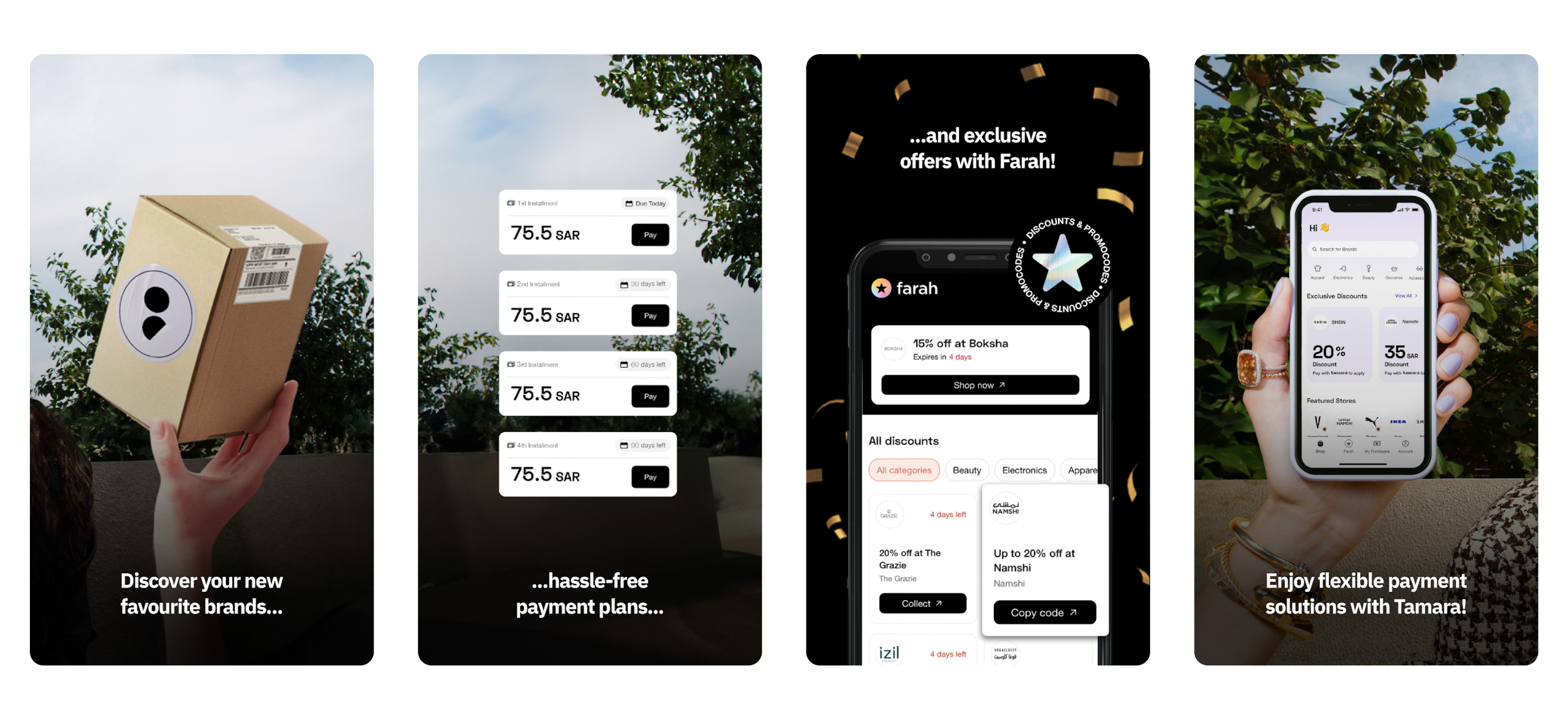

In this fast-moving world, managing finances effectively is more critical today. This buy now, pay later approach has given customers muscular flexibility while making purchases, not immediately bearing the burden of total payment. The Tamara app is one such app that is making waves within the UAE.

