payment software or running a company and want to increase revenue. This blog will walk you through every step of the P2P app development dubai process and discuss best practices related to security, design, and other important areas.

Recognizing Trends In The P2P Payment App Market

Imagine handling trip bills with ease or dividing a meal bill. Thanks to the power of P2P payment apps, these cases are now easily controlled.

You should be aware that the term "P2P" in the payment app refers to "Peer-to-Peer" or "Person-to-Person," which denotes simple transactions with individuals we know in a cashless society. These apps have replaced clunky ATM trips and traditional banking systems with more efficient financial procedures.

The fact that these services are highly valued in the market highlights how widely used P2P payment apps are. Global P2P transactions are expected to surpass $11.62 trillion by 2032 due to its promise of efficiency, security, and ease. Additionally, 48% of users prefer utilizing P2P apps for direct money transfers, according to Statista.

It has made corporate and business people ponder upon app development Dubai in the P2P payment applications due to the sudden rise in applications of P2P apps rather than traditional banking. However, before proceeding any further, it is important that we recall some elemental concepts.

What You Must Know About P2P Payments?

P2P is an online money transfer that is enabled through application in an aspect of payment processing called peer to peer payment applications. These apps monitor the transaction amount from start to finish and securely connect users' bank accounts and digital wallets. Money transfers are safe, traceable, and easy to use with this digital approach.

When examining it closely, all P2P payment apps fall into three groups, each with advantages and a group of competitors in the market.

Various P2P Payment App Types That Are Available Today

It becomes crucial to comprehend the newest features and trends in order to design a P2P payment app that succeeds in today's broad industry, where independent P2P payment apps, crypto payment apps, traditional banking applications, and social apps with built-in payment coexist.

Later on, we'll go back to that, but for now, let's examine the various P2P payment options available.

- Standalone P2P Payment Apps

- Crypto Payment Apps

- Messaging Apps with In-Built Payment

Standalone P2P Payment Apps

Unlike standard banking apps, payment apps like Venmo and PayPal are specifically focused on payments. They have their own independent system for managing and protecting money, and they don't depend on any financial institutions.

Crypto Payment Apps

People can transfer and receive cryptocurrency through P2P payment apps called crypto wallets, which facilitate cross-border transactions. However, you'll have to put in a lot of research to locate a P2P cryptocurrency payment program similar to, say, PayPal. A couple of instances include BitValve and Raby Wallet.

Messaging Apps with In-Built Payment

Without a doubt, financial areas are applicable to social programs like Facebook Pay and SnapCash. With the help of these apps, users may conduct fundraising campaigns, make credit/debit card purchases, and give to creators in a safe environment.

How Does a P2P Money Transfer App Actually Work?

The popularity of P2P payment apps has been largely attributed to continuous internet connectivity. It focuses on the ability of the user to connect the application to the bank account with the possibilities of two persons to negotiate and transact digitally even if they have accounts in different banks.

In its simplest terms, peer-to-peer peer-to-peer money transfers have revolutionized the handling of cash with ease, speed and security while conducting financial transactions.. How precisely does the P2P payment app operate, though?

Here's a quick rundown:

Enrollment of Users

One of the basic features, which clients are to complete initially, is registration aimed at the subsequent use of P2P payment software. For one to register for the website, they must provide certain details including name, email address, phone number, etc.

Connecting a Bank Account

Customers, in their turn, should link their cards and/or bank accounts to the applications for the transactions to be as quick as possible. This allows easy facilitation of exchange such as that of peer-to-peer, peer-to-bank, bank-to-bank and so on including the peer-to-bank form.

Add Contact

P2P payments facilitate fast and safe transactions by enabling contacts to be added within the app. Additionally, you can look up other users using their email address or registered phone number.

Start of a Transaction

Users only need to choose the receiver from their contact list and enter the amount to complete a transaction.

Verifications of Security

P2P payment apps use two-factor authentication and encryption, among other security measures, to ensure secure financial transactions.

Finalisation of Transaction

Users receive notifications verifying successful completion of transactions.

Harmonious Management

This is unavoidable since it enables consumers to handle their money, check their balance, and see transaction history all at once.

Withdrawal and Deposit of Funds

Users of the app can instantaneously take money out of or deposit money into their respective bank accounts.

You must feel that there are still some things missing, such as listings of particular technologies or suggestions for developing the admin portion of the program.

The problem is that these requirements change a lot from project to project. To ensure you get the most out of whichever team you partner with, we are nevertheless addressing a few points.

Voice-Activated Messaging System

Imagine being able to execute a transaction with just a voice command. Yes, that sounds incredible!

Even while speech interfaces are finding their way into an increasing number of devices, many payment processing software programs are either unable to process payments at all, or if they can, the process is extremely confusing.

Flexibility in UX/UI

Customization reigns supreme when it comes to user interfaces. Customers generally adore having the option to customize what they see on their devices. Your efforts will be rewarded if you can apply AI to enhance the user experience by displaying the options that are most commonly used.

Adaptable Design

Your app will adapt to the market with new features and functions more quickly the more integration capabilities it possesses.

In the other direction, this is also quite effective. You can get similar add-on goods for your fintech app from other companies. In this instance, you'll soon discover that you're thriving in the environment.

Continuous Enhancements

Incorporating app analytics into the app development dubai process enables the extraction of priceless usage data at a later time and the application of that data for product development. AI analytics is a fantastic tool for assessing the flaws and functionality of your program.

How Much Does Developing a P2P Payment App Cost?

A P2P payment android development Dubai costs are determined by a number of things. P2P financial application. Here’s what you should follow:

On average, it may cost from a few thousand dollars at the low end, like $10,000 to $20,000, for a basic P2P payment app. These applications manage basic financial transactions and lack many other capabilities.

