In the modern digital era, mobile wallets are turning into an integral part of everyday life providing convenience, security, and speed in dealing with money. Of these, STC pay is a leading financial service in Saudi Arabia. Stc pay has been introduced by STC (Saudi Telecom Company) as a full-fledged digital wallet offering individuals and businesses alike the facility to manage, send, and receive money using a secure and user-friendly mobile platform.

Whether you're just stepping into digital banking or seeking an improved substitute for conventional practices, stc pay is among the region's safest choices. We're going to discuss every detail of how to utilize the stc pay application, its functionalities, business features, security, and how it supports individuals and organizations throughout the Kingdom.

What is STC pay?

STC pay is an authorized digital wallet in Saudi Arabia, under the supervision of the Saudi Central Bank. It allows its users to:

- Send and receive money locally and abroad

- Pay bills, services, and online purchases

- Exchange currency features

- Handle business transactions

- Link to bank accounts and debit/credit cards

- Make contactless payments through QR codes

The app is not exclusive to STC users. Anybody who has a Saudi mobile number and a valid national ID or Iqama can utilize it. The aim of the app is to provide financial services available and mobile-based for day-to-day users.

Getting Started with the STC Pay App

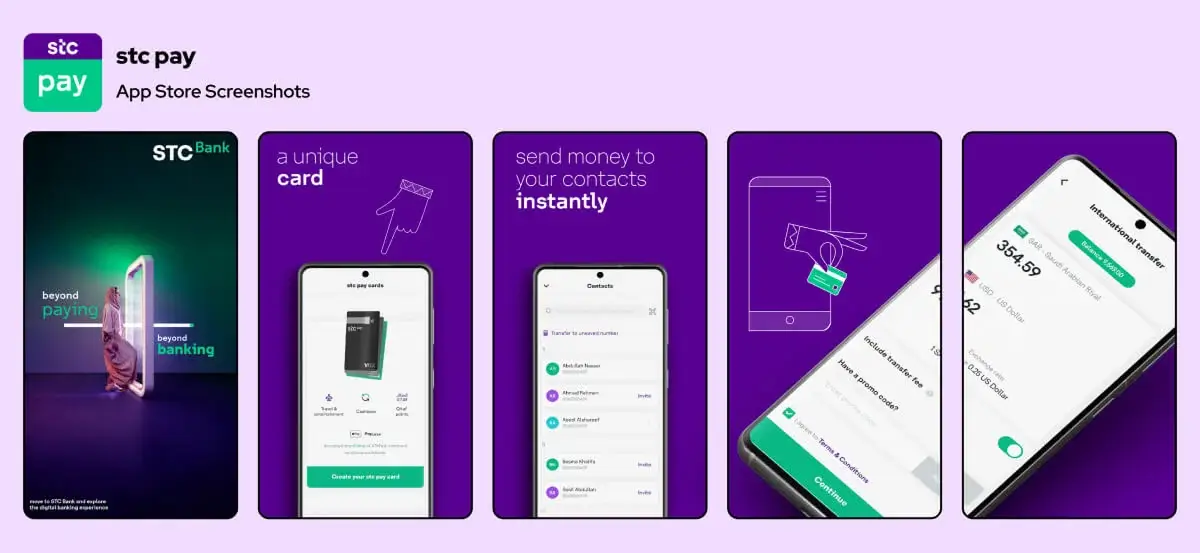

Where to Download

First download the official app from:

- Apple App Store

- Google Play Store

It is compatible with most iOS and Android devices. Once downloaded, you’re ready to begin your digital financial journey.

Registering Your Account

To set up your STC pay account, follow these steps:

- Open the app and click on “Register.”

- Enter your Saudi mobile number and personal ID or Iqama.

- Receive and verify the code sent via SMS.

- Fill in your name, date of birth, and password.

- Set up a 4-digit PIN for app access.

- Accept terms and conditions.

This should only take a few minutes. On completion, your mobile banking app is ready for use.

Absher Account Verification

Another of the distinguishing features of STC pay Saudi Arabia is the Absher integration, which is the official government platform for digital identity and services.

- Proceed to "Profile" in the app

- Click on "Verify via Absher"

- Log in using your Absher credentials

- Proceed with the authorization steps

Once confirmed, you'll have complete access to all functionalities, including international remittance and account top-ups.

Discovering the Dashboard

The STC pay app is intuitive and easy to use. The dashboard features:

- Wallet balance

- Transaction history

- Quick links to Pay, Transfer, and Request

- Promotions and featured services

- Spending categories for budgeting

This friendly interface makes it possible even for first-time users to find their way around the app without getting lost.

How to Add Money to Your Wallet?

You can add money to your STC pay account in several ways:

1. Bank Transfer

- Tap "Add Money"

- Select "Bank Transfer"

- Utilize your own IBAN number given to you

- Transfer money through your banking mobile application

2. SADAD Payment

- Select "SADAD" option

- Utilize the unique SADAD bill number

- Pay through the SADAD portal of your bank

3. Credit/Debit Card

You may link a Visa or Mastercard to fund in real-time.

How to Send Money Locally?

