Living in the UAE involves embracing a busy life, more so when it comes to financial transactions like remittances, bills, or currency exchange. The demand for fast, secure, and easy digital money is increasing.

Among all the Best exchange apps that we currently have, the Al Ansari Exchange Mobile Application stands out as the best among the rest. It is a complete system that caters to every single resident whether you are an expat who needs to remit money overseas or a resident who has bills to settle.

With more than 50 years of history behind them, Al Ansari Exchange is a name that is known to every household when it comes to remittances of money as well as currency exchange in the UAE. The same confidence and quickness is now in your hand with their application, making transactions easier, quicker, and safer than ever before.

This blog explores why the Al Ansari Exchange Mobile App is more than just a convenience it’s an essential tool for residents in the UAE. We’ll explore its features, benefits, how it works, the security protocols it uses, and how it compares to other similar Money exchange rate apps.

The Digital Finance Revolution in UAE

UAE is also one of the region's most technologically advanced economies. It boasts internet penetration in excess of 98% and smartphone penetration of nearly 100%. The citizens are therefore greatly reliant on mobile apps for payments, banking, and money sending. Over 70% of aggregate remittance volumes in UAE are said to now be carried out over electronic rather than conventional branches.

This rise in digital adoption has shaped customer expectations customers anticipate applications to be user-friendly, secure, and responsive. Al Ansari Exchange Mobile App achieves this with great precision and effectiveness.

