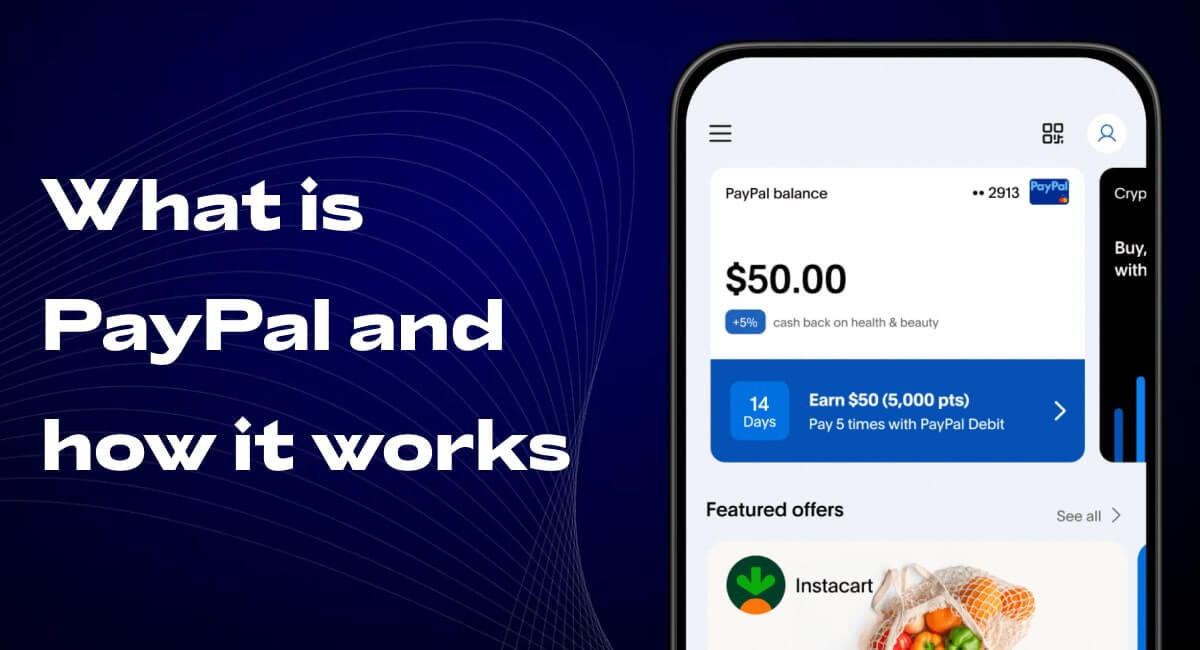

In 2025, PayPal App UAE is revolutionising the digital payments ecosystem with greater features, safety, and usability for its active users all around the world. Having more than 249.9 million active users this year, the platform remains at the top as a giant in the fintech arena, providing easier money transfer processes and safe transactions. Be a business owner or an individual; knowing how the PayPal app works now can help manage your finances easily.

"Simplifying payments, empowering lives."

How Paypal Works?

PayPal is primarily a trusted digital intermediary between your financial accounts and your transactions. Using PayPal offers users simple secure options to both send and receive funds easily. Users must connect their PayPal account through their bank accounts or debit or credit cards to begin. That's almost like a form of security when the users don't allow the service to expose their confidential financial data to anyone, including merchants. However, with transactions through PayPal are being secured, others do not gain access to your information, including personal details and banking credentials.

How Paypal Works for Businesses?

For individuals, most simple features are presented by PayPal when dealing with money easily and in good time. Above all, these include the following:

Instant Fund Transfers:

Customers can transfer their money to friends, family members, or other businesses almost at once. That helps split some bills, to pay services or even to fund giving a gift to the person.

You Will Get Paid Flexibility:

You will be allowed to pay from any of the following sources: credit or debit card linked to a bank account and balances in a PayPal account. This flexibility will enable you to make payments in the way you like.

Invoicing And Shipping Tools:

Businesses can easily generate professional invoices directly in PayPal and print shipping labels, which simplifies transactions and logistics management.

Subscription Management:

To businesses with services offering subscriptions, there is automated processing with very little workload to put in manual inputs, hence prompt payment from clients.

How to Open your Paypal Account in 2025?

