In this fast-developing world of technology, new ways of approaching our daily existence are being moulded, and certainly, the money sector is the same. Hence, mobile applications for banking act as a central tool for each consumer and every business. The DIB mobile app is one innovative solution that suits the modern trends of Dubai Islamic Bank. This application has already transformed the entire scenario of making financial transactions within the city and globally. From money transfers, paying bills, or even tracking your investments, these banking functions can now be brought closer to you, right in your hands, through the dib bank. Convenience, security, and efficiency will ensure the application arrives on your mobile.

DIB alone will stand as the best mobile banking app and align with how fast mobile banking is going. This is the case with Dubai Islamic Bank's strong platform, which is based on the feature base plus security aspects, so it sets itself out to deliver and fulfil the customers' demands. This is a comprehensive report that addresses the different characteristics of the application, research on the security feature of the app, and a discourse on how it would be helpful to the consumers while elaborating on the effect the mobile app would have in future banking in general.

Core Functions of The DIB Mobile App

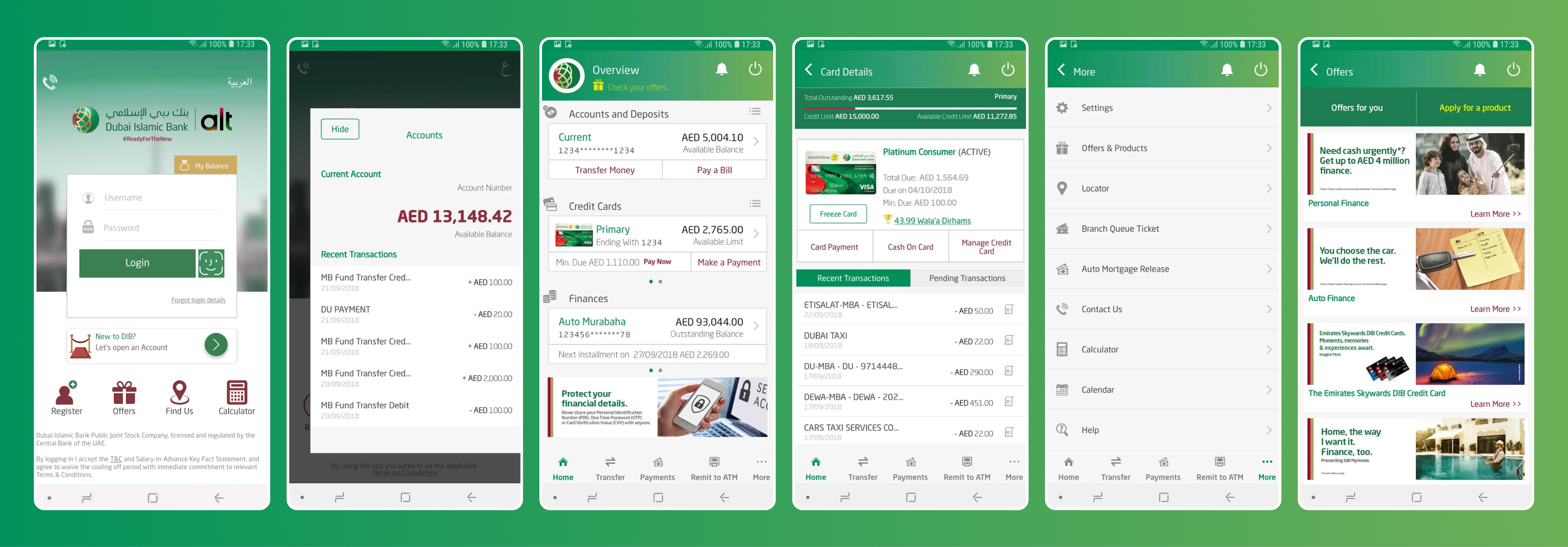

The DIB mobile app boasts various features to make banking more accessible and improve user experience. Now, let's see what this application offers: some of its key functionalities include Fund Transfers

Transferring Money

Money transfer is one of the most important features of the DIB mobile app. People will use the app to transfer money easily to their Dubai Islamic Bank account or any other bank account. Irrespective of whether it is a domestic transfer or international, the processes involved would be fastened for efficient completion by the app. This application allows ACH transfers for clearing house transactions at local levels, while SWIFT transfers are allowed for any other international payment.

For instance, you might transfer money to another person's bank account without writing any paper and wait for the branch queue to clear in seconds.

Bill Payments

The DIB mobile app makes paying bills rather easy. The app includes utilities, telecom services, government services, and credit card bills. It hosts various billers in its system, which it offers to meet every user's needs as a one-stop shop. The process can be altogether automated, too. It never missed its due date.

Account Management

The app will enable the user to view account balances transaction histories and set up alerts for specific activities. This will enable customers to stay on top of their financial activities and keep their money in order. Real-time access to account information will allow users to understand their spending habits and take action if something is amiss.

Investment Management

The DIB mobile app equips customers with all the tools necessary for investment management. It lets customers track their investment portfolios, such as stock prices, mutual funds, and other investment products. Users can set alerts to monitor performance and make appropriate adjustments.

Card Management

It is no longer that challenging to manage debit and credit cards manually. Users can just open the app, check card balances, track spending, and view all recent card transactions. It also allows users to block and unblock cards directly through the app; this is further security for lost or stolen cards.