Live Exchange Rates and Real-Time Alerts

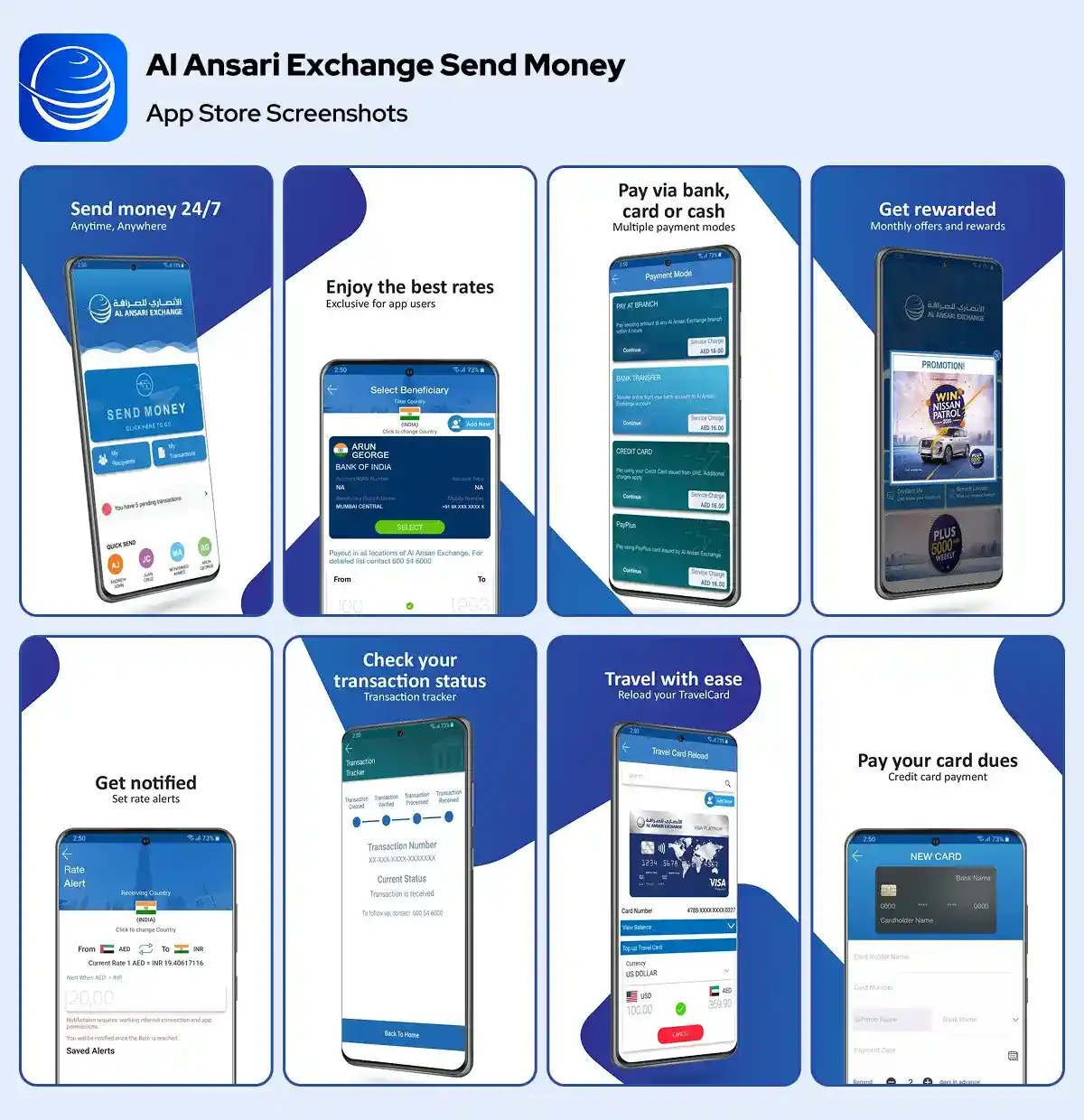

One of the most helpful functions of the exchange rate app is live exchange rate tracking. Those were the days you phoned or visited a branch to obtain up-to-date rates; with the app, you have immediate results. You can even set rate alerts, which indicates that you will receive an alert as and when your preferred exchange rate is being offered.

For UAE nationals sending money to countries such as India, Pakistan, or the Philippines—where exchange rates fluctuate on a regular basis this aspect alone will keep you saving thousands of dirhams every year.

Instant International Transfers

Transfer money to over 200 countries and territories with ease via the Al Ansari Exchange App. The app facilitates multiple payment mediums like:

- Direct account transfers

- Cash pick-up facilities

- Mobile wallet recharges

- Instant bank deposits

Transfers take a matter of minutes, and the best exchange rate app also offers live tracking so you can always know where your transaction is.

While some less prominent services are not governed by the UAE Central Bank, Al Ansari's app gives total synchronization with all money and legal security systems.

In-App Bill Payments and Top-Ups

Those were the good old days when you needed to juggle a dozen or more platforms for various utilities. The UAE exchange app download allows you to pay a variety of assorted bills instantly:

- DEWA, SEWA, and others

- Mobile recharge (Etisalat, DU, international operators)

- Credit card dues

- Government charges for services

- Prepaid card reloads

This makes it an all-encompassing finance administration system ideal for those managing family budgets, working professionals, or anyone who needs it all at their disposal.

Prepaid Card Management

The Convert currency app iOS/Android also enables you to control Al Ansari's own prepaid and travel cards. You can:

- Check your balance on your card immediately

- Recharge your card immediately

- View your transaction history

- Lock/unlock your card to increase security

It is very handy for online buyers and regular travelers who need tight management of their spending without compromising security.

User-Friendly Design and Interface

Al Ansari Exchange Mobile App is built with convenience and simplicity in mind. It includes:

- Support in multiple languages (English, Arabic, Hindi, Tagalog, Urdu and so forth)

- Biometrics Fingerprint or Face ID log-in Biometrics

- Modern and clean interface

- Safe payment gateway

- 24-hour customer service through a live chat

Whether you are an experienced person or opening a mobile finance application first time, the structure and guidance are simple and straightforward.

Built for UAE’s Multinational Population

What makes this the Best exchange app for Android stands out is that it's specifically tailored for UAE's multicultural resident population. With multiple currency options, language, and recipient country features, it's uniquely designed to serve the specific needs of a nation where more than 85% of the population are expatriates.

Whether sending AED to INR, PHP, or PKR the app simplifies it, speeds it up, and secures it.

How Safe is the Al Ansari Exchange App?

Security is a top concern with online cash. The app has:

256-bit SSL Encryption

The application has 256-bit Secure Socket Layer (SSL) encryption that is applied in major banks and financial institutions all around the world. The encryption protects information passing between your phone and the Best Exchange app for iOS servers from unauthorized use, and it becomes next to impossible for hackers and third parties to gain access to it. Anytime you send money or check rates, all your data are kept confidential, safe and uninterceptable and untamperable.

Two-Factor Authentication (2FA)

The application has embraced the Two-Factor Authentication (2FA) to reach each individual transaction and each individual log-in. It increases a verification measure- a special code in your phone or mail. Without your second factor, a hacker cannot log in to your account unless he or she possesses your password. It prevents access to unauthorized parties and enhances account security by a big margin.

