Sending money to other countries used to be hard and expensive for regular people. Now things are different thanks to new phone apps that changed everything. Taptap Send is one of the best apps for sending money across borders quickly and safely. This comprehensive guide will tell you everything about this helpful money transfer app and why millions of people love using it daily.

Banks and old money transfer companies charge high fees and take many days to send money. People got tired of waiting and paying too much money for basic services. That's why the Taptap app became popular with users around the world. It helps families send money quickly without breaking the bank or dealing with complicated paperwork. Whether you need to help family members abroad or pay for business transactions internationally, this app makes everything simple and straightforward for everyone to use.

People sent $831 billion around the world in 2022, which is 5% more than 2021

What Makes This App Special?

This money transfer service works differently than others. Taptap send app picks certain country pairs and makes transfers super fast between them. People can finish their setup in just a few minutes and send money right after they get approved.

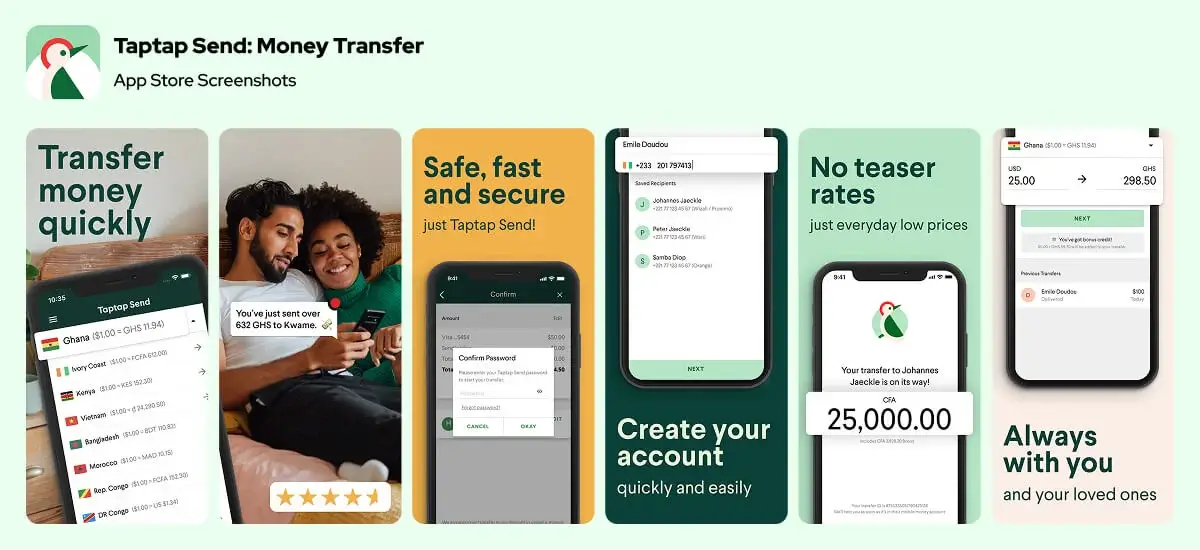

The app looks clean and simple for users of all ages. Even grandparents can figure out how to use it without help from younger family members. The company tells you exactly how much you'll pay and what exchange rate you get before you send money anywhere. No hidden surprises or confusing terms that trick people into paying more than expected.

"We want to make sending money as easy as texting someone, but keep the costs really low for regular people,"

Getting Started Is Really Easy

To utilize this app, one can get through it in a few straightforward steps that everyone can undertake. The required action is, first, to obtain the Taptap download through your phone app store or web site. It is compatible with both iPhone and android phones and hence nearly everyone can use it without compatibility and issue differences.

After you install it, you make an account and prove who you are. This usually takes 1-2 days and you need to show some basic info and ID cards. Once they approve you, you can send money anywhere they serve. The Taptap send app download process is quick and only takes a couple minutes to finish completely.

Cool Features That Help You

The app has lots of helpful features built right in. Taptap send apk works great for Android users who want to install it directly on their phones. You get better exchange rates than most banks offer to their customers. Most money arrives in minutes or hours, not days like old companies make you wait.

Safety is really important here for all users. They use the same security technology as major banks to protect your money and personal information from hackers. The company works with real banks in each country they serve to ensure reliability. You get messages on your phone telling you exactly where your money is during the whole transfer process, giving you complete peace of mind.

Phone apps now handle 35% of all money transfers globally

Banks still charge about 6.2% in fees while phone apps only charge 1-3%

How Sending Money Works and What It Costs?

Sending money is pretty straightforward once you understand the process. You pick which country to send to, type how much money, and choose how you want to pay. Taptap money transfer shows you exactly how much your family will get, including all fees and exchange rates clearly displayed.

The fees are clear and fair to everyone. Unlike banks that hide costs in bad exchange rates, this app shows everything upfront before you confirm. Most transfers cost a small flat fee plus a tiny percentage that changes based on where you're sending and how much you're transferring.

Which Countries You Can Send To

The service works in many countries around the world right now. free money transfer app features are available where the company has deals with local banks and financial partners. They keep adding new places based on what customers ask for and where they can get proper licenses to operate legally.

