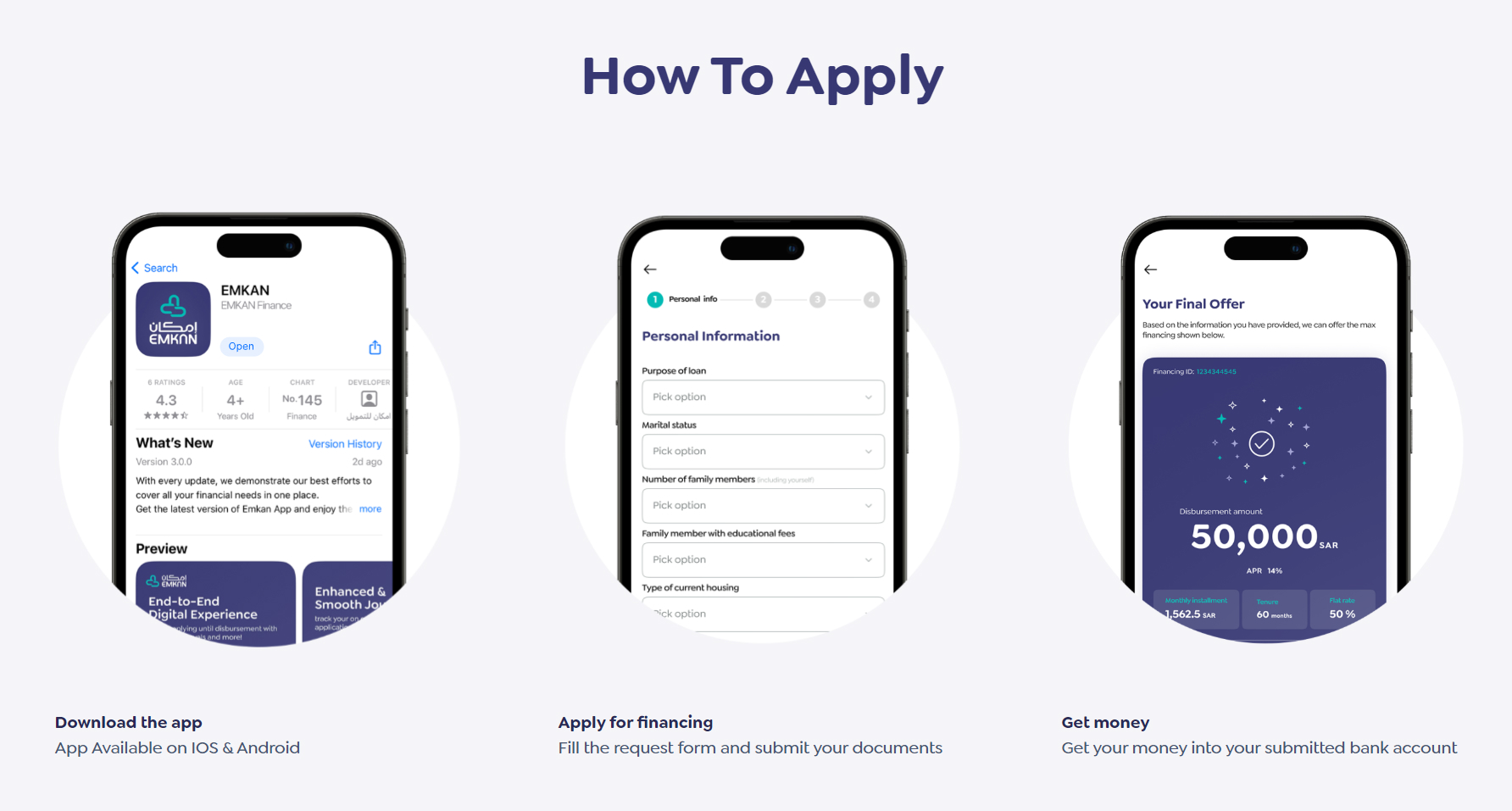

In such a fast-paced world, the demand for instant loans has spread rapidly. This is very apparent in economically active places such as in the UAE. With fintech innovations, companies are now focusing on personal loan apps to cater to this demand. Among the most prominent players is EMKAN Finance, which offers instant loans through a smooth mobile app that lets users access quick funds directly from their smartphones. But how much does building a personal loan app like EMKAN Finance cost? It is a question that many businesses, potential and existing enterprisers, who are using and planning to use fintech products or services, want answered. The opportunity to grow the global fintech market is above USD 300 billion in 2024 with a boom growth rate.