Real-Time Fraud Detection

The app provides a more sophisticated real-time protection system from fraud that monitors your account activities all the time. It checks for unusual trends like large transfer values, unknown device logins, or untimely locations. If something unusual occurs, it will alert you right away and suspend the activity until you approve. This feature is a great addition of security against internet threats and identity theft.

Biometric Login for Additional Security

The app supports biometric login such as fingerprint and Face ID. What it actually means is that the app will only be accessible to you even if your phone is stolen. Biometrics are more challenging to replicate than passwords or PINs, with easy and safe access. It's a simple yet effective method of ensuring that other persons are not able to access the app and your money.

Transaction Confirmation Alerts

The moment you initiate a transaction (a sending of money, a reloading of a prepaid card, or a payment of a bill), an automatic notification is sent in real time. It makes you fully up to date and enables you to detect suspicious activity in real time. In case anything objectionable happens, they can freeze the account at any time or can highlight for assistance, which enhances the reaction.

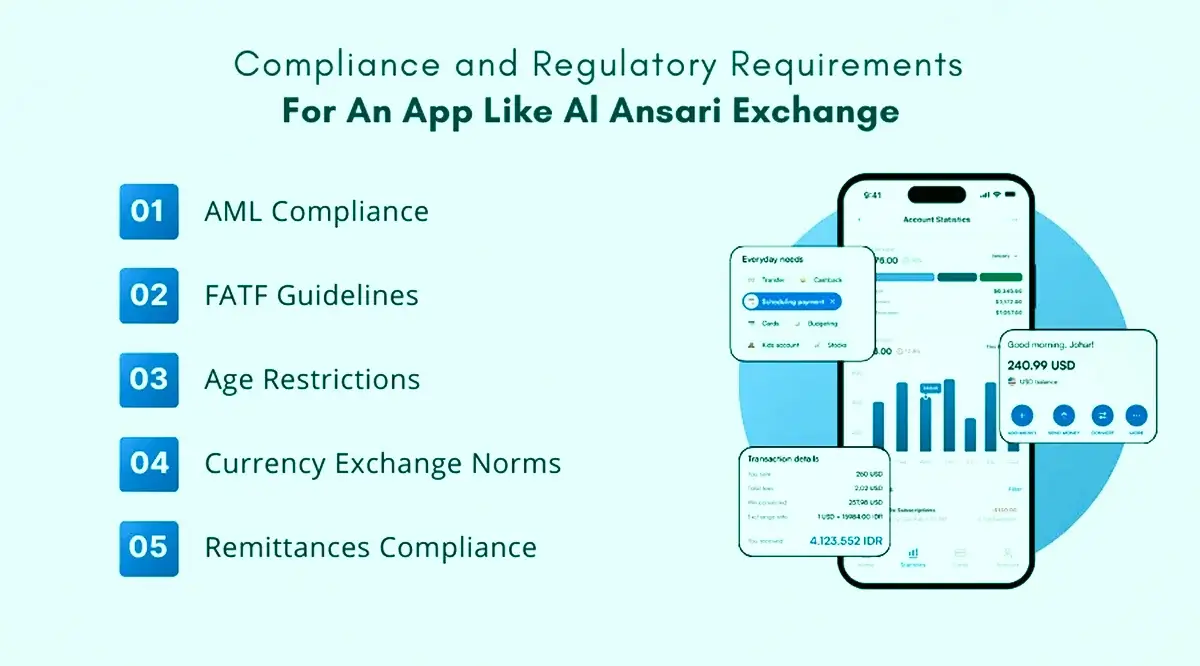

UAE Regulatory Compliance

The app is compliant with all UAE Central Bank regulations and local data protection laws, among the strongest in the industry. What this entails is that the app is always refreshed with the highest level of cybersecurity measures and privacy management. It further implies that your private data is managed responsibly, lawfully, and in absolute transparency leaving you secure and comfortable to use the service.

It follows the UAE's rigid data protection laws, and your personal and financial data are absolutely secure.

How to Get Started?

Al Ansari Exchange Mobile App is easy to use. This is how:

- Get it in the Google Play or Apple App Store.

- Register a secure account and enable it.

- Enter your beneficiary details.

- Choose your service money transfer, bill payment, or top-up.

- Verify and track your transaction in real-time.

It also remembers your past transfers and contacts, so subsequent transfers are even faster.

Send faster. Pay smarter. Live easier with the Al Ansari Exchange Mobile App.

Comparison with Other Exchange Apps

While there are several currency exchange apps in the UAE, very few offer the level of integration that Al Ansari does. Other apps often require switching between platforms for different services remittances in one, bill payments in another. With Al Ansari’s app, everything is in one place.