Peer-to-peer transfers are one of the most popular uses of stc pay:

- Tap on "Send Money"

- Choose from contacts or enter a mobile number

- Enter the amount

- Include a note if wanted

- Tap "Send"

Funds are transferred instantly to the recipient's wallet, making it an ideal app for paying bills, sending allowances, or making fast payments.

How to Pay Bills?

The STC pay app offers a very large range of bill payments:

- Telecom services (STC, Mobily, Zain)

- Utilities (Electricity, Water, Gas)

- Government charges

- Private education and tuition

- Insurance renewals

To pay a bill:

- Tap "Bills" on home screen

- Choose biller or enter account number

- Authenticates the amount

- Continue paying

The payment is immediately reflected and a receipt is generated immediately.

Mobile Recharge & STC Services

Recharge mobile prepaid numbers or pay postpaid bills with stc pay.

- Tap "Top-Up"

- Choose provider and number

- Choose amount

- Pay from wallet

You can also buy internet packages, roaming services, and international calling credit.

International Money Transfers

International money sending is one of the main features of stc pay. It has support for more than 200 countries such as Pakistan, India, the Philippines, Egypt, and so on.

How to Send Money Internationally:

- Tap "International Transfer"

- Select the country

- Fill in recipient information (cash pickup or bank account)

- Fill in the amount

Pay and confirm

Transfer charges are low, and in most instances such as sending funds to Pakistan there are no charges over a threshold. It's among the best options compared to the conventional remittance service.

What is STC quick pay?

STC quick pay is an option for users who want to make payments without logging in to the application. It's widely utilized in Bahrain and Kuwait.

STC quick pay Bahrain

Go to the STC quick pay Bahrain website and fill in your mobile number and amount. Next, select to pay via a card.

STC quick pay Kuwait

Go to the quick pay kuwait bill payment and recharging website. It is suitable for customers wishing to recharge or pay dues without app installation.

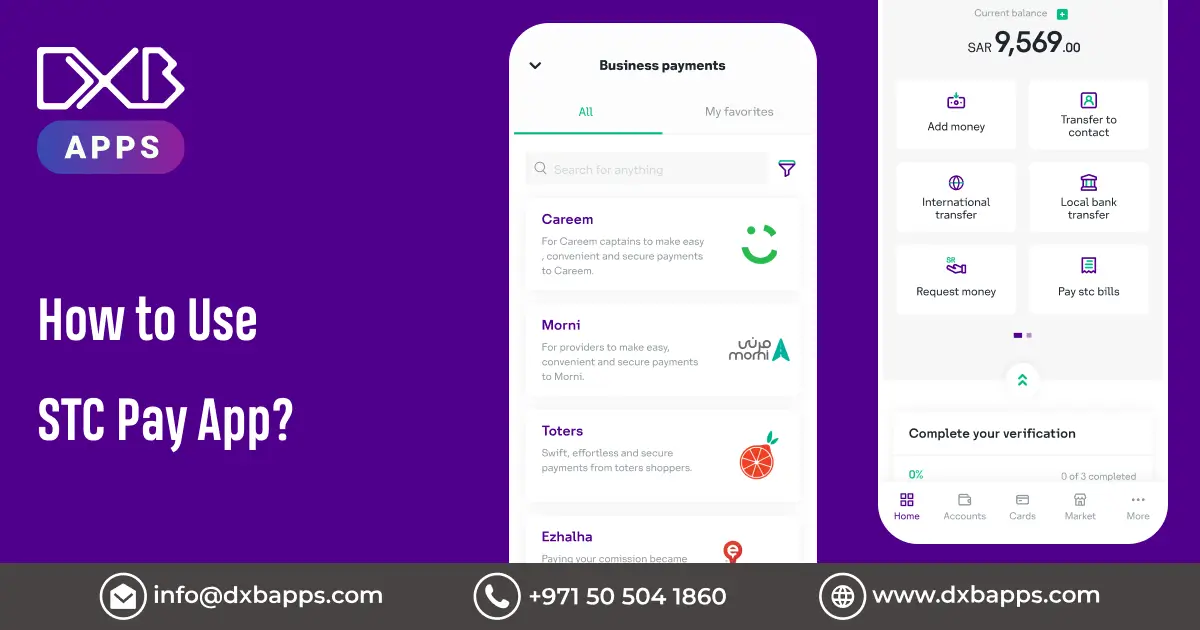

STC pay for Businesses

STC pay business platform has been created to cater to the contemporary financial requirements of startups, SMEs, and corporates present in Saudi Arabia. With the Kingdom moving towards Vision 2030 and a cashless society, stc pay performs an indispensable function by providing businesses with a safe, instant, and low-cost means to conduct financial transactions digitally.

