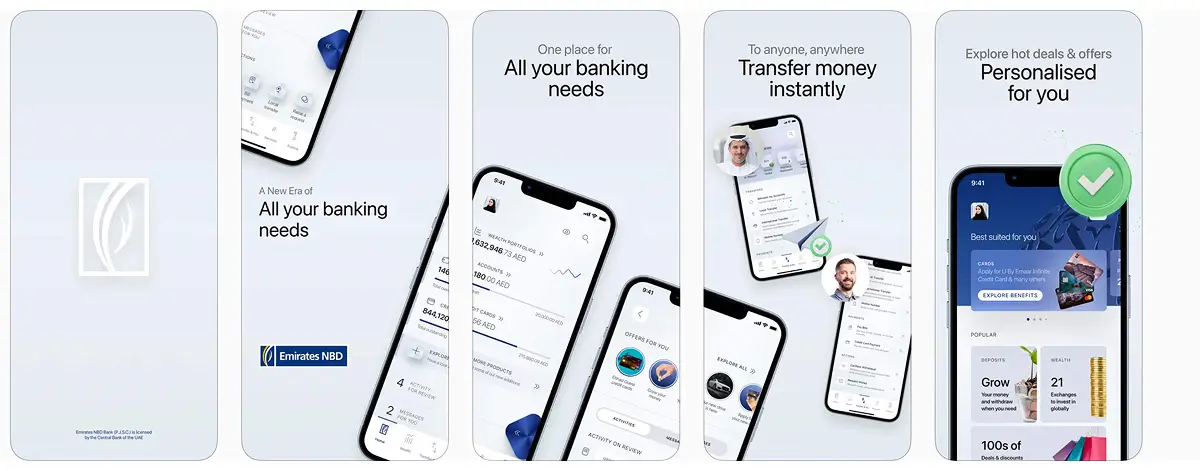

With the digital age that has been constantly changing, access to money tools is easier than ever. It is not just another application; ENBD X by Emirates NBD upsets the very concept of how individuals in the UAE manage their money and access personal loans. Standing out across the area, this mobile platform brings serious ease to users can start, track, or adjust their ENBD loan plans right from their phone, with zero branch trips needed.

The UAE's banks have changed fast thanks to digital tools, as more people now use phones to manage money. Emirates NBD, the biggest bank there by total holdings, leads this shift with ENBD X, a single smooth app combining more than 150 financial features.

The UAE's finance industry makes up 14.2% of the country's GDP in 2024, showing how vital bank operations really are

From weddings to surprise bills, the ENBD personal loan fits all sorts of money needs with options that adjust to your situation. Getting one's easier now, thanks to the Emirates nbd x platform, which streamlines everything from signing up to paying it off.

What are Emirates NBD Personal Loans?

Emirates NBD personal loans are unsecured, meaning no asset backup is needed, letting people tackle different money goals. These funds come fast, whether it's a few hundred dirhams for urgent costs or over AED 3 million for big life events. What sets ENBD loan options apart locally? Lower rates, repayment plans that fit your pace, and approvals that don't drag on.

ENBD gives out various kinds of personal loans, each suited to different people and needs. If you're a UAE citizen, you could borrow as much as AED 3 million. Expats aren't left out; choices depend on job type, income, or how long they've banked with ENBD. When it comes to interest, ENBD stays sharp in the market; some pay just 2.90% yearly, so qualifying individuals don't end up overpaying.

One thing that sets the ENBD personal loan apart? Their hands-on support is paired with smart tech upgrades. Using the nbd x app, people handle money stuff way faster than before. The Emirates online banking system links up smoothly with phones, so everything feels familiar no matter where you log in.

"Digital banking isn't just about convenience, it's about empowering customers with instant access to financial solutions that transform their lives," says Pedro Sousa Cardoso, Chief Digital Officer at Emirates NBD.

Understanding Emirates NBD Personal Loans

Emirates NBD hands out personal loans without requiring any collateral, so no property needs to be tied up. Approval hinges on your job situation, how much you earn, past credit behavior, what debts you're already managing, along how long you've been banking with them.

Loan Amount Flexibility

The personal loan ENBD sizes change a lot depending on who you are. If you're a salaried worker and move your paycheck through the bank, you could get up to 15 times your monthly income or AED 2 million, whichever hits first. But if you don't switch your salary, the highest you can borrow is AED 200,000. UAE citizens may qualify for as much as AED 3 million. To figure out what you'd pay each month, the ENBD personal loan calculator in the NBD X app download lets you plug in different amounts and timeframes.