- According to cost estimations, the application of a simple P2P payment application may cost within the range of $10000-$20000. For instance, there are features of better security, the application with a simplified design, the history of transactions, and dividing the bill.

- $45,000 and up. These apps are packed with features, such as sophisticated security, international payment gateways, and comprehensive transaction monitoring.

Trust DXB APPS As The Leading Web Development Company

Leading website Development Company in Dubai, DXB Apps, with its headquarters in Dubai, United Arab Emirates, has been in the front of the area's digital revolution.

DXB APPS as a top mobile app development company has a team of very talented app developers UAE, known for providing innovative solutions for both Android and iOS app development in Dubai that meets the various demands of both customers and companies.

Wrapping Up!

The manner in which the world is evolving presents both challengers and those who currently hold considerable power with opportunities to increase their market share and to acquire the loyalty of new customers while also enabling them to establish new and unique approaches to meeting consumers’ needs. In short, the configuration of the fintech app development by DXB APPS has effectively undergone a fundamental reshuffling. Innovators and leaders on the other hand are well positioned to capture a significant percentage of the growing market share.

FAQs

What distinguishes the P2P Payment App 2024?

The P2P Payment App 2024 is distinguished by its strong security measures, smooth user interface, and cutting-edge features that make peer-to-peer financial transactions easier.

In what ways does the P2P Payment App 2024 help companies?

The P2P Payment App 2024 provides businesses with a safe and effective platform to split invoices, process payments, and handle money. Businesses can improve customer happiness, get a competitive edge in the market, and streamline operations by including this app into their app development dubai strategy.

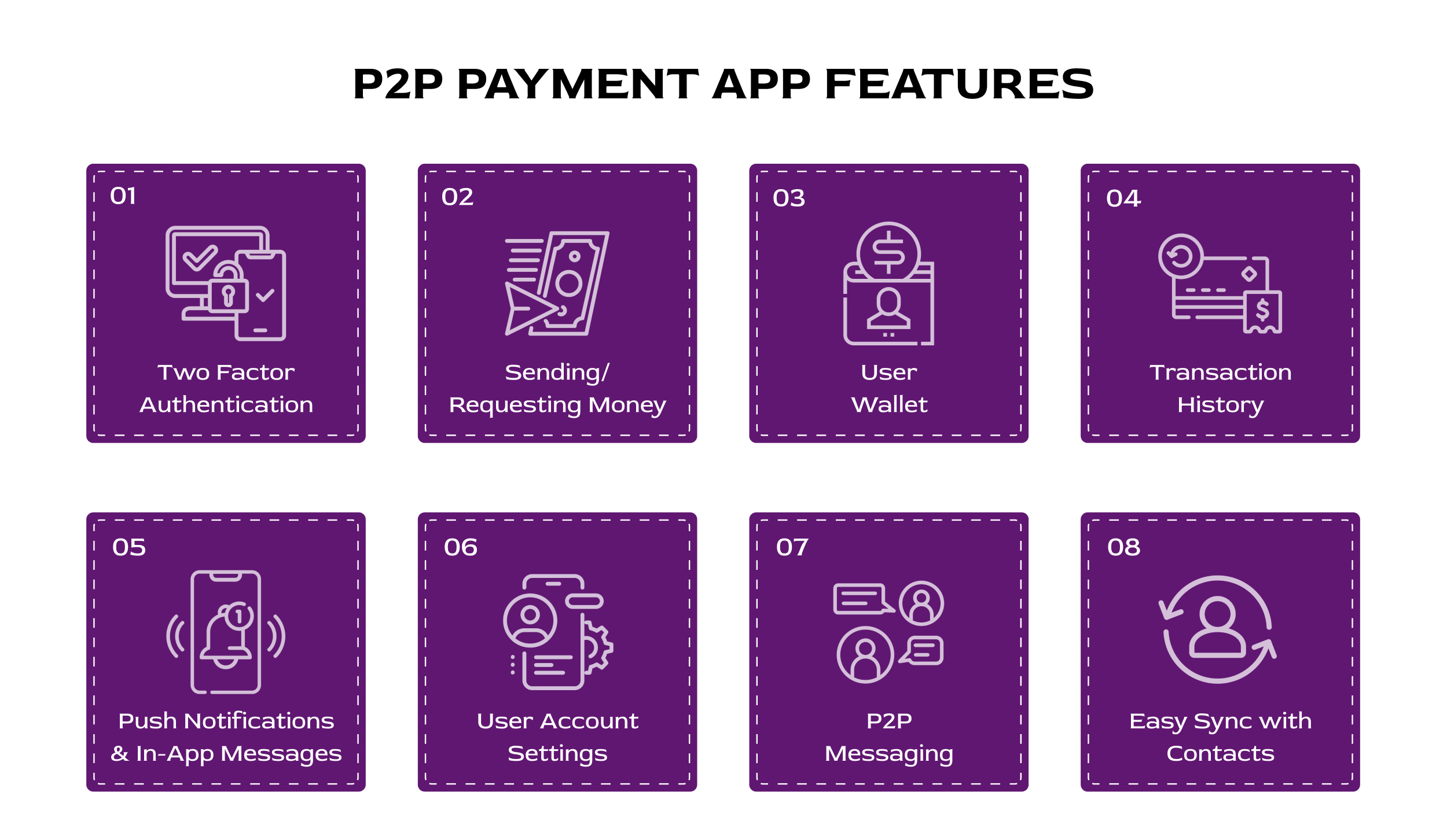

Which characteristics make up the P2P Payment App 2024?

The P2P Payment App 2024 is a unique app development solution in Dubai because of its many capabilities, which include recording transaction history, split bill capability, rapid payment transfers, and sophisticated security procedures.