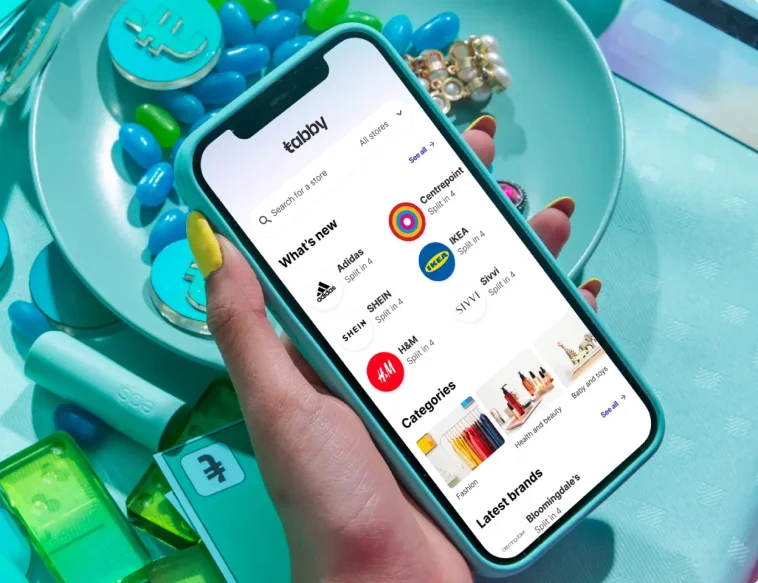

Buy Now Pay Later BNPL is a fantastic idea that is becoming very popular today. Although BNPL is novel, everyday consumers might benefit from this smartphone application. Companies have also begun to provide their own unique BNPL apps to cater to the requirements of their clients. Personalized payment choices, more client loyalty, and indeed better user experiences surely are just a few advantages that these custom apps can provide. The technologies used to create a buy-now, pay-later app like Tabby by Mobile App Development Company Dubai will be covered in this section.

Get An Overview Of What A Tabby App Is

Tabby provides services to retailers, including Sheen, Ali Express, and others. Customers only need to choose what they want and then choose the "pay later" option on the checkout page to utilize the app. They will receive an email acknowledging the payment as soon as it is done, and their credit score will be updated with the transaction.

With Tabby, you can pay for your purchases in whole after 14 days or in four interest-free installments. Customers can pay with ease and flexibility using these two methods, and there are no additional costs.

"According to a recent survey, indeed 67% of consumers are more likely to purchase if a Buy Now Pay Later option is available."

Types of Technologies Use In Buy Now Pay Later App Like Tabby

Secure Register/Login

The ability for users to sign in by email or OTP is the primary goal of a Buy Now Pay Later app developed in the UAE. You can use the features without entering your login information, even if it might look like you must.

In contrast to other payment methods by app development Abu Dhabi, the SNPL application allows you to use it as a guest and take advantage of all its capabilities. You can enter your login details later once you've been approved.

Distinct Payments

Customers want to buy something, but their income or budget only covers roughly 1/4 of the cost. This is a relatively common scenario. One excellent alternative for iOS mobile app development in Dubai is the "split payment" method.

Autonomous Inference

Customers who must arrive on time or make their payments can benefit from automatic deductions. The app offers the option to deduct automatically. All amounts owed for the subsequent purchases are taken out of the customer's account on the designated date.

Shop Now, Pay Later – Empowering Your Financial Freedom

Advance Payments

Additionally, app developers in UAE enable customers to have the option to pay in advance for the goods they want. Most customers will still prefer to pay on time even if they have the option to "Pay Later," particularly for two reasons.

To lessen the financial strain, a mobile app Development Company in Saudi Arabia lets users first wish to pay or utilize the app once more. Automatic deductions won't happen in certain circumstances. But adding eWallet app development to the SPNL application can also be a nice feature.

Management of Accounts

The Dubai app, available for purchase now and pay later, will include a much-needed account management tool. This feature, which lets customers see their purchases, plan payments, and access all their data on the screen, is prioritised by Pay Later apps.

Analysis of Merchants

The services provided by the mobile app development company in Riyadh in SNPL are well-liked by merchants and customers. The number of orders placed and the total amount of money made are instantly accessible to any third-party site that uses SNPL.

Mobile payment statistics encourage consumers to build a long-lasting relationship with the app by providing a thorough overview of the relationship between the two parties.

Payment Links

The most well-liked technology is the specific payment links. They enable retailers to accept payments from clients via a special link. This feature is helpful when you shop at a neighbouring store. Web development agency Dubai lets customers convert their payments to flexible EMIs and Pay Later instalments if the app is accessible.

Repayment Schedule

Customers should be given a repayment schedule by the app developers in Saudi Arabia that details the total amount owed and the due dates for each payment.

Interest Rates and Late Fees

To keep users from being surprised, the app should make all late penalties and interest rates related to the BNPL service crystal apparent.

Combination of E-Commerce Services

To make it simple for companies to take payments through the BNPL service, the app should interface with payment gateways and e-commerce services.

"The future of shopping is here, where convenience meets flexibility."

Choosing DXB APPS For Developing Apps Is A Good Decision!

For our clients worldwide, DXB APPS a leading mobile app development company UAE has effectively completed immense projects. We are always adorning our crowns with new feathers. Our only goal is to give our customers top-notch mobile apps.

App Developers Dubai at DXB APPS is devoted and hardworking, working nonstop to maintain the reputation we have built over the past few years.

DXB APPS and Web App Developers' Expertise

Contact DXB APPS website design company UAE to learn more about buy now, pay later. You can employ our web app developers to get started, or DXB APPS the best web design company Dubai can indeed help you create a customized, scalable app that meets your specific needs. So, why do you hesitate? Get in touch with us right now!

Summing Up!

DXB APPS the best web design company Dubai and top app development company dubai may allow companies to provide their customers a flexible payment alternative that can enhance their shopping experience and increase sales by creating a custom Buy Now Pay Later (BNPL) app. Businesses should consider essential aspects, including an easy-to-use interface, payment alternatives, an approval procedure, a payback plan, customer assistance, security, integration, and marketing and promotion when developing a BNPL app like Tabby. By increasing sales and improving the shopping experience, a custom BNPL app by DXB APPS the top mobile app development company UAE can provide a win-win solution for companies and their clients.

FAQS

How does Tabby generate income?

Tabby pays the remaining purchase price to the merchant, and if the client pays on time, the remaining balance is automatically charged to them in three free monthly payments.

Can we reduce the price of developing a mobile app like Tabby?

The price of indeed creating a mobile app like Tabby can be reduced using several strategies. Two strategies exist: the first is to prioritize essential features before adding more intricate ones, and the other is to opt for cross-platform development using frameworks like React Native or Flutter mobile app development Abu Dhabi.

Does Tabby provide safety?

Yes, robust security measures must be implemented in the app to safeguard user information and stop fraud.