In this digital age, a fast, easy, and secure money transfer is necessary. Whether it's paying back friends for dinner, breaking your rent with several roommates, or sending money to your family, you want quick, reliable service headache-free, and that is where cash app Zelle enters into the picture with millions of its users all over the nation and has obviously transformed a paradigm in person-to-person transaction payment, making the process of sending money through person-to-person absolutely effortless and convenient-by fetching it right from your checking bank account.

This blog will cover everything you need to know about Zelle, from how it works to key features and benefits and why it stands out as one of the most popular money transfer services today. If you are already a user or simply considering giving the app a go, you'll find all you need here to make the most of Zelle.

What is Zelle?

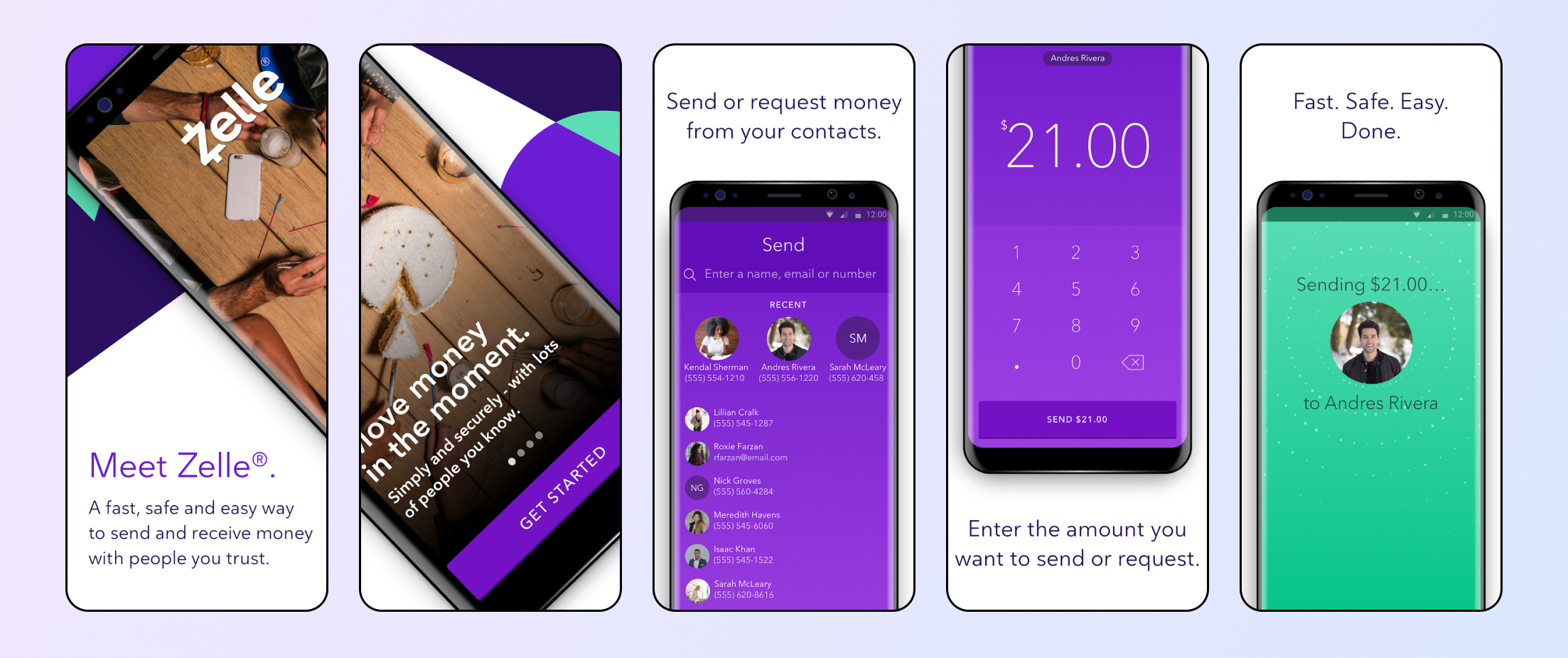

Zelle is a P2P payment service. A person who uses this service with an email or phone number can share and receive money with complete scenarios in real-time directly from the bank account as a transfer channel without involving an intermediary, which is easier than using a traditional intermediary, such as any payment processor or credit card.

Zelle Cash app is very different from applications like PayPal or Venmo. It doesn't hold any money, and it actually works only directly with participating financial institutions. So no separate account must be established or balances maintained in an electronic wallet-direct transfers exist between accounts linked.

But in addition to that, Zelle is also deeply embedded into apps of more than 1,000 participating US banks and credit unions. Chase, Bank of America, and Wells Fargo are all on that list and all are trying to get transfers to work as smoothly as possible for end customers. And so whenever these transfers hit the Zelle network, they appear essentially immediate-though actually, they are usually within just minutes.

How Does Zelle work?

It's extremely easy and pretty straightforward to use the Zelle app. Here's how you get started.

Download the App:

Go for the Zelle app download through the Apple App Store or the Google Play Store. Or, if your bank supports Zelle, you might even access it from the mobile banking app on your bank's side.

Set Up Your Account:

Upon downloading the app, the user needs to set it up through a link to a bank or credit union account of preference. To support your verification, you will also be required to input an email or phone number linked to your bank account.

Send Money:

Now you are all set and ready to send money. To do this, you just go to the money transfer app Zelle or directly to your bank's partner institution, choose a recipient from your contact list, input the amount to send, and then click the send button. Money will promptly and fee-free be transferred to the recipient's bank account.

Receive Money:

Probably the most vital benefits of Zelle include that the Zelle pay app facilitates very fast transactions that take only a few minutes, regardless of the bank or financial institution. Therefore, you can always send or receive money immediately by using Zelle.

