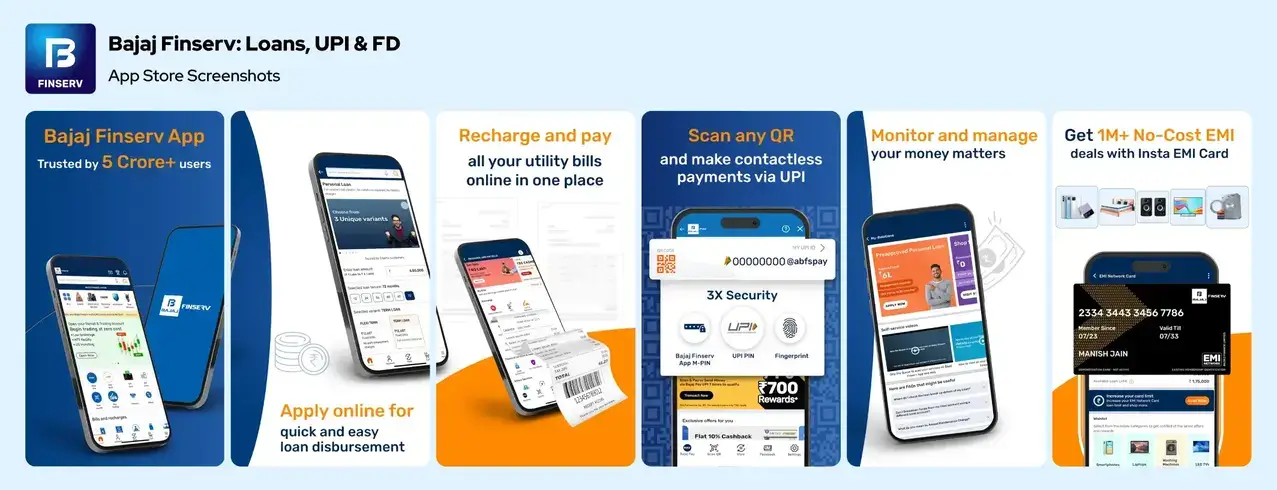

With the busy life of today, where personal loans, EMIs, and credit facilities are a part of everyday living, financial management in an effective and smooth manner is no longer a luxury but a requirement. The Bajaj Finance App is a one-stop solution that aims to make financial management easy allowing users to monitor loans, handle EMIs, apply for credit, and get personalized financial services at their fingertips. Whether you are applying for a UAE personal loan, settling your consumer durable loans, or just keeping an eye on your financial well-being, this app makes it hassle-free and stress-free.

The economic scene is changing at a fast pace. Based on a 2024 report by Statista, online lending applications in India had over ₹16 trillion worth of transactions, and finance apps experienced a 36% increase in year-over-year active users. Interestingly, apps such as Bajaj Finance App reign supreme because of their strong security, extensive feature offerings, and well-known brand name.

In the UAE, with over 90% digital banking penetration, there's a growing need for trusted, real-time loan solutions. This guide goes in-depth on how the Bajaj Finance App download can empower you to deal with loans, monitor EMIs, and get financial services from anywhere.

Why Financial Apps Matter Today: A Global & Regional Perspective?

Financial apps have revolutionized the relationship between users and their money. The era of waiting in long lines, paperwork, and disorganized records is gone. Apps such as the Bajaj Finance App bring together advanced technology and consumer-centric design to provide:

- Real-time loan management

- Smooth EMI tracking

- Instant approvals for personal loans

- Facility for insurance and investments

Worldwide, digital lending sites are estimated to achieve a market size of $43 billion by 2028. The UAE alone has more than 8.8 million smartphone users, and financial applications have become an essential aspect of daily life.

"The greatest wealth is financial freedom — and the right app puts it in your hands."