Interest Rate Structure

The ENBD personal loan interest rate uses either reducing or flat calculations, making costs clearer to figure out. Starting from just 4.79%, reducing rates go hand in hand with flat rates near 2.55%. Each loan type has its own rate setup, depending on what it offers and how long it lasts. Knowing how reducing differs from flat rates lets borrowers choose smarter.

Repayment Terms and Tenure

People who grab an ENBD personal loan usually enjoy how easy it is to pay back. Many can stretch payments over 48 months, basically 4 full years. Since the monthly EMI stays steady, planning expenses gets simpler. If someone wants to clear things early, that's doable too, adding breathing room. Now and then, certain plans even let you skip two separate payments each year when cash gets tight.

Additional Benefits

Emirates NBD personal loans pack extras that boost their worth. Many of these loans offer life insurance as an add-on, covering what's left to pay. Some plans throw in free debit cards along with account access. Thanks to ENBD online tools, handling everything feels smooth, no matter the device. Meanwhile, downloading the Emirates nbd app opens doors to a range of money services outside just borrowing.

Seven in ten people in the UAE pick mobile apps first when doing bank stuff, thanks to easy access, along with custom money features

Step-by-Step Guide: How to Apply for a Personal Loan from ENBD X App

Getting a personal loan via the ENBD X app is quick, plus it's easy, one of the speediest options you'll find with banks in the UAE.

Step 1: Download and Install ENBD X

Start by grabbing the Emirates nbd app from your phone's app store. If you're using Android, head over to Google Play and look up the Nbd x app download for Android, tap install when you spot it. For iPhone users, just open the Apple App Store instead. Type in "ENBD X" and pick the real Emirates NBD app from the results using the Nbd x app download for iPhone.

Step 2: Registration and Login

New users need to sign up using the Emirates nbd X app. To get started, you'll need your Emirates ID, passport info if you're an expat, a linked phone number, also an email. Current Emirates NBD clients might log in with their online banking details right away. The sign-up process involves getting an OTP by text, setting up biometrics, and then making a PIN.

Step 3: Navigate to Loan Services

After signing in, head to the main screen, then go to "Loans." You'll see live loan options, personal loan offer deals from ENBD, along with quick approval checks. On the ENBD X app, you get full details, like today's rates, highest borrowing limits, repayment periods, plus setup charges.

Step 4: Check Eligibility

The app quickly checks if you qualify using details from your profile. If you're already a customer, it uses your income, existing debts, or credit history. In moments, you'll see the most you can borrow, the suggested repayment period, plus the rate that applies.

Step 5: Select Loan Amount and Tenure

Play around with the ENBD personal loan calculator to tweak your borrowing needs. This hands-on calculator lets you see how changing numbers shifts your monthly payment. Think about what fits your paycheck, the full cost of interest over time, or if delaying the first payment helps ease things up front.

Step 6: Submit Required Documents

Handing in papers via ENBD X means no more printed forms. If you're on a salary, share your Emirates ID along with a passport copy, plus a fresh salary proof, bank records from the past 3 to 6 months, and security checks. The app works with clear photos or scanned PDFs.

Step 7: Review and Confirm

Go over everything you've filled in before hitting submit. The screen shows a full breakdown, loan size, interest rate, how long it'll take, monthly payment, plus overall payback total. Check the fine print about paying off early, missing deadlines, or what the insurance covers.

Step 8: Submit Application

Once you've checked everything, go ahead and send in your form. You'll get a text plus an email right away to confirm. Thanks to ENBD X's instant loan app tools, plenty of people hear back with a first approval in just a few hours. If your paperwork's all there, expect an answer in 1 to 3 workdays.

The UAE's digital banking industry should expand 4.77% each year from 2024 to 2029, hitting a total value of $3.61 billion by the end of that period

Mobile payments in the UAE should rise 8.2% each year till 2030, thanks to new tech such as tap-to-pay systems

Step 9: Track Application Status

The ENBD X tool lets you check your loan progress instantly. Head to the "Requests" tab to see where things stand. Should more details be needed, alerts pop up in the app, come via text, or land in your inbox.

Step 10: Loan Disbursement

Once approved, the money hits your chosen Emirates NBD account, usually in under a day. Right after, the ENBD X app shows the loan in your list, so you can check payback dates and past payments straight away.

Eligibility Criteria for Emirates NBD Personal Loan

Knowing if you qualify before you apply cuts delays while boosting your odds of getting approved. Emirates NBD sticks to straightforward rules that keep personal loan access open and consistent.