The Rise of Zelle:

Zelle has been growing explosively since its launch date in 2017 and has attained instant status among the leading money transfer services within the United States. Today it has emerged as one of the favorite services among millions of its users in the country with a rapid, easy-to-use platform. Here are some of the key statistics related to the rapid growth of Zelle:

- Zelle had processed nearly 2 billion transactions in 2023, translating to over $500 billion. This means such an enormous scale and the amount of trust achieved in such a short period with Zelle.

- Now, more than 50% of United States households are using Zelle to transfer money. And it is not only people who are using them; companies are using many of them these days for easy and safe payment handling.

- Zelle is available to any of the over 2,500 banks in the United States, including Chase, Wells Fargo, Citibank, and Bank of America, which can access Zelle directly from their respective apps.

- A 2023 survey found that more than 90% of respondents were satisfied with how easy it was to withdraw money quickly from this service, which was enormously helpful in its rapid expansion.

- Of course, as of 2024, Zelle is still an open service. Many banks and credit unions are part of this network, making it accessible to many.

- Zelle is the digital payment leader but continues to act like a tough competitor—even beating out Venmo, Cash App, and PayPal.

Zelle vs. Other Apps: Which is Best?

There are hundreds of peer-to-peer payment apps than Zelle alone. Many have terrific strengths and weaknesses as well. Let's take a closer look at apps like Zelle and how Zelle measures up versus some of the strongest competitors:

Zelle vs. Venmo

The second most used app, besides Zell,e which sends money, is Venmo. This application has applied the most for recent use in young users are the ways like getting a pay, being paid, bill splitting, and merchant services. Transfers conducted with such a platform don't happen immediately by charging for it; a normal transaction between individual money can get transferred depending upon the transfer days in relation to the transfer to the system done during business working hours. Zelle does free instant transfers every single time.

Cash App vs Zelle

It has one other big competitor Cash App, which has all the features: direct deposit capability, buying Bitcoins, and a debit card on which one can withdraw money from an ATM. Though many other helpful services are provided through Cash App, instant transfers aren't as free. Zelle sends and receives money for free. For Cash App, it might be more complicated than to expect a hassle-free payment solution.

Zelle vs PayPal

Another oldest money transfer system is PayPal, its widely used features are not only for the purposes of peer-to-peer transactions, but it boasts features like online shopping or even merchant service. Pretty pricey in this regard because there are no PayPal fees to fund sending money from a PayPal balance or linked bank account, whereas transferring money will incur charged fees for funding a credit card payment or an instant transfer at Zelle app for Android the transfers will be no hidden at any time.

Why Choose Zelle? Key Benefits To Know

Millions of users in the U.S. keep coming back to Zelle. Here are the benefits:

Speed

It is real-time and will process all transactions within a few minutes. Other applications will take one to three business days. Then, there is Zelle, which does transfers instantly.

No Fee

No charge is made on the transfer, either while sending money or receiving money on Zelle. Most of its competitors charge a fee for their transfers, mostly fast ones; therefore, the appeal to use Zelle highly increases among its users who wish to send their money without extra fees.

Security

Since Zelle is bank-centric, it directly integrates with the banks, meaning their security measures help protect your transactions. This reduces some of the fraud and third-party vulnerability risks.

Wide Availability

This service is also very accessible, with more than 2,500 participating banks and credit unions in the U.S. Most of the big banks have included Zelle in their mobile banking applications, so the user does not even have to think twice before he or she can start using this service.

Very Intuitive And User-Friendly Interface:

It does open up an option to just mail money by sending an email address or cell number. It actually does look pretty pretty, really straightforward. It's best for fast small payments but spares one of the headaches normally associated with a digital wallet; one doesn't need to create a payment account.

How to Download and Install the Zelle App?

Download the Zelle App:

It is free in the Google Play Store for android and directly downloaded via the Apple App Store for users with iPhones. In the meanwhile, if using one of these banks that Zelle partners with, then you never have to actually use Zelle app-just access via your bank mobile app and get right to the transferring of your money.

Setup Account:

The application presents the account or debit card linking process directly, prompted through the app itself. This entails following a subsequent confirmation of email or phone number to verify it, which is advisable only for security purposes.

Start Sending Money

You move your money to any contact using only a screen tap once or twice. There will be a selection of the contacts plus adding the amount to be transferred, that's it. It happens in a blink of an eye.

DXB APPS: The Future Changing App Development About Banking

DXB APPS specialises in high-performance banking applications with the latest technology. Being one of the best App Development Dubai Company, we ensure that each application we develop is safe, working, and user-friendly. DXB APPS, as the top Mobile App Development Dubai company offers apps with good security and effectiveness to advance digital banking. Whether it's a money transfer app, payment platform, or other kind of financial technology, the only place you can hire for developing an excellent-quality

Conclusion

There is hardly any doubt that Zelle has dramatically changed the world of money transfers. Sending money today is fast, free, secure, and, above all, directly transferred from one bank account to another right away. Tremendous growth rates in adoption across the United States make Zelle on its way to being the one solution for millions of users' money transfers.

If you can't enjoy the ease of using Zelle, start now. Get Zelle today and start sending money instantaneously without hassle or other hidden fees other apps may incur.

FAQs

1. How do I send money using Zelle?

You can just open up your banking app or download Zelle on your mobile and start sending money. Then you would click a link to select a contact to send to, type in the person's name, select how much you would like to send, and then you are all set with the send button. The money would be processed right away.

2. Is Zelle free?

Actually, yes! Free to use, there is no charge for using the app to send money to another individual, with no added fee. Please note you must confirm that your bank does not add a fee to process.

3. Is Zelle international?

It currently only operates in the United States and offers a different service for sending money from another country to a PayPal account or to TransferWise.