People can get their money in different ways depending on where they live. They might get it in their bank account, mobile wallet, or pick up cash at certain locations. This makes it easy for everyone to get their money however works best for their situation and needs.

Special Deals and Savings

New users often look for ways to save money on their first transfer. Taptap send code promo deals pop up regularly for people trying the app for the first time. These deals might give you lower fees or extra money added to your transfer amount.

If you use the app a lot, you get better deals over time. The more you send, the better rates and bonuses you can get. This helps keep customers happy while giving real value to people who use the service often for their family needs.

Different Ways to Send and Receive Money

The platform lets you choose how you want to pay and how your family gets the money. Taptap send money options include bank accounts, debit cards, and digital wallets for your convenience. Each way has different speeds and costs, so you can pick what matters most to you and your budget.

Your family can get money through several methods that work for them. Bank deposits usually arrive fastest, while cash pickup works great for people without bank accounts. The app explains all the choices for each country clearly so you understand your options.

Using the Phone App

The mobile app gives you everything you need right on your smartphone or tablet. Taptap send app download puts all the powerful features in your pocket with an easy-to-use design that anyone can understand quickly. Everything is laid out simply and intuitively while keeping your money totally safe and secure from any threats.

Your phone buzzes when your transfer updates, when there are special deals, and for important account stuff. The app also keeps track of all your past transfers so you can see your spending patterns and manage your money better over time.

Mobile money transfers grew by 45% each year since 2020, mostly because of apps

Growing Around the World

The company keeps expanding to new countries all the time. Taptap global plans focus on places where old money transfer companies charge too much or provide bad service to customers. They look at each new country carefully, checking demand, rules, and local infrastructure before entering.

When they enter a new market, they partner with local banks to make sure everything follows the law and works reliably. By finding these gaps in service, they can offer real value while building solid business in new areas that need better options.

Keeping Your Money and Info Safe

Security in the app meets global standards for financial services worldwide. All your personal information gets encrypted properly, and your transaction details stay private during the whole transfer process. They do regular security checks to make sure protection stays up to date with new threats and risks.

Following the law is different in each country, but the app keeps proper licenses and partnerships everywhere they work. These relationships with local banks add extra security layers and make sure all transfers follow legal rules and regulations properly.

Getting Help When You Need It

The customer support group executes its services professionally in various handy methods such as using the live chat within the application, email support, and phone calls within normal work days. They tend to reply back within minutes or hours depending on the complexity of your question and the communicational avenue that you select to reach them to seek help.

Quality ratings show that customers are really happy across all the markets they serve globally. The platform regularly asks users for feedback to find ways to improve and make service even better. This focus on always getting better helps them stay ahead in the growing money transfer market.

DXB APPS: Making the Best Phone Apps in UAE

When UAE businesses need amazing mobile apps, DXB APPS creates solutions that really work for their customers. As a top technology company, DXB APPS builds innovative apps for all kinds of businesses and industries across the region.

The expertise in fintech app development Dubai makes them perfect partners for money and banking app projects. The expert team knows exactly what challenges and opportunities exist in the UAE market today. Whether you need services from a trusted mobile app development company for new startups or big enterprise solutions, DXB APPS combines technical skills with deep local market knowledge.

The comprehensive mobile app development Dubai services handle everything from the first idea to ongoing support after launch. In all the projects, the professional team of this leading provider upholds very high standards of quality and innovations. The professional mobile app developers will collaborate with clients to find out what they really want and design specific solutions that will give them the desired outcomes.

To companies seeking technology partners that they can trust, app development Dubai services at DXB APPS offer them all-encompassing expertise in ensuring the entire development process is dealt with successfully. They have endeavored to give the best services to the companies in the entire UAE region and thus the ability to earn the trust of companies around the region.

Final Thoughts

Taptap send represents a big step forward in how people send money internationally today. The platform combines good rates, fast processing, and easy design to create a better money transfer experience for everyone. With technology continuing to revolutionize the financial services, solutions, such as this, demonstrate how technology can simplify and reduce the cost of essential services to ordinary individuals.

Digital platforms where customers are prioritized over other aspects at the expense of security and legal compliance are the future of money transfers. Users will be able to make wiser decisions regarding international transfers by selecting secure providers and keeping the users informed on the services available, and save a substantial amount of money paying fees and the rates.

FAQs

Q: How much time will it be to send money through the platform?

Each country has different transfer times which mostly take a few minutes to a few hours. Deposits at banks tend to be made quicker than cash pick-ups and when you decide to send money, the app will tell you how far into the future the process is expected to be completed.

Q: What documentations do I require to prove my account?

You must provide a government photo identification (passport, driver license or national ID card) and any document showing address (utility bill, bank statement within the past 90 days). Documents are normally verified between 24-48hours after submission to bureau.

Q: Is there a ceil on money sent?

The type of verification your account is and other measures of the destination country determine the transfer limits. New users begin with less limit which increase as more verification procedures are performed. In the app, your current limits are shown in account settings.