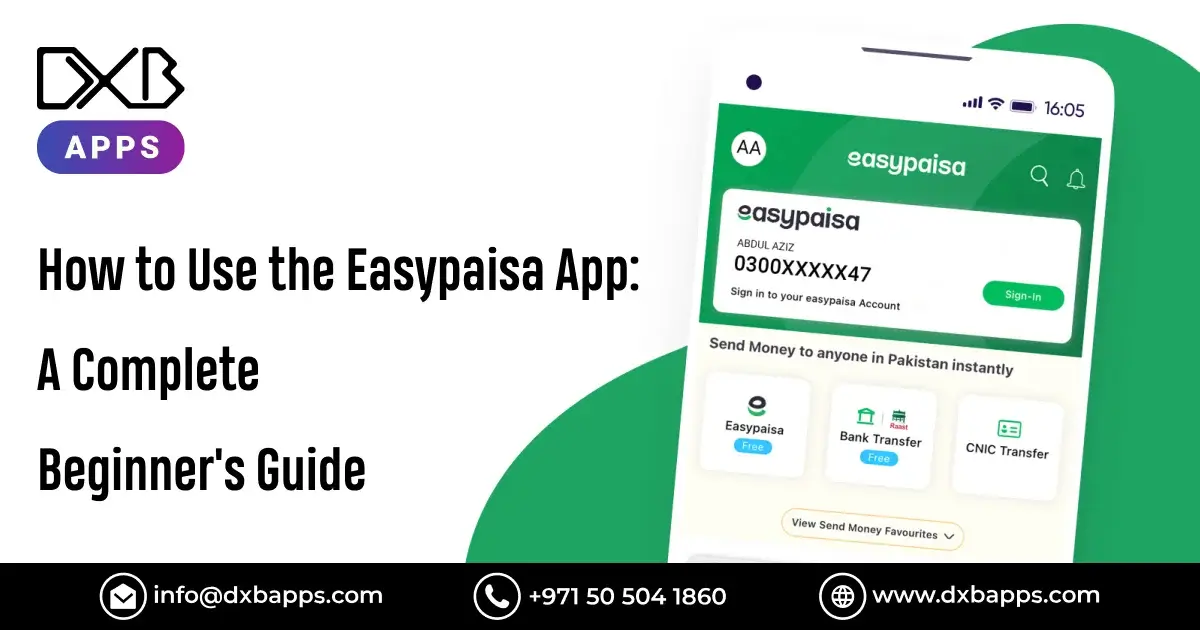

Users today need mobile phone management of their finances rather than considering it an extra convenience. Easypaisa features among Pakistan's leading digital financial institutions that enable secure daily banking through convenient and rapid transactions. The beginner's ultimate guide will assist both novices and advanced users in accomplishing their Easypaisa-related goals confidently.

In this blog, you will learn how to begin using the best mobile banking app, Easypaisa. Its main features include sending money, bill payments, and even loans directly from your phone.

What Is Easypaisa?

Easypaisa operates as Pakistan's biggest mobile wallet and digital banking platform through Telenor Microfinance Bank. Easypaisa initiated its operations as Pakistan's initial branchless banking project in 2009 and evolved into a comprehensive financial system which currently assists more than 10 million active users and grants monetary control to numerous Pakistanis through their smartphone devices.