Tamara is a BNPL application that helps customers buy now and pay later without interest. This innovation is rapidly growing in popularity across the region and in Dubai, the UAE, where consumers seek flexibility in Tamara payment.

Rise of BNPL Services in the UAE

BNPL has been booming worldwide, and the case is no different in the UAE. Statistics prove that BNPL services are fast on the rise, with a considerable percentage of consumers in the region reaching for these payment solutions over traditional credit. The convenience and financial flexibility offered by apps such as Tamara dubai drive this trend and become the preferred option for many shoppers.

"Empowering your purchases, one installment at a time."

How Does the Tamara App Work?

The Tamara app offers a great user experience that makes it easy to manage one's payments. You can download the app, browse the partnered merchants, select your products, and select Tamara Dubai pay as a checkout option. After that, the application allows you to split the total amount into manageable installments that can be paid off over a set period with no interest or hidden fees.

"With Tamara, financial freedom is just a few taps away."

Key Features of the Tamara App

The Tamara app is genuinely one of its kind in the BNPL market because of its user-oriented approach and lucrative financial offerings. Listed below are a few of the key features that make Tamara the favorite amongst all users:

Interest-Free Payments

The most exciting thing about the Tamara app download is that its payment plan does not include interest rates. While most conventional credit options burden people with high interest rates, Tamara makes it easier to break down payments into installments without extra costs. That way, consumers can easily plan their finances and make big-ticket purchases.

Easy to use:

Tamara is designed to be user-centric with an intuitive interface that provides a smooth, hassle-free experience. It has easy navigation and direct checkout, which enables users to speed up their transactions without confusion about whether tech-savvy or not, Tamara's simple layout makes it accessible to everyone.

Wide Variety of Merchants

Tamara is partnered with various merchants, from fashion brands to electronics stores. This wide range allows users to shop for multiple products through the application, making it an all-in-one solution for shopping needs. This extensive network of merchants also enables users to find deals on almost anything they want to buy, providing further value to this application.

Secure Transactions

Tamara app uae asserts that security comes first. The app is equipped with strong encryption protocols to keep all of the user's data and transactions safe from unwanted eyes. This gives the users peace of mind by securing their personal and financial information when using the app.

Apps Like Tamara

The success of the Tamara app uae has seen several BNPL platforms emerge in the UAE. These apps like Tamara in UAE, focus on flexible, money-convenient payment solutions to cater to the growing consumer demand. In this regard, here are some of the most essential tamara alternatives discussed:

1. Postpay

One of the leading buy now pay later apps in UAE is Postpay, which offers interest-free installment plans of apps similar to Tamara. Born with a vision to make shopping easy, Postpay allows customers to split their payment into three or four equal parts, making it accessible from extra fees.

One of Postpay's central properties is how seamless it is to register. Registering using a mobile number takes seconds. Further, it doesn't require credit checks. This accessibility quickly made Postpay a go-to means for shoppers who are averse to credit cards or seek a tamara alternative in UAE.

2. Spotii

Like the Tamara app for Android, Spotii allows users to pay for their purchases over time without interest. It empowers consumers by giving them a flexible method for making payments without high fees or complex terms.

It's also famous for its focus on financial inclusion. Apps like Tamara do not charge interest or late fees, which makes them very different from most traditional credit products.

3. Tabby

It is also amongst the top BNPL competitors within the UAE, such as Tamara. Tabby offers users interest-free installments. What sets Tabby apart from others is its vast number of partner merchants and seamless shopping experience through its user-friendly app interface.

This value addition is unique in that users can earn rewards and discounts through the app Tabby. When shopping with any of Tabby's partner merchants, users can earn points redeemable for future purchases.

Why One Should Use These Alternatives?

What sets each of these Tamara alternatives apart is their features, but there seems to be one clear goal: making shopping more accessible by letting consumers pay over time. From the ease of sign-up on Postpay to the financial inclusion on Spotii, the broad merchant network, and a rewards program from Tabby, these apps provide user options based on individual shopping needs.