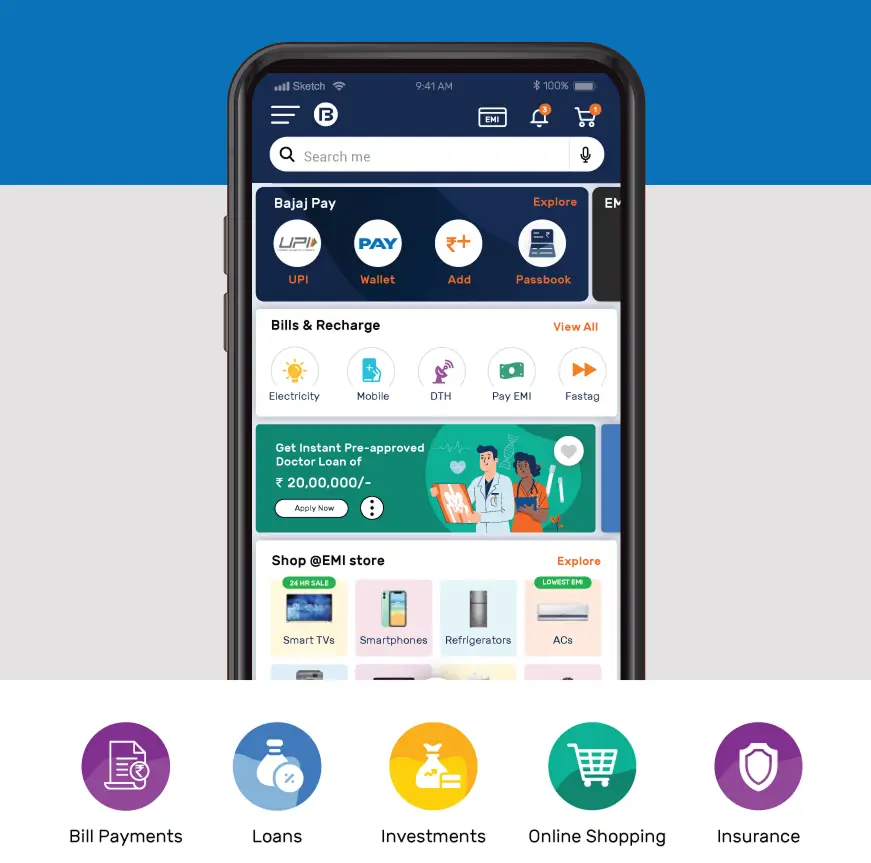

Top Features of Bajaj Finance App: Your Financial Control Center

Let's take a closer look at what makes the Bajaj Finance App so revolutionary:

1. Easy Loan Management

The Bajaj Finance App simplifies loan management and keeps it organized. You can manage all your loans be it a personal loan, a home loan, or a consumer durable loan at one go. Check your outstanding balances at any time, view your repayment schedules in detail, and download account statements instantly. Having everything on your phone, you will always be updated and in command of your loan journey easily.

2. Hassle-Free EMI Tracking

With the Bajaj Finance App, managing your EMIs is easy and hassle-free. You will receive timely reminders about your EMI due dates so you never miss a payment. Automate your payments with auto-pay so that your payments are made on time without any additional effort. You can also monitor your EMI card limits and see exactly how much you've spent or how much you have left staying financially aware every month.

3. Instant Loan Application & Approvals

Getting a loan has never been simpler. With the app's instant loan option, you can apply for loans directly from your mobile phone. Find pre-approved offers customized to you and get the loan credited in minutes. The procedure is a fast one with less paperwork, so you do not have to go through extensive documents. It's a convenient, easy, and quick method of getting money when you urgently require it.

4. Insurance & Investment Access

It is easy to manage your investments and insurance policies with the Bajaj Finance App. Renew insurance policies easily without worrying about missing deadlines, monitor the maturity dates of fixed deposits, and discover new investment plans to increase your wealth. All this is available in the app, so it is a one-stop-shop for managing your savings and financial security from home.

5. Simple Account Management & App Security

Your data and account are secure at all times with the Bajaj Finance App's strong security measures. Log in quickly and easily through biometric authentication or create a secure PIN. Customer support is at your service at all times through real-time support. From password resets to dealing with a query, assistance is only a click away. Safe and easy management of your money has never been easier.

6. Bajaj Auto Finance Integration

If you have car loans, the app also consolidates bajaj auto finance app services for you to manage your loans with ease. You can view your car loan EMIs, get hold of vital loan-related documents on your fingertips, and even pre-close your auto loans seamlessly on the app. No branch visits or dealing with mounds of paper all your vehicle finance information is within reach on your mobile phone, so you have complete control of your automobile finances.

Step-by-Step Guide: How to Use Bajaj Finance App

Let's break down how to start and move through the Bajaj Finance App download process.

Step 1: Download the App

First download the Google Play Store or App Store directly on your own smartphone. Just go on and search for Bajaj Finance App download in the search bar and get the official application to your device. The download process is quick and the app size is manageable, so it won’t take much of your storage space. Once installed, you’ll have the entire Bajaj Finance platform at your fingertips.

Step 2: Registration & Login

Open the app and sign up with ease using your mobile number. Through the bajaj finance app login, you get a simple way to access your account. Login to your account using an OTP sent to your device, or through utilizing your fingerprint or face recognition for a safe authentication. Using this method gives a smooth log in that is fast and secure while at the same time, a secure service that will not expose one’s financial information to other people.

Step 3: Discover Dashboard

When you log in into bajaj finance emi app, you'll find yourself on a simple dashboard that shows you everything at one glance. Here, you can see your entire loan summary, monitor your EMI schedules, monitor your investment portfolio, and view all pre-approved offers available. The neat and simple design means you don't have to spend time looking for key information it's all there, waiting to be used.