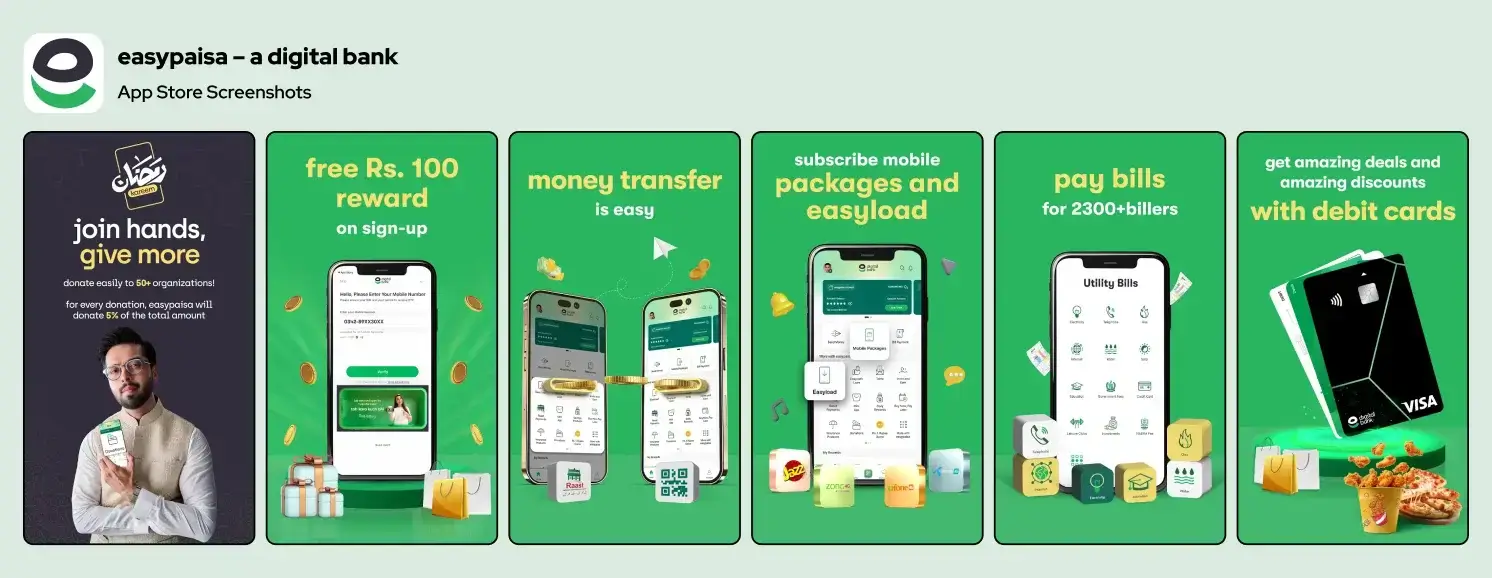

With the Easypaisa mobile app, customers can make a range of financial transactions such as utility bill payments, money receipt and transfer, mobile credit recharge, and even instant loans—all at home. The app can also facilitate QR code payments, micro-insurance, and e-saving schemes, thus emerging as an end-to-end solution for banked and unbanked wallets.

What is unique about Easypaisa is how accessible it is. You don't need a regular bank account to take advantage of its basic services. Student or salaried person, freelancer or businessman – Easypaisa provides you with secure, 24/7 access to money in your pocket through your mobile phone. With over a thousand partner agents and more merchants going online in Pakistan on a daily basis, Easypaisa is changing the way people think about banking in Pakistan.

Why Is The Easypaisa App So Popular?

The Easypaisa app has achieved widespread popularity as a mobile banking application within Pakistan's market. Here's why everyone likes it:

- It is easy to use. Anyone can use it — even newcomers to banking app.

- No regular bank account is needed. Simply sign up with your mobile number and CNIC.

- Within seconds, you can pay bills, send money, or top up your phone.

- It is secure and safe with a PIN lock within the app, fingerprint verification, and provides alerts on every transaction.

- Works everywhere. Between a big city and a small town, Easypaisa works with any Pakistani mobile network.

- Many individuals who do not have bank accounts can still manage money effectively using Easypaisa.

- Backed by Telenor Microfinance Bank, it's utilised by more than 10 million customers.

- With more than 170,000 agents in Pakistan, cash-in and cash-out services are available at all times.

- You can take microloans, buy insurance, and save funds on the app as well.

Step-By-Step: How To Use The Easypaisa App?

Being a first-time user of mobile banking, Easypaisa's mobile application makes it so convenient to start. Whether you are in town or a village, you can easily control your money on your mobile phone. You simply need to do the following easy steps:

1. Download the Easypaisa App

Android users should visit the Google Play Store, while iPhone users should go to the App Store. Both platforms offer the download option to fetch the "Easypaisa app download". Users can go for the Easypaisa app download by searching "Easypaisa app download", then clicking Install and completing the application installation through the Google Play Store or App Store.

2. Open the App

Once installed, open the app by clicking the Easypaisa icon. For ease of navigation, choose your preferred language (English or Urdu).

3. Register for an Account

Tap on "Create Account." Enter your mobile number (it must be registered under your CNIC). You'll get a 4-digit OTP code via SMS. Enter it to continue.

4. Enter Personal Information

The transaction system requires your CNIC details alongside your full name and date of birth information. The PIN system consists of setting a 5-digit access code for safe online transactions.

5. Set Up and Add Money

Your mobile wallet is now active. Visit an Easypaisa retailer or link a bank account or debit card to deposit money. You're ready to explore Easypaisa's full range of features!