1. Sign Up Free

Visit PayPal.com or download the PayPal app from your app store. Depending on users' needs, Select a personal or business account type.

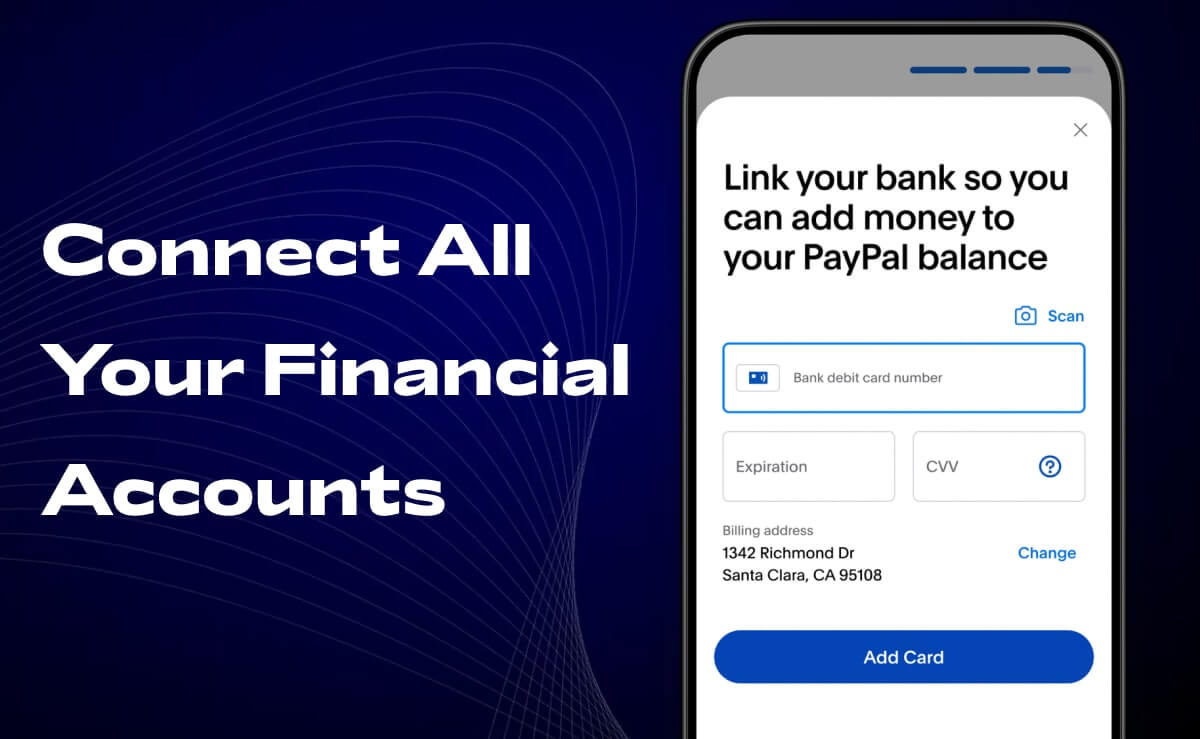

2. Connect All Your Financial Accounts

To add your bank account, debit, or credit card for funding and withdrawals, verification has to be completed through a small deposit or an OTP.

3. Start Transacting

Use PayPal to send or receive money, pay bills, or shop online with confidence.

Unique Features of Paypal in 2025

PayPal continues innovating and has become a leading solution in the fintech sector. It develops new features and will allow convenience, safety, and increased accessibility until 2025. All these new updates work not just for users but also for business users, further making PayPal the trustworthy global payments platform.

1. Speed of Transfer

One of the great inventions in 2025 is real-time bank transfer, which is done at near zero cost. Where PayPal has long provided fast transfers, a new technology applied assures that deposit balances are found within seconds and minimises the delay involved to create smooth access to one's bank account.

2. Tools for Business

Altogether, advanced analytics and advanced invoicing systems are there in PayPal these days for business users. The merchant can look into sales trends, customer behavior, and patterns of transactions so that they can make calculated and data-driven decisions. Further, the invoice tools are customisable and have the capacity to connect each business's branding to its financial documents.

3. Subscription and Recurring Payments

PayPal has made its subscription management system more flexible and can allow customisable payment intervals, automatically adjusting for taxes or discounts. It makes it easier for businesses to handle memberships, recurring bills, or subscription-based services.