Comprehensive Tools for Business Management

Companies that implement stc pay can benefit from a range of cutting-edge tools that streamline operations, enhance financial management, and offer customers seamless digital payment experiences. Among the platform's most notable features are:

1. Payroll Services

Businesses can use stc pay to automate employee salary disbursement directly from their wallet. The service is especially convenient for firms with a large number of employees or freelancers. Employers can:

- Process payroll instantly and securely

- Minimize cash-based salary disbursals dependence

- Adhere to local wage protection systems and labor (such as WPS)

- Maintain digital records for audit and compliance

2. Payment Gateway Integration

Companies can add stc pay as a payment gateway on their mobile application or website. It enables customers to make effortless payments directly from their stc pay account at checkout. It enhances the success rates of transactions and lowers cart abandonment.

3. QR Code Payments

Merchants and service providers can create customized QR codes associated with their business wallet. Customers just have to scan the code with their mobile banking app, input the amount, and make the payment within seconds with no cash or physical contact involved.

4. Invoice Generation

The platform allows business users to create and send electronic invoices to customers. These invoices can be augmented with embedded payment links, simplifying the payment process directly through stc pay or linked banking channels.

5. Expense Reports and Audit Trails

All transactions are logged automatically, so detailed reports are simple to produce. Businesses can monitor expenses by category, spot trends, and provide financial transparency during audits.

Business Benefits

Through STC pay business, there are many benefits:

- Real-time transfer of funds and updates on transactions

- Lower costs than other banking services

- Improved customer satisfaction with various payment choices

- Better financial control and transparency

- Elimination of paper-based and manual processes

In a market that is quickly shifting towards digitalization, stc pay provides Saudi business with a robust competitive advantage.

Login Tips for Security

As digital wallets are increasingly part of our daily lives, it's crucial to secure your STC pay login. Your money transfers, bill payments, and personal financial information are all at risk, but the app offers robust security features users also have a role to play in securing their accounts.

Here are top tips to secure your STC pay account:

1. Always Use the Official App

Only download STC pay via the genuine Apple App Store or Google Play Store. Refrain from downloading from third-party websites or unofficial channels, which could result in hacked versions of the app with malware.

2. Turn on Two-Factor Authentication (2FA)

This provides additional security. Even if an attacker is able to get your password, they cannot sign in without the second code being sent to your registered mobile number or email.

3. Employ Biometric Security

Turn on fingerprint scanning or facial recognition if available on your phone. These are much more secure than passwords or PINs in isolation and speed up opening the app and securing it.

4. Shun Public Wi-Fi

When accessing mobile app developers' platforms such as stc pay, eschew public or unsecured Wi-Fi available in airports, cafes, or shopping malls. These networks tend to be tapped by hackers for the purpose of intercepting sensitive information.

5. Logout When Not in Use

Although the app has auto-lock options, it's advisable to logout once you've finished your transactions particularly when using a shared or company machine.

6. Monitor Login Activity

The app records all login activity and sessions. Check your login history in "Security Settings" regularly to detect any suspicious activity and take action if anything appears abnormal.

By observing these precautions, customers can have their STC pay login be secure and stress-free.

Currency Exchange & International Use

The wallet also accommodates multi-currency exchange, so it's a good one to have if you travel a lot. You can exchange your Saudi Riyals to USD, EUR, and other currencies based on where you are.

If you're traveling or shopping abroad, stc pay has more reasonable exchange rates than banks or airport booths.

Security and Compliance

STC pay follows global security standards:

- Licensed by the Saudi Central Bank

- Encrypted end-to-end transactions

- Biometric and PIN login

- 24/7 fraud monitoring

It’s also aligned with Saudi money regulations, providing both safety and transparency to users.

DXB APPS: Building the Best Healthcare Mobile Apps in UAE

In the Gulf region, one of the top-rated development firms is DXB APPS, a leading mobile app development company with a solid track record in healthcare, fintech, logistics, and e-commerce.

What Sets DXB APPS Apart?

- Deep regulatory compliance expertise (HIPAA, GDPR)

- Scalable health management system architecture

- Adoption with wearable devices, hospital ERP, and AI tools

- Secure patient-doctor communication portals

- Real-time appointment, record, and prescription management

Being a leading mobile app development company in Saudi Arabia, DXB APPS continues to set new standards with strong platforms that drive both user experience and clinical results. Their expert team of mobile app developers and UX/UX designers create innovative solutions that revolutionize industries.

From wellness apps for individuals to complete hospital management systems, DXB Apps is the most trustworthy mobile app development company in Saudi.

Conclusion

The STC pay platform is a major step up in mobile financial services in the Gulf. For daily expenses, remitting cash to the homeland, or running a business, the app brings value in each transaction. With inherent security, simplicity, and features that meet both local and global requirements, stc pay is not just a wallet but your one-stop financial ally.

If you are in Saudi Arabia and in the market for a secure digital payment service, get the stc pay app today. As mobile banking expands, this platform is easily at the forefront of making it more accessible and secure to conduct your finances.

FAQS

Can I use stc pay with a mobile number?

With this service, stc pay allows you to send money instantly from your phone number to another phone number with total ease.

Does stc pay have a card?

STC pay mada card has a greater range for speed, security and simplicity. It can be added stc pay Mada in "Apple Wallet". stc pay Mada simplicity, security to pay and cash out.

Can I use stc pay with a mobile number?

With this service stc pay allows you to transfer money to and fro easily from your phone number to another phone number instantly.