Importance of Security in Mobile Banking Apps

Security is one of the major reasons any person who intends to use a banking app and DIB will take it seriously. There is this sense of cybercrime on the loose in the contemporary global scenario; therefore, their customer data and financial details need to be kept safe at all costs. Therefore, security measures are embedded in various app safety features to protect users' confidential information.

2FA:

The DIB mobile application uses 2FA for an additional layer of security during the login or other transactions that are considered sensitive. This involves the user verifying two aspects of identification: something he knows, like the password and something he has, like a mobile device or one-time password via SMS. Only then can actual users access their accounts.

Encryption

The app uses end-to-end encryption: user data from the device is sent to the bank server, and all forms of data are secured through encryption. This makes it impossible for malicious users to read intercepted data. Encryption is of utmost importance in protecting one's financial and personal information.

Biometric Authentication

Along with password authentication, DIB mobile also offers its users the chance to utilize biometric authentication, which scans fingerprints and facial recognition. This would enable the user to log into his account easily and safely without having a problem remembering long passwords. Biometric authentication is considered one of the safest and easiest methods to save your account.

Mobile Banking Statistics Showing Growth in Mobile Banking

Mobile banking has exponentially been increasing across the world. According to a 2024 survey conducted by Statista, mobile banking users have exceeded 2 billion and are forecasted to surge even higher within the coming years. Mobile banking uptake alone in the UAE has progressively grown as over 75% of bank customers have started to opt for using their accounts via mobile apps instead of going to the physical bank.

Besides, McKinsey & Company shows that 92 per cent of the banking customers now expect to perform at least one banking activity through their mobile device. Keeping this in mind, banks like Dubai Islamic Bank have invested in the latest cutting-edge mobile banking solutions to meet clients' needs in seamless and user-friendly banking experiences.

Customer Experience and Usability

Having top-notch security means the DIB mobile application offers an excellent user experience. The application was created with attention to its visual and easy navigation properties. Its minimalist interface is so intuitively created that it naturally guides the user to what she or he is looking for in the least superfluous way possible.

The DIB mobile application is very friendly. Whether you just started with your very first account or are a long-term user of the application, you are welcomed by it at any time, irrespective of experience. Due to its layout, you can easily process complicated banking tasks like international transfer and investment control with just some taps.

The DIB mobile application can be downloaded both on iOS and Android. This will cover a larger percentage of the target market. Since updates are usually implemented, the app is improved and enhanced in terms of usability and functionality with user feedback.

Advantages of Using the DIB Mobile Application

The DIB mobile application offers various advantages to its users. Among them include;

24/7 Access:

The application allows anyone to access their banking services anytime. The client will not need to worry about business hours since the application can be accessed anytime or at night.

Time-Saving:

The user does not have to visit the bank branch as one is required when using the app. The client can perform all the transactions, bill payments, and account management from the convenience of their house or even when moving around.

Cost-Effective:

The DIB mobile app saves the cost of in-person banking, such as travel costs and possible service charges at the branches for the users.

Instant Notifications:

The application will provide instant notifications for account activities so that users will be informed about every transaction, and there will be no surprises.

Secure Transactions:

With advanced security features such as encryption and biometric authentication, secure transactions are possible while ensuring the user's financial information is safe.

Weaknesses and Future Recommendations

The DIB mobile application is highly rated, but some areas need improvement as a digital platform. Some users reported loading the app during peak usage hours may take longer. Even though the development team continuously works on improving performance, it is sometimes a problem for some users.

The customer support options feature stands out as the second area that might be improved. The app offers customer support through different channels. Still, most users have requested that the app include more comprehensive in-app features, such as live chat or AI-powered assistance, to solve queries much faster.

How Did DXB APPS Develop the Best Mobile Banking Apps in Dubai?

Dubai is the leading technology industry where most firms experiment with Mobile App Development Dubai. Among several firms, the topmost that stands out from the rest and is on the list of the developers of mobile applications concerning finance in Dubai is DXB APPS.

The App Development Dubai team at DXB Apps partners with financial institutions like Dubai Islamic Bank to design functional mobile banking applications that are intuitive and secure. Known for integrating artificial intelligence, machine learning, and blockchain into its mobile apps, it enables the bank to present its users with much better features, including fraud detection and predictive analytics, among others, and fast processing of transactions.

With knowledge of local markets and world trends in mobile technology, the company can develop ideas for apps that will align with what the people in Dubai need since they come from different walks of life. They are customer-centric, with each feature engineered to ensure every feature is customer-centric and provides a seamless and efficient experience from start to finish.

Conclusion

The DIB mobile banking app is one of the strongest tools for handling personal finances and ensures security at every step. With a list of services like fund transfer, bill payments, investment management, and monitoring your accounts within one interface, Dubai Islamic Bank never forgets that the security of customers' information should be top on the agenda.

It could serve your purpose of having a convenient manner to manage several accounts, or you could just be searching for a good mobile banking technique, and the answer is the DIB mobile app.

FAQs

1. What is the DIB mobile app used for?

Access a range of financial accounts, pay your customers, deposit/withdraw, and receive money or services from any mobile banking service.

2. How safe is DIB on Mobile?

DIB incorporates two-factor authentications, encryption and biometrics for every transaction online via the application.

3. Is International Money Transfers possible using the DIB Application?

Yes, DIB allows its customers to remit abroad through the DIB mobile app and offers facilities for transferring funds within the country.