Key Features of The Easypaisa App

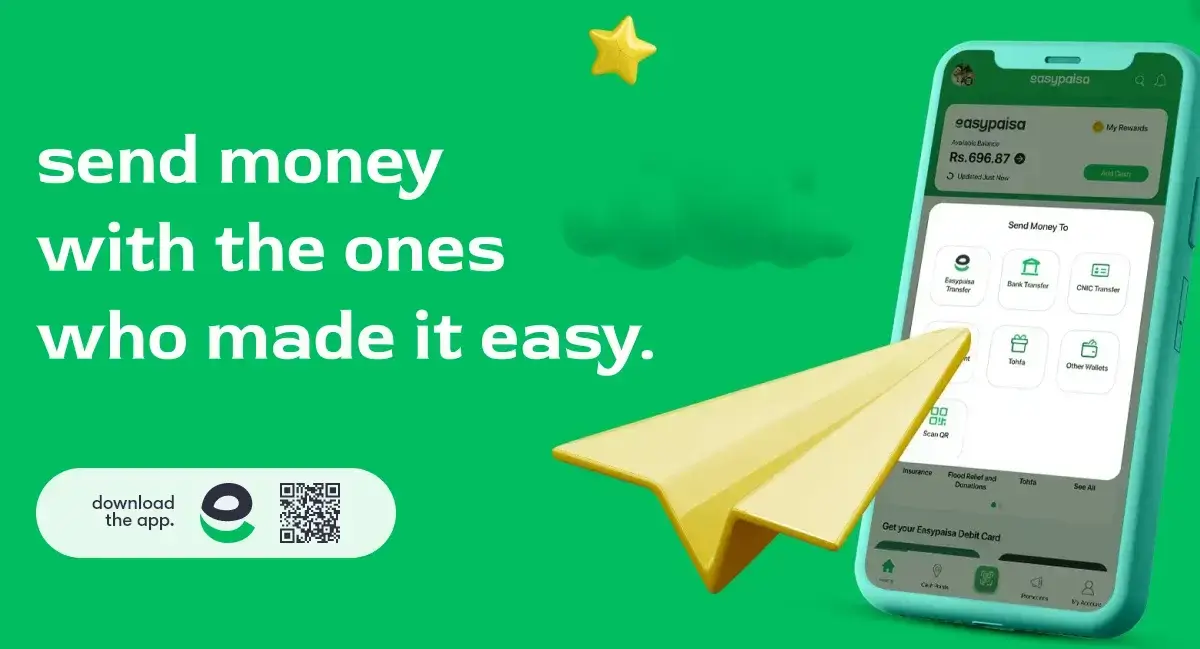

1. Money Transfer

Easypaisa lets users transmit funds either to mobile wallets or CNICS, or bank accounts. A rapid and secure procedure exists for money transfers to vendors and friends along with vendors. Simply choose the recipient type, pay the amount, and use your PIN. Being 24/7 available, networked with 15+ banks, and supported by different banks, Easypaisa enables you to send money like messaging.

2. Bill Payments

Utility bills can be paid within the app in under a minute. You have the option of electricity, gas, water, and internet service providers. Just put in your consumer number, pay the amount shown, and tap to confirm. You are also given an e-receipt straight away, which is handy for keeping records. Queues and paper bills, farewell—pay at your convenience.

3. Mobile Top-Ups

Recharge your phone or another person's phone immediately. Easypaisa supports all major Pakistani telecom operators. Recharge with minimum balance (credit) or buy packages like call, SMS, or data bundles. Heavily using customers may also turn on auto top-ups so that they will never run out of balance at the wrong time.

4. Easypaisa Loan

The service offers convenient access to instant loans, usually within minutes. The convenience of a loan in Easypaisa is for those who need instant cash with less paperwork. Apply online, select an Easypaisa loan amount, and pay back in easy instalments. Credit score processed through machines ensures quick approvals and is one of the fastest-growing instant loan apps.

5. QR Payments

Pay and scan at QR code shops. Users can make payments at petrol stations and restaurants, and supermarkets, as well as online shopping stores by utilising Easypaisa QR codes. The payment system provides safe transactions through contactless methods while omitting cash and debit cards.

6. Saving Plans

Save money without any trouble through in-app digital saving plans. Save daily, weekly, or monthly, Easypaisa has plans which give profit in the future. Withdraw or cancel the plan as suitable to you.

7. Insurance Services

There are digital insurance policies for health, life, and travel by Easypaisa. For a minimal PKR 2/day premium, users can buy a policy in the application and receive instant cover confirmation.

8. Account Management

You can check your balance, transaction history, and monthly statements on the app itself. Customers can change their profile, set or change PINS, and message or call customer service.

9. Request Money

The "Request Money" feature enables customers to request friends or relatives for a fixed amount. They transfer money instantly after they accept the same. It is very suitable to split bills or expense bills.

10. Easypaisa Debit Card

You can buy a physical Easypaisa debit card from the app. The card may be swiped at ATMS and retailers across Pakistan. It is linked to your wallet, so you can spend your money even more easily.

"Digital finance doesn't replace banks—it redefines them."

Security Features In The Easypaisa App

Security is of paramount concern to the Easypaisa application since millions of customers trust it with their everyday monetary transactions. In an effort to safeguard your money and personal information, Easypaisa has imposed very tight security measures to make the application safe and reliable for everyone to use.

The following are the key security features you should be aware of:

1. PIN Security

Your 5-digit PIN is the only PIN known for every Easypaisa account. You must enter it when logging in or making a transaction, and it is virtually impossible for anyone else to log in to your account.