Of all these developments, mobile finance applications, mainly focusing on personal loans and quick access to credit, have been notable. Considering that fintech app development has become a recent hot trend, businesses in the UAE are highly interested in developing loan apps that would enable users in need of quick access to funds.

Fintech has changed everything related to how customers borrow in the UAE-from applying for a personal loan through mobile apps whereby instant disbursements are made directly into the wallets. Success through apps like EMKAN Finance has proven a sizeable market for personal loan applications. Cost breakdown involves looking into the development features, technology, and the people developing it.

Essential Features of Personal Loan App:

To develop an instant loan app like EMKAN Finance, some essential features are required to ensure lending is transparent, safe, and effective. Some of the basic features defining a suitable personal loan in UAE are mentioned below:

1. User Registration and KYC.

Registration in a personal loan app should be smooth and require only a few steps without compromising security. A user can register with a phone number or an email address, and the KYC process should comply with the financial regulation that verifies a customer's identity by submitting official documents such as an ID card and proof of address.

This very entity becomes critical for their identity verification purpose, their check for lending allowance, and warding off scams. Digital KYC has developed into one of the most traditional methods through newly launched loan requests. The minimal reduction in paper has also increased the speed regarding loan sanctioning. According to Accenture's study, the digital KYC process might have to decrease the onboarding times by 80%, thus ensuring a great degree of improvement in user experience.

2. Loan Application and Processing

The most prominent feature of any loan app would be the loan application. The users should be able to fill out their loan amount, tenure, and the purpose of the loan. Upon submitting the request, the backend system would process it using algorithms based on credit scores, financial history, and so forth to deem a user eligible for a car loan UAE.

Analyse the loan processing algorithm. With the credit score system and AI-based credit scoring models, processing loan applications is also faster and more efficient. Algorithms for machine learning or credit scoring tool usage may be implemented for immediate loan approval, thus allowing for a quicker and more reliable procedure in the case of EMKAN Finance.

3. Loan Approving and Instant Withdrawal

The other success factor of an instant loan app is quick approval. Your app must integrate with several financial systems and services to quickly approve loans based on set parameters. Once approved, the funds must be transferred instantly to the user's bank account, making disbursement instant.

This is achievable if the company can integrate with multiple payment gateways, banks, and other fintech companies. Instant payment APIs ensure that the money reaches the user immediately. In a McKinsey report, it has been established that 45% of consumers expect instant loan disbursement, and this adds another layer of importance to the feature.

4. Interest Rate and Repayment Calculators

It should calculate the proper interest on interest, and include a simple loan calculator so he or she can know what will be paid each month. The system gives the user reliability from the application while informing the user of his commitment.

The loan calculator can be integrated with real-time lending partners to display proper rates. In return, the application can present customised rates depending on the user's profile. That way, a user becomes informed and assured of comfort about accepting the loan. Over time, Fintech applications have incorporated AI-driven interest rate calculators that depend on users' credit scores, history, and credit.

5. Credit Score Integration

For a personal loan application, there is a deep need for its integration with any credit score system. Through those credit scoring models, they will be able to deduce how creditworthy that user is to enable lenders to work out the kind of risk subsequently attached towards giving the loan. This means that in the UAE, integration with Emirates Credit Bureau (ECB) could provide real-time credit scores that may be used to establish the possibility of more correct loan assessments.

It gives insight into the credit scores that the users may have, so it offers a chance to mend the scores before lending money. This might involve bringing credit products from APIs from Experian or Equifax into your loan application to ensure timely and accurate loan decisions.

6. Repayment Features

Repayment management will be one core functionality on each loan request. The app should empower users to make repayments through various modalities, which include periodic repayment plans and auto-debited savings accounts or mobile wallet-linked integrations. This will educate the users whenever there is any pending repayment so that clients can track it for themselves and minimise default events.

The users are also given automated reminders on repayments so that they do not miss the dates for repayments, thus avoiding delays and penalties. The flexibility in the repayment option can be early loan repayment or rescheduling of the payment dates, which will be another distinguishing characteristic of your application and make it user-friendly and competitive.