Age Requirements

People must be at least 21 to apply for an ENBD loan. When the loan ends, expats can't be older than 60, while UAE citizens must not be older than 65.

Employment and Income Criteria

Salaried workers usually need to earn no less than AED 5,000 each month to qualify for many ENBD personal loan interest rate options. On top of that, they've generally been at their present job for half a year or more. Meanwhile, freelancers and company founders should've run their ventures for two years before applying.

Nationality and Residency

UAE citizens and foreigners can apply, but conditions might differ. Foreign residents need a current visa that doesn't expire for at least half a year when they submit their request.

Credit History and Debt Ratio

Credit checks play a key role when lenders decide. A spotless record boosts your odds quite a bit. Most applicants at Emirates NBD can't have repayments over half their monthly pay.

Required Documents for Emirates NBD Personal Loan

Good records help apps move faster. The ENBD X system lets you upload files online, so no paper is needed.

For Salaried Employees

- Clear copy of the Emirates ID front and back

- Passport page showing UAE visa

- Salary slip from the past 90 days

- Bank records covering the latest 3 to 6 months

- Blank post-dated cheques marked for security

For Self-Employed Individuals

- A working trade license

- Company registration papers

- Business bank records from the last half to the full year

- Checked finances for two years back

- Emirates ID, passport, plus residency visa

- Personal bank summaries

Interest Rates, Fees, and Repayment Terms for Emirates NBD Personal Loan

Knowing all the costs tied to ENBD personal loans helps you make smarter money choices. Emirates NBD shows clear pricing, no surprise fees tagged on.

Interest Rate Structure

The ENBD personal loan interest rate sits anywhere from 4.79% up to 5.69% each year, using reducing rates, while the flat rate runs between 2.55% and 3.03%. From time to time, special deals let borrowers grab an ENBD personal loan offer lower rate than usual.

Processing Charges

Processing charges usually make up 1% of the loan you get, taken straight from the payout. Paying off the loan sooner than planned means extra fees kick in. If you skip monthly payments, fines pile up and your credit score takes a hit. Life cover isn't required, yet it bumps up your EMI while offering solid financial safety.

Features of ENBD X Personal Loan

The ENBD X app brings the best perks, setting Emirates NBD's personal loans apart from rivals, making it stand out among the top loan apps in the UAE.

Key Features

- Apply online right away: fill out forms from any spot using your phone, while lots of individuals get first-time okay signals in just a few hours thanks to instant loan apps tools.

- Cool interest rates: Emirates NBD gives you top deals that match what others charge across the UAE.

- From AED 10,000 up to AED 3 million: ENBD covers all sorts of needs.

- Fast approvals: Lots of individuals get the green light in just one to three workdays, then cash hits their account within a day.

- No collateral needed: since these loans aren't backed by assets, you don't have to risk your property.

- Pay your way: pause the first payment for as long as 120 days, skip some due dates when needed, add funds later if required, or pay it off sooner without hassle.

- Anytime access: The banking application runs nonstop, with chat help built in or detailed FAQs ready to go.

Managing Your Loan Through the ENBD X App

After getting your loan cleared, use the ENBD X app to handle everything. Just log in to online banking to stay on top of it all.

Loan Management Features

- Check your full loan details, see what's left to pay, how much interest you'll owe, your monthly installment, when the next payment's due, plus the entire payoff plan

- Turn on auto-debit so payments go through without you doing a thing

- Toss in extra cash now and then to lower the overall interest

- Need more funds? Ask for a loan boost straight from the app

- Change your details whenever you want

- Keep an eye on payments through clear records, with reports you can save anytime

Common Mistakes to Avoid When Applying for a Loan

Slipping up less means your app runs more easily, so you're more likely to get the green light.

Key Mistakes

- Handing in half-finished or unclear papers causes holdups or straight-up denials

- Taking out bigger loans than required piles on monthly payments, along with extra interest

- Applying for several loans close together drags your credit rating down

- Mixing up reducing and flat rate terms can bring unexpected expenses

- Not checking various ENBD personal loan options before signing up

- Ignoring the fine print can lead to surprise fees

- Giving fake details, on the other hand, results in instant denials

Why Choose ENBD X Over Other Banking Apps?

In the crowded scene of the top best loan apps in the UAE, ENBD X stands out, not just by chance, but because of several important reasons.