2. Biometric Login

The application supports these features for phones that have enabled both face unlock and fingerprint login. This feature delivers extra security protection through app login requirements, which demand that you unlock the app first.

3. One-Time Password (OTP)

When you register or make substantial changes in your account, Easypaisa sends an OTP to your mobile number via SMS. This means no one can retrieve it prior to your awareness.

4. Instant Transaction Alerts

For every transaction, you are provided with an SMS alert in real time. This alert reminds you of your activity and allows you to detect something suspicious right away.

5. Account Locking

If your phone is stolen or you think your account has been compromised, you can lock your Easypaisa account immediately by calling the helpline or your local agent.

6. Secure App Interface

The application has secure connections, and hence your data remains safe while sending or receiving.

7. Limited Login Attempts

If a customer repeatedly tries to log in with the wrong PIN, the app will automatically lock them out to ensure that their account does not get hacked.

Easypaisa For Businesses

Easypaisa is not just for personal use; it contains some robust functionalities for businesspeople to schedule payments and keep their money saved. Whether you are a small shopkeeper or a corporate owner, the Easypaisa app can simplify your business and make it convenient. Some of the methods through which companies are made convenient through Easypaisa are enumerated below:

1. Easypaisa Merchant Account

Get an Easypaisa Merchant Account to accept direct payments from customers who deposit money into the Easypaisa wallet. The payment system accepts payments through QR codes, mobile wallets, and bank accounts to benefit both your users and your cash management needs.

2. Collect Payments Anywhere

Easypaisa makes it possible for your company to get paid anywhere, at any time. Online business, offline business, or mobile business – you get paid by scanning a QR code, by bank transfer, or even by cash-in option using Easypaisa.

3. Bill Payments and Utility Services

You, as a businessman, are able to make utility bills, supplier bills, and other major bills directly from your Easypaisa account. It is time-saving and makes business processes smooth without having to visit the bank or pay in cash.

4. Payroll Management with Easypaisa

For businesses with workers, Easypaisa allows you to pay wages and salaries into the Easypaisa account of workers. It's a secure and easy way of handling payroll, especially for businesses that have numerous workers or freelancers.

5. Loan and Credit Services

Easypaisa also offers microloans to small and medium-sized businesses which need working capital in a pinch. You may even borrow money through the application and get it financed within minutes, which may be used towards business growth or paying bills.

6. Building Customer Base

The Easypaisa payment facility enables business enterprises to expand their consumer base beyond banking customers, reaching new markets of consumers. A large number of people in Pakistan choose Easypaisa for mobile phone-based payments because they find the solution convenient.

7. Real-Time Financial Tracking

With the business features of Easypaisa, you will find it easy to monitor all the transactions in real-time. This will imply that you will be able to monitor the finances of your business and ensure all the receipts and payments are accounted for.

8. No Setup Fee

Easypaisa Merchant Account does not charge any setup fee. You won't be charged with high setup fees or have to undergo lengthy registration. Simply register and start accepting payments.

9. Security and Fraud Protection

Easypaisa uses the best security features to secure your business transactions. Two-step authentication, PIN protection, and encryption are utilised by the app's advanced features to safeguard your business from fraud.

10. Easypaisa Business App Features

Easypaisa also has a merchant business application through which you can easily keep track of transactions, track customer payments, and generate reports. This business app makes managing money on the move even easier.

DXB APPS – Creating The UAE's Top Banking Apps

DXB APPS is a leading mobile app development company. We are well-established when it comes to mobile app development Dubai and app development Abu Dhabi services, creating secure, user-centric, and scalable banking, fintech, ecommerce, and healthcare mobile apps.

Our talented mobile app developers bring design, performance, and technology together to deliver applications that transform user experiences. We are your go-to digital innovation partner, whether you're an enterprise or a startup.

Conclusion

Easypaisa's mobile app is a powerful offering that takes banking to your fingertips. It is secure, new-age, and easy and is one of the most used mobile banking apps in Pakistan. From bill payment and money transfer to loans and savings, Easypaisa is for everyone—students, individuals, and even small business owners. With frequent software enhancements and other collaborations, it is a prerequisite financial tool for those who are ready to stay cashless.

Frequently Asked Questions

Q1.Does a user need to own a Telenor number to access the Easypaisa mobile application?

The Easypaisa app enables users to operate it on any Pakistani cellular network, including Jazz Zong and Ufone.

Q2: Is Easypaisa safe for transactions and banking?

Yes. Users gain protection through complete encryption, biometric identification systems, and continual fraudulent activity identification.

Q3: What is the process for applying for an Easypaisa loan?

Go to the "Loan" feature in the app, verify your eligibility, and follow the steps to apply. It usually gets credited instantly.