Step 4: Take New Loan

Require extra money? Go to the bajaj finance personal loan app section of the app. On this page, you can view your loan eligibility instantly, upload documents directly from your phone, and apply for a loan within minutes. Post-approval, the money gets credited instantly in your account. The process is seamless, paperless, and very fast, enabling you to receive the cash you require without undue delays.

Step 5: Track & Pay EMIs

Repaying is easy with the app's EMI functionalities. You can easily schedule auto-pay to have your EMIs repaid on time automatically, without having to intervene manually. View your EMI dates clearly and be aware of when each instalment needs to be paid. You can even download precise statements at any time for your reference. It's a hassle-free manner to stay informed and on top of your loan repayment every month.

User Interface and Experience: Why People Adore It

The Bajaj Finance App is built with simplicity and ease of use at its very core.

Sleek Dashboard Minimalistic Interface with Color-Coded Tabs

The Bajaj Finance App is meant to simplify managing money, even for a first-timer. Its modern dashboard provides a simple, intuitive layout where you can find your way around. Color-coded tabs neatly divide your loans, EMIs, investments, and insurance so you never need to look around. The friendly interface makes it easy to get to important information without finding yourself lost in complex menus or tech speak.

24/7 Support Chat and Email Support Directly through App

Whenever you have a query or encounter a problem, assistance is just within the app. 24/7 customer support by chat and email is available with the Bajaj Finance App so that your problems are resolved in no time. No calling helplines or visiting branches required simply send a message and receive assistance at any time, anywhere. It's intended to save you time and give you hassle-free, on-the-move customer support.

AI-Powered Offers Receive Tailored Loan & Insurance Quotes

Thanks to cutting-edge AI technology, the app studies your spending pattern and financial activities to provide you with personalized offers. You will receive personalized loan and insurance proposals that are tailored to your very specific needs, enabling you to make wiser financial choices. Whether it is a pre-approved personal loan or a custom investment plan, these proposals are created to fit your way of life facilitating your financial journey to become smoother and more gratifying.

Customers have reported a 94% satisfaction rate as a result of seamless navigation and no downtime.

Advantages of Using Bajaj Finance App

Ease All Services At One Place

With the Bajaj Finance App, you do not have to switch between apps or go to branches for various services. All that you require loan management, tracking of EMI, renewal of insurance to investment management is all in one platform. All this in one platform spares you the trouble of switching websites or waiting in queues, providing a seamless and integrated experience for all your financial requirements.

Security Multi-Factor Authentication & End-to-End Encryption

Your financial information is secure and protected with the app's high-end security features. It employs multi-factor authentication, such as OTPs, biometrics, and safe PINs, to guarantee that only you can use your account. Furthermore, end-to-end encryption secures all your sensitive data when making transactions. This implies that all activity, ranging from logging in to requesting a loan, is secured — providing you with absolute peace of mind at all times.

Flexibility: Be in Control of Your Finances

The Bajaj Finance App gives you the power to manage your finances at your convenience, anywhere, anytime. Whether you are at home, at the office, or on holiday, you can monitor loans, make EMIs, invest, or buy insurance at your convenience. You don't need to be bound by business hours or visit physical branches. This flexibility ensures that your financial management adapts to your life, not vice versa.

Time-Saving Instant Loan Approvals and Digital Documentation

Those days of extensive paperwork and hours of waiting are now behind you. With the digital documentation of the app, you can submit required documents in minutes. The instant approval mechanism for loans then accelerates the process further, allowing you to access funds rapidly when you most need them. For emergencies, or even budgeted expenses, this rapid turnaround means that you're never stuck waiting for cash assistance.

How DXB APPS Develop the Best Mobile Apps in UAE?

In the process of developing innovative, trustworthy, and scalable financial apps such as the Bajaj Finance App, businesses rely on experts such as DXB APPS. As a top mobile app development company, DXB APPS excels at producing world-class apps for various industries particularly fintech.

Our experienced mobile app developers use state-of-the-art frameworks and the latest technologies to create apps that are fast, secure, and easy to use. From mobile app development Dubai to app development Abu Dhabi, we guarantee every product to meet the highest levels of functionality and design.

Conclusion

The Bajaj Finance App is more than a financial app it's your financial freedom partner. From UAE personal loan management to stress-free EMI tracking and instant approval, everything is designed to make life simpler. Coupled with strong security and support available 24/7, it's one of the safest loan app solutions around.

FAQs

1. Is the Bajaj Finance App secure to use?

Yes. The app practices multi-layered security, biometric login, and end-to-end encryption for protecting user information.

2. Can I obtain a personal loan in UAE on Bajaj Finance App?

Yes. The instant loan app in UAE feature allows eligible users to apply for personal loans with less documentation and faster disbursal.

3. What documents do I need for Bajaj finance loan app?

Generally, Aadhaar card, PAN card, proof of income, and bank statements are needed. The app makes document uploads simple.