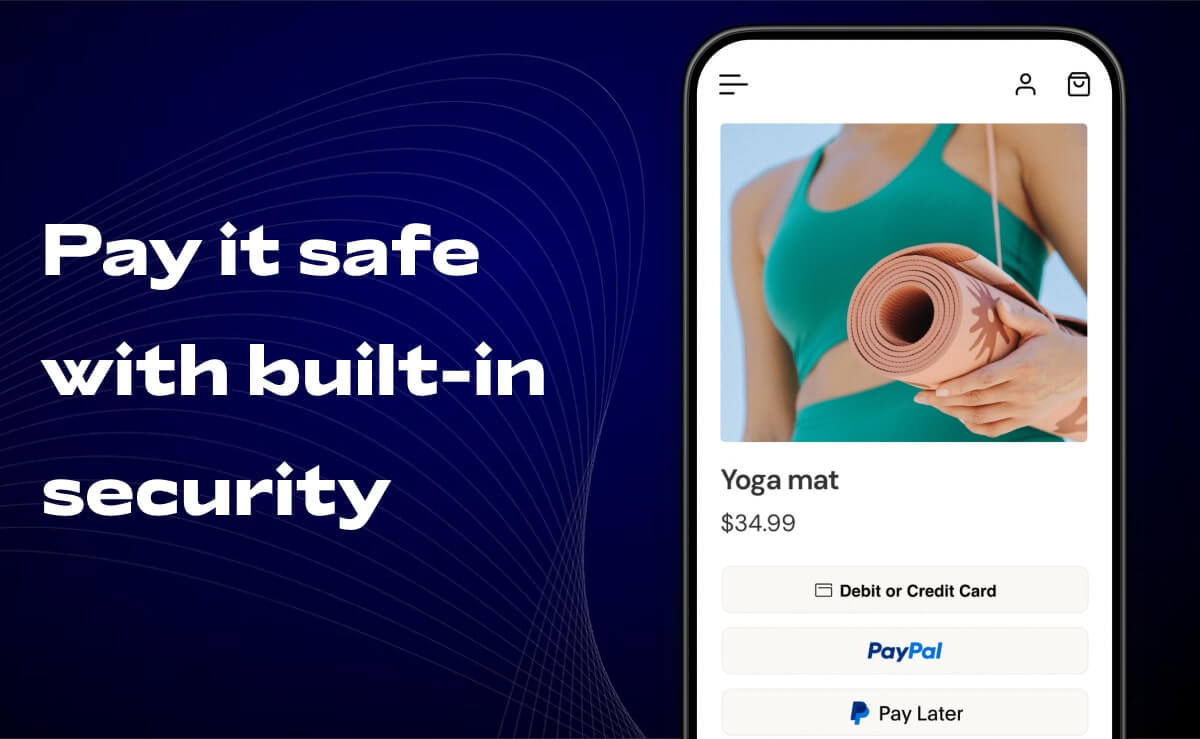

4. Improvements in Biometric Security

The security level in 2025 has never been seen before. PayPal can now use even a fingerprint or facial recognition to access the user's account. Added on are AI-powered fraud detection and 24/7 monitoring, where all transactions have been proven to be safe and secure for the users as well.

5. Multi-Currency Wallet

PayPal has a multi-currency wallet, meaning one can hold more than 120 currencies. This allows users to hold, convert, and transact in multiple currencies without high conversion fees. This is particularly useful for international travellers, freelancers, and businesses with global clients.

6. Crypto Integration

The service expanded its user base for cryptocurrencies by supporting purchases, sales, and even holdings of more cryptocurrencies on the service. Added to that is the fact that customers can now pay merchants in cryptocurrencies; the amount at checkout is automatically converted to local currency by PayPal.

7. PayPal for the Gig Economy

With this boom in gig, PayPal would devise products targeting income tracking and enable a route through which their due can be made in minimal time for freelancers or other types of gig workers in collaboration with creating the smallest effort for generating an invoice with any client.

8. Environmental Initiatives

PayPal has vowed to be environmentally sustainable. Therefore, the company has published an Eco Impact Dashboard for all users. Using this dashboard, the user would know the nature of the environmental impacts of purchases made with PayPal and, in this way, would be nudged towards eco-friendly businesses and far more sustainable decisions.