7. Security and Data Privacy

Security in finance applications is very imperative. So your loan application should respect the highest level of security, including end-to-end encryption and two-factor authentication, etc, in a secure procedure for login; respect data protection legislations such as GDPR in European countries, etc.

This will ensure the security of personal and financial information, increase users' confidence level in using the application, and prevent cases of security hacking. Biometric authentication is further added to give the application higher levels of security. Fintech applications are looking more into using blockchain technology to provide further protection and add transparent transactions.

Expenses to Build an Instant Loan Application Like EMKAN Finance

This depends on several things, including feature complexity, technology stack, and the team at hand. Below are the potential costs of creating a personal loan app.

1. App Design

This is particularly true in the concept behind apps, where simplicity and flow of the overall design are the usability and stickiness. The notion of UI/UX design encompasses the design of a smooth interface with straightforward and easy-to-follow navigation. In the design phase, it may cost between USD 5,000 and USD 15,000, depending on the interface's level of customisations and invasions.

The statistics imply that properly designed applications can retain up to 40% of users. An attractive design also helps users build trust, which is a significant factor in the finance space.

2. Development Cost

These costs can be significantly different depending on the features to be incorporated, the platform, iOS or Android, and the region where your development team is located. Loan app is considered back-end app development, which belongs to the servers and databases part, and front-end app development, which involves the user interface part.

Backend Development: Businesses can expect to spend between USD 10,000 and 25,000 depending on the system and custom integrations.

Front-end Development: this would depend heavily on the platform where the app is to be developed – as a cross-platform, iOS and Android or solely iOS/singly Android, as the cost would be around USD 15,000 to USD 30,000.

API integrations: third-party API for all the payment gateways, KYC verification and credit scoring services, which would go up or down the range from around USD 5,000 to USD 15,000.

3. Testing and QA

The application needs to be tested for functionality. The following may apply: functional testing, security testing, and load testing—the quality assurance cost ranges between USD 5,000 and USD 10,000.

Testing and QA are known to absorb over 50% of the development costs for fintech applications since the safety and regulations related to the financial activities need to be followed.

4. Continuous Maintenance and Updates

During live support, regular maintenance and updates will be needed to sort out bugs, introduce new features, or meet financial regulations—these range from USD 3,000 per year up to USD 8,000. The Fintech industry is not stagnant and is changing continuously.

Your app needs regular updates according to new regulations, customer preferences, and technological advancements.

5. Total Estimated Cost

The cost of developing an instant loan app like EMKAN Finance ranges from USD 30,000 to USD 90,000 based on the scope, complexity, and development team.

How Does DXB APPS Build the Best Personal Loan App in Dubai?

DXB Apps is one of the leading App Development Dubai companies specialising in developing safe, user-friendly, and scalable personal loan applications. Here, our professional developers and designers work with customers to ensure that every feature of the app is perfectly relevant to the target audience's needs.

Best of Mobile App Development Dubai, specialises in blending and combining the ultimate state-of-art technology with the best user-friendly designs of UX/ UI, all this with robust protocols of security at bay for complete cycle solutions so that your loan application app in question is made of the finest quality any fintech will be able to render.

Conclusion

It's a very promising business idea, but applying for personal loans similar to EMKAN Finance takes good planning and development with a deep understanding of the fintech industry and the market. How much it may cost will depend on your design decisions, the number of features implemented, how complex the development may be, and the development team you select.

If you are ready to build a personal loan app that can meet the rising demand in the UAE or worldwide, DXB APPS can significantly assist in bringing your vision to reality. We are experts in developing fintech apps with secure, reliable, and scalable solutions for business houses looking forward to entering the loan app space.

FAQs

1. How to select the best personal loan app?

You can look for apps that provide quick loan approvals, competitive interest rates, precise repayment schedules, and data security.

Check the ratings and reviews that users have provided about the reliability of the application.

2. How do you choose the proper finance application?

Consider your financial needs, the app's security features, customer support options, and loan eligibility criteria. Ensure the app is compliant with local financial regulations.

3. How do you get a loan in UAE?

You can apply for a loan through a bank or a fintech app. The eligibility requirements are income verification, credit score, and KYC requirements.

4. How do you get a loan in Dubai?

Dubai's major financial products are personal, car, and home loans. You can apply through local banks or fintech apps like EMKAN Finance, ensuring that you provide all the necessary documentation.