Some of the rest of the app exchanges do not refresh rates frequently or have fewer countries to send. Some have a slow processing time or fewer security measures. Al Ansari app remains one of the most secure for good reason—speed, transparency, and security.

User Scenarios

- For Residents: Send money home instantly at the best exchange rates.

- For Travelers: Top up prepaid cards and check currency rates in real-time.

- For Families: Pay bills and top up mobiles with convenience.

- For Businesses: Make safe high-value payments and manage recurring bills.

Why It's a Must-Have?

Al Ansari uae exchange mobile app is a full-bank full-suite solution. In the UAE where the standard is cross-border financial transactions it's convenient, but more importantly, it's a necessity. The app has been built based on tens of millions of transactions that have proven, with app store reviews that are consistently high, and continued customer trust.

It's especially critical for:

1. Monitor Exchange Rates

Al Ansari Exchange Mobile App enables you to keep track of real-time exchange rates of currencies at any time. You can even be notified when your target rate is available. This enables you to send money at the opportune time and save more on each transfer. It's best for anyone who needs more control of his cross-border transactions without necessarily keeping abreast of the developments in the market himself.

2. Send Money Quickly

Sending money abroad is easy with the UAE exchange app. If you have a stored recipient, you can send multiples in one touch. Repeat payments are quick and simple with your previous details stored by the app. No branch trip the choice to agree in just minutes, securely on your device.

3. All-in-One Tool

Why five applications when you can do everything in one? With Al Ansari's application, you can transfer money, load prepaid cards, pay bills, and monitor your transactions all in one place. It's all made simple, easy to use, and safe. To send money or access your history, it's all available in one single dashboard.

4. UAE-Regulated Security

The best currency exchange app is in accordance with the UAE Central Bank's stringent money rules as well as data protection regulations. Which means your personal and financial data is extremely secure. In addition to security features like 2FA, SSL encryption, and biometric login, it's among the safest platforms in the UAE for mobile money transfer and currency exchange.

DXB APPS – Creating the Best UAE Mobile Apps

We understand what it means to develop an incredible mobile app at DXB Apps. That is why we concentrate on developing user-centered, extremely secure, and scalable apps that will make a difference to your business goals. If you are in the fintech or retail industry, healthcare, or education sector, we have mobile app development in dubai based on functionality and experience.

Our mobile app developers and designers take advantage of the latest frameworks, security protocols, and best practices of agile development to craft apps like the Al Ansari Exchange Mobile App seamless, intuitive, and efficient.

"A smart app is like a smart assistant always available, always secure, and always one step ahead."

Conclusion

Al Ansari Currency exchange app is not just a finance app but one of the UAE must-haves. From real-time exchange rates monitoring to instant remittances across the globe, prepaid card management, and bill payments—to the most sophisticated security features the app is designed to deliver all that today's UAE citizens expect.

It is time-saving, enhances financial control, and gives you peace of mind with each transaction. You could be an expat, a businessperson, or a digital nomad – it's an empowering means of having command over your money while on the move.

If you're ready to take your financial life to the next level, there's no better place to start than with the Al Ansari Exchange Mobile App.

FAQs

1. How to transfer money through Al Ansari Exchange App?

To send money, simply launch the exchange platform app that you may find at the store Al Ansari Exchange, enter into the system through a safe connection to your personal profile and then choose the option of transmitting funds. Chose your receiving country, the name of your beneficiary, and bank details, write the sum of money you want to transfer and confirm. You will get an immediate confirmation and a tracking number on which you could keep an eye on the status of your transfer directly on your mobile, at any time and at any place.

2. How does the UAE Exchange app function?

The UAE Exchange mobile app is an all-in-one financial application through which customers can exchange money, remit cross-border, pay bills, and manage prepaid cards all with their hand. The application operates within secure virtual channels and is regulated in its entire scope by the UAE Central Bank, meaning that transactions are secure. It facilitates the easy use of financial transactions by bringing instant availability, real-time data, and simplicity-based functionality to your fingertips.

3. Is the Al Ansari Exchange application secure for large transactions?

As a matter of fact, the Al Ansari Exchange Mobile App supports small as well as large transactions. It uses 256-bit SSL protection, two-factor authentication, and biometric identification, which provides the newest protection to its users. Online fraud-Characteristic frauds are prevented in real-time. Backed by UAE banking regulations, the app ranks as one of the safest interfaces to conduct large sums securely and safely.