9. Smart device integration

Of course, the Internet of Things and smart gadgets have also made it easier for users to pay with watches, voice assistants, and other devices, making it convenient and fast without necessarily accessing a phone or computer.

Understand the Impact of Paypal in UAE

The PayPal app in the UAE has really had a good uptake, especially because it interfaces with local banking systems and is Arabic-compatible. Businesses in the UAE use PayPal, especially to handle cross-border transactions efficiently.

For instance, it has partnered with some of the best companies in this region's fintech space, which has enabled a large number of people to access digital payment. There is no better comfort than PayPal, especially with e-commerce and even personal transactions to Dubai, Abu Dhabi, or Sharjah.

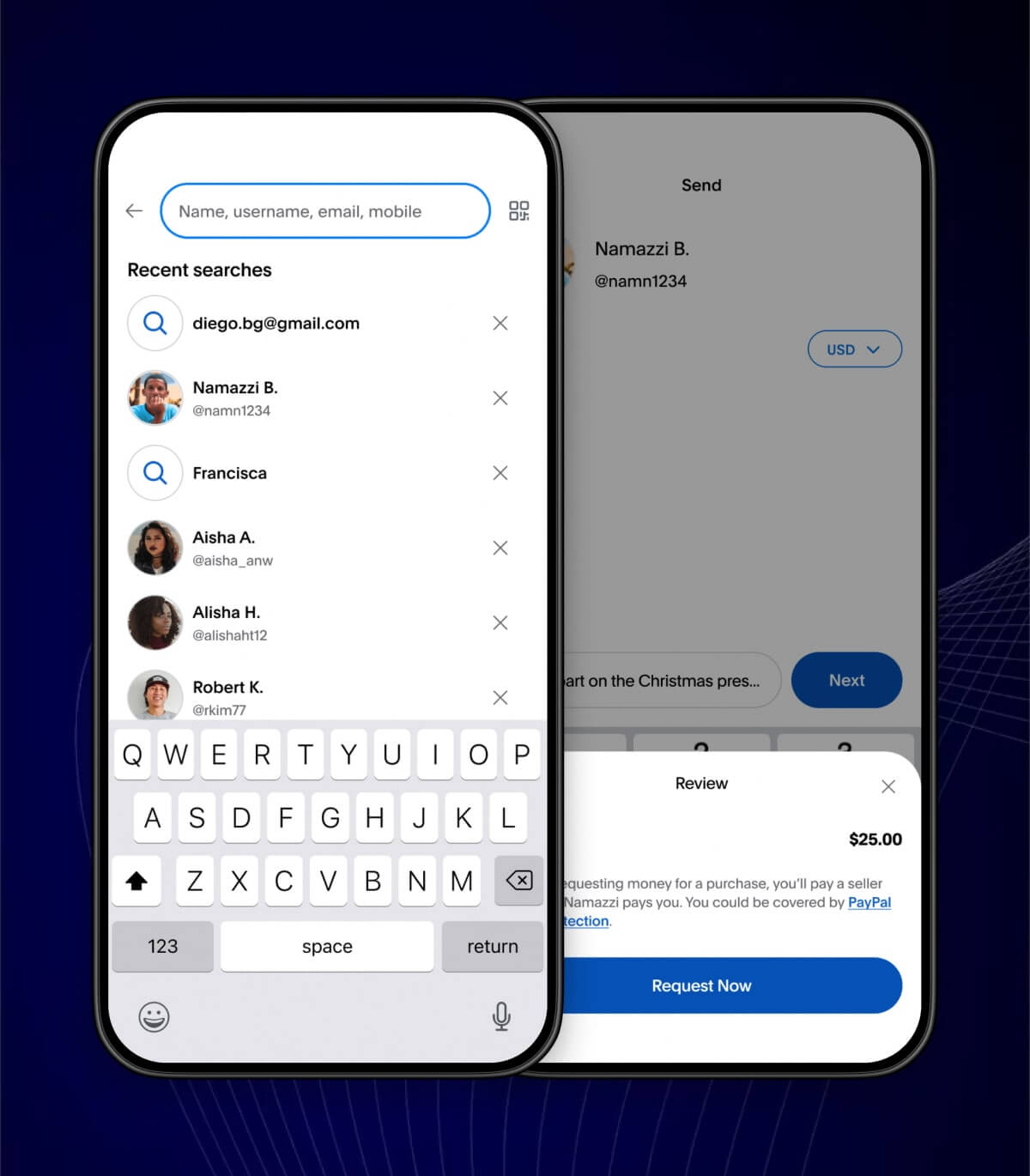

Making Payments with PayPal

Paying people the fastest and safest way to send money to friends, family, or businesses in this world- yes, that's PayPal. Here's how you can pay for something using PayPal:

