Middle East financial technology has seen a revolutionary transformation. The new digital solutions are transforming traditional banking and investing practices which are enhancing the ability of people to regulate their own financial futures. The front-runners of this movement is the Sarwa App- a generic financial technology that has transformed the way individuals in the UAE and the MENA investment region in general invest, trade, and save their money.

The Sarwa app is not another trading app offering; it's a whole ecosystem designed to democratize wealth management and access sophisticated investment strategies to everyone. With its intuitive interface and personalized approach, Sarwa has turned into a go-to partner for thousands of investors.

Dubai Financial Services Authority (DFSA) and Securities and Commodities Authority (SCA) have established clear frameworks that protect investors

The regulatory environment of the UAE has been established to support fintech app development. Sarwa Dubai has flourished as a regulated, trustworthy platform in such a friendly environment.

"The future of wealth management is in democratizing access to sophisticated investment strategies. Sarwa is making available what once was limited to the affluent to everyone."

The Rise of Smart Investing in the MENA Region

MENA is experiencing a paradigm shift in the manner in which individuals approach personal finance. Demand from a young, technologically literate population and increasing smartphone penetration is compelling digital investment platforms to disrupt traditional behavior. The spread of Sarwa fintech solutions follows global trends with unique regional twists.

High disposable income levels in the region create high demand for alternative investment sources besides traditional savings accounts. Public policies encouraging the diversification of the economy have forced people to seek other investment avenues. The Sarwa mobile app has exploited such trends by offering a platform with specific regional needs, like Shariah-compliant investments and Arabic language capabilities.

UAE-wide campaigns in financial literacy have created a more informed ground of investors who demand transparency and low fees. Commission-free investing services like Sarwa UAE with professional-level tools are gaining popularity with this new generation of investors.

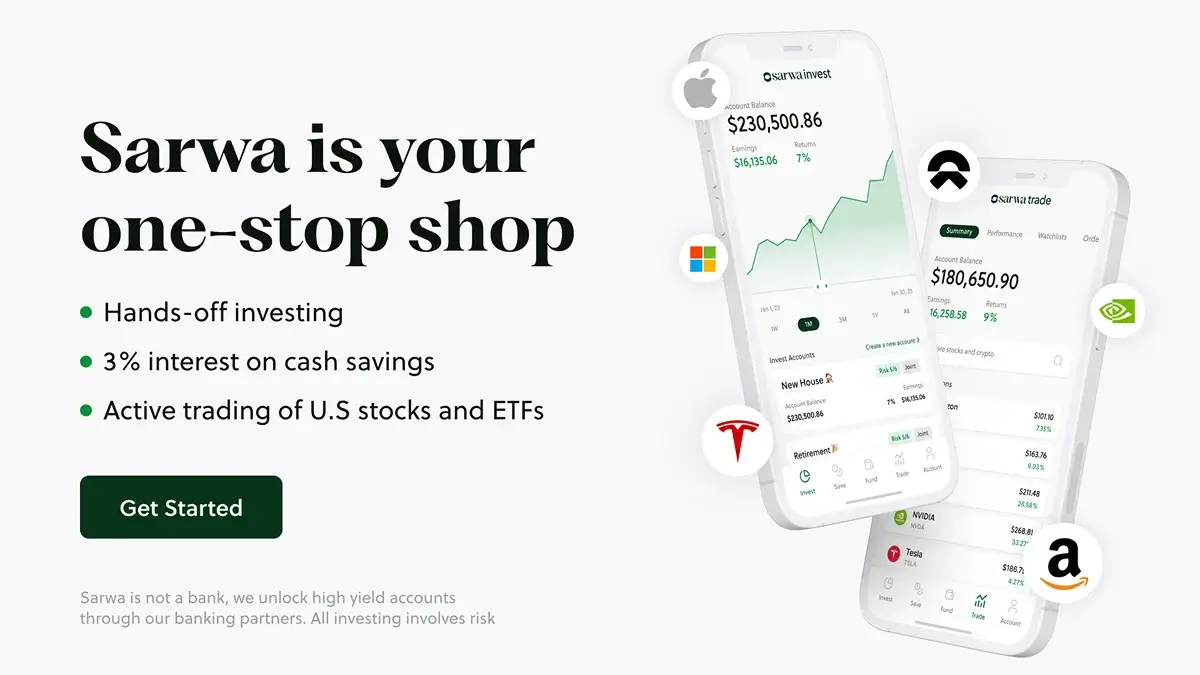