BNPL platforms are most attractive to people who avoid traditional credit options with high interest rates and strict approval procedures. The apps effectively offer zero-interest installment plans that let users better manage their finances, making budgeting easier for essential and discretionary spending.

How Can You Develop a Buy Now Pay Later App Like Tamara?

Designing a BNPL app like Tamara requires detailed planning and execution. Here are the steps to follow for building one:

1. Market Research

Any successful app starts with understanding the target market. BNPL will require going down to the bottom to understand consumer behavior, pain points, and competitive landscape analysis. It will also examine the regulatory environment, mainly in countries like the UAE, where financial services come under stricter regulations.

You will develop an application that meets their needs, making a mark in the BNPL competitive space by gaining insight into what consumers want and how they prefer to shop.

2. Development of technology

Any BNPL app should leverage underlying technology on the back end. It has to be secure, user-friendly, and able to process large volumes of transactions seamlessly. This demands building a solid backend that can handle payments, integrate with multiple merchant platforms, and offer real-time updates to users.

3. Merchant Partnerships

BNPL apps should be founded on a solid network of merchant partners for better success. Such partnerships allow the app to offer users a wide product and service portfolio, making it more engaging and multi-functional.

4. Compliance with Regulations

BNPL services are governed by financial regulations that differ from region to region. For example, in UAE, some governance is identified by the Central Bank about offering financial services involving BNPL. It becomes imperative to comply with all regulations so one does not get into legal tangles and elicit customer trust.

5. Marketing and Launch

In BNPL, efficient marketing decides how much thrust an app needs to gain space. This includes launched digital marketing campaigns, influencer partnerships, and consumer promotions including Discount or Cashback offers.

How Much Does It Cost To Build An App Like Tamara?

The development cost of a BNPL app like the Tamara app for iPhone may differ significantly due to many factors. This includes factors such as the level of complexity of the app, the number of features to be developed, and the team to create the app. The prices rise from $50,000 on average BNPL application to $200,000 or above.The breakup of the constituent parts of the cost includes:

1. Designing and Development of the App

The cost of additional development of a user-friendly interface and the backend that supports secure transactions increases. This includes sketches and drawings as well as ‘mock-ups’ and ‘mock-run’ where the usability and appearance is made more appealing to its target market.

2. Integration of the Payment Gateway

Integration with different payment gateways is essential to offer the user payment choices. This will involve the collaboration of payment service providers to ensure the smoothness and security of transactions.

3. Security Measures

Any BNPL app has to implement advanced security protocols to protect users' data through encryption, two-factor authentication, and compliance with data protection regulations.

DXB APPS- Your Partner in Developing BNPL Apps

At DXB APPS, we deal in innovative and high-end iOS app development in Dubai apps that can assist in helping our clients in particular ways. Whether you want to build an android app development in Dubai, we have the capability and expertise to bring your vision to life.

The top-notch team of experienced developers at DXB APPS knows the current market trends and will help you create a unique BNPL app similar to Tamara.

Conclusion

The Tamara App will reshape how people shop in the UAE, offering the most flexible and convenient solution to cater to modern consumers' needs. As the BNPL market grows, apps such as Tamara will increasingly play a vital role in retail.

FAQs

How to use the Tamara app?

The Tamara loan app is straightforward to use. First, download the app and then sign up. When signed up, you can shop through partnered merchants. When you finish your purchase, select Tamara at checkout to pay in easy monthly installments with 0% interest.

How do I open my Tamara account?

Get a Tamara account through the Boubyan mobile application for iPhone or Android through the app store; get logged in by entering your details and input your phone number to activate the account

Is Tamara legal in the UAE?

Yes, Tamara is fully legal in UAE and is subject to the country's financial regulations, which makes the BNPL offered by Tamara to users secure and reliable.