Competitive Advantages

- One platform handles 150+ bank services, not only personal loans, but also things like account management or payment tools

- Emirates NBD, known for its best performance, runs as the top bank in the UAE when measured by asset size

- Top-notch protection: Uses fingerprint login, strong 128-bit SSL coding, along with extra login verification

- User Experience: Smooth layout, quick response speed, yet easy movement across sections noted over and over

- Quick handling: Lots of apps get early green lights in just hours, thanks to real-time loan platforms working fast behind the scenes

- Good deals: Always near the top when comparing ENBD personal loan rates across UAE banks, thanks to the best pricing that stands up well over time

- Great help: Reach out through chat inside the app, call them directly, or visit local offices for hands-on assistance

Alternative Options for ENBD X Over Other Banking Apps?

Though ENBD X has top features, checking other options lets users pick wisely, because comparing reveals what really works.

Other Options

- Old-school banking apps, like FAB, ADCB, Mashreq Bank, or Dubai Islamic Bank, give top mobile access plus options for personal loans

- Digital-first banks: Liv from Emirates NBD, along with Mashreq Neo, CBD NOW, or the ADIB Banking Application, each built for faster loan handling

- Fintech platforms: New fintech startups offer loan networks between users, pay-later deals, also small-scale financing choices

- Comparison sites such as Souqalmal, Policybazaar UAE, or Yallacompare pull deals from various banks together

- Islamic banking's big here, Dubai Islamic Bank runs on Sharia rules, meanwhile Abu Dhabi's version does too, while over in Sharjah, the local bank follows the same path.

Cost to Develop an App Like ENBD X

Building a banking app like ENBD X means spending big on tech, plus the best security, while also meeting strict rules.

Development Cost Breakdown

- Planning with Analysis ($15,000 – $30,000): Looking into market trends, checking legal rules, then setting up the tech layout

- UI/UX Design ($20,000, $50,000): Skilled work that includes wireframing, building prototypes, testing with users, also handling visual layout

- Core Development ($100,000 – $300,000): Creating mobile apps along with web portals, admin panels, also the systems that run behind them

- Security Setup ($30,000, $80,000): Scrambling data tools, fingerprint or face scans for login, spotting shady activity, along with checking weak spots by simulating attacks

- Third-Party Integrations ($20,000, $60,000): Payment gateways, along with credit bureaus, tied to core banking systems, are also linked to analytics platforms

- Testing + QA ($15,000 – $40,000): Full checks on features, safety, speed, along with real-user trials

- Staying within UAE Central Bank rules + handling data laws: (costs around $25K to $75K)

Total estimated cost: $225,000 to $635,000, maintenance after that hits 15–25% every year.

How DXB APPS Builds Exceptional Banking Applications?

DXB APPS is the team of mobile app developers in the UAE, crafting smart finance apps that go head-to-head with big names such as ENBD X. Based in Dubai, this top-tier iOS app development company in Dubai blends advanced tech skills with real insight into banking needs, bringing powerful, polished apps to life.

Our team of seasoned app developers knows the ins and outs of fintech, rules set by authorities, along crafting smooth interfaces made just for banking tools. We get what it takes to build systems that are safe, able to grow, and easy to use, hitting all the tough standards from the UAE's central bank while still giving users a top-notch experience.

DXB APPS uses full-cycle app development, starting with deep research and clear roadmaps, followed by strong security setups, clean interfaces built for finance users, best server-side systems, and smooth links to external tools. Being a top mobile app development company in UAE, we focus on crafting apps that tap into Apple's full features, yet still work just as well on Android devices.

Conclusion

ENBD X represents a possible future of banking in the UAE, combining the old-fashioned trust and the fast new style of app-based finance. The ability to apply for and receive a personal loan via a simple phone application demonstrates how fast money services are transforming across the whole country.

For people looking to borrow cash, ENBD X makes it easy with the best rates, choices that fit your schedule, plus help every step of the way. If you're combining bills, paying for school, fixing up your place, or dealing with surprise costs, Emirates NBD's personal loans, right from ENBD X, offer a straightforward way to get funds without breaking the bank.

FAQs

How to borrow money from Emirates NBD?

Grab the ENBD X app, finish signing up, head over to Loans, see if you qualify, pick how much you need and for how long, add the needed files, then send off your request for quick review.

How much salary is required for an NBD loan?

The lowest income needed for an Emirates NBD personal loan is AED 5,000 monthly if you're employed; earning more might get you improved terms or a bigger loan.

How long does it take to get a loan from NBD?

Many ENBD loan requests that have all the needed papers get the green light in 1 to 3 workdays, then cash hits the account within a day after approval if you're a current customer.