Open The Paypal App Or Website:

You may log into your PayPal account through the app on your smartphone or via the website on your computer.

Write Down The Recipient's Email Address:

The PayPal-linked email address your recipient provides allows you to transfer funds with confidence they will reach the intended person or business.

Amount And Currency:

Enter the amount you wish to send together with the correct currency. PayPal supports a wide range of currencies, thus enabling seamless international transfers.

Click "Send" To Confirm The Process:

After completely filling out all necessary fields, you must send the transaction request. After processing the transaction, you will get both an alert message and an email notification that confirms payment transmission.

Receiving Payment With Paypal

Receiving money via PayPal is similarly easy. From an individual looking to collect payments from friends to a business that accepts customer payments, PayPal makes it all seem that it is rather easy.

Share Your PayPal-Linked E-mail Address:

You can also receive money easily by sharing your PayPal-linked email address with the payer. They will send funds directly into your account through this email.

Use "Request":

As a payment requester, you can use PayPal's request functionality to send invoices and ask others to remit payments. This tool simplifies payment monitoring by making it easier to track pending payments and manage advanced monetary transactions.

Withdraw or Spend Funds:

When you add money to your PayPal balance, the ability to pull funds from your PayPal account to your bank account becomes available. Payment through PayPal will work at any retail location accepting this payment method for internet shopping. This really makes PayPal quite convenient for both personal and business transactions.

Role of PayPal in Business

With many benefits involved, financial management and transactions easily go to businesses that utilise PayPal. Here are some of the key benefits received by merchants in a PayPal business account:

Low Transaction Fees:

The fees PayPal charges are lower than competing payment processors so businesses with small revenue can find it affordable.

Customisable Invoices:

The businesses can easily create and send professional-looking invoices that are branded to their specific business, thus making it easy for clients to pay.

Subscriptions Management:

It offers a PayPal subscription, which enables a business to operate based on repeat payments from its clients. Most businesses operate as subscriptions, so this is the most crucial attribute.

Easy integration with e-commerce platforms

PayPal integrates easily with various e-commerce stores like Shopify, WooCommerce, and BigCommerce, making easy payment for all online merchants.

How DXB APPS Develop The Finest Fintech Apps In UAE

DXB APPS is one of the top Mobile App Development Dubai companies in Dubai that offers sustainable fintech applications. The Mobile App Development Company uses the latest technology to create secure, friendly, and flexible platforms that can compete in the international arena. The core competencies of the company include the following;

- Our Mobile App Development Abu Dhabi offers applications with pay gateways with ease, such as PayPal.

- Compliance with the regulatory framework of the UAE.

- Exceptional user experience through intuitive design and features.

- You have that mobile application you want in Dubai or Abu Dhabi, and that is what DXB APPS is offering you in order to develop the business for your company.

Conclusion

As of 2025, PayPal remains a central hub for digital payment ease. Flexible, secure, and innovative, it both facilitates personal account management and empowers businesses to go global. In the field of financial technology, it takes a leading position through instant fund transfers across different currencies and enhanced system protection mechanisms.

FAQs

1. Is PayPal an ideal and safe facility for online purchasing transactions?

A resounding: Absolutely! There are advanced uses of encryption here: two steps are used, plus 24/7 monitoring is conducted for owners' accounts and all transactions.

2. Should I set up a bank account to access PayPal?

Having a PayPal account without linking it to a bank requires conducting payment transactions using debit or credit cards while paying both withdrawal and funding fees.

3. How to avoid PayPal charges?

Generally speaking, transfers done within your own country are free of charge, but if you're using a bank account, you're avoiding more charges than you'd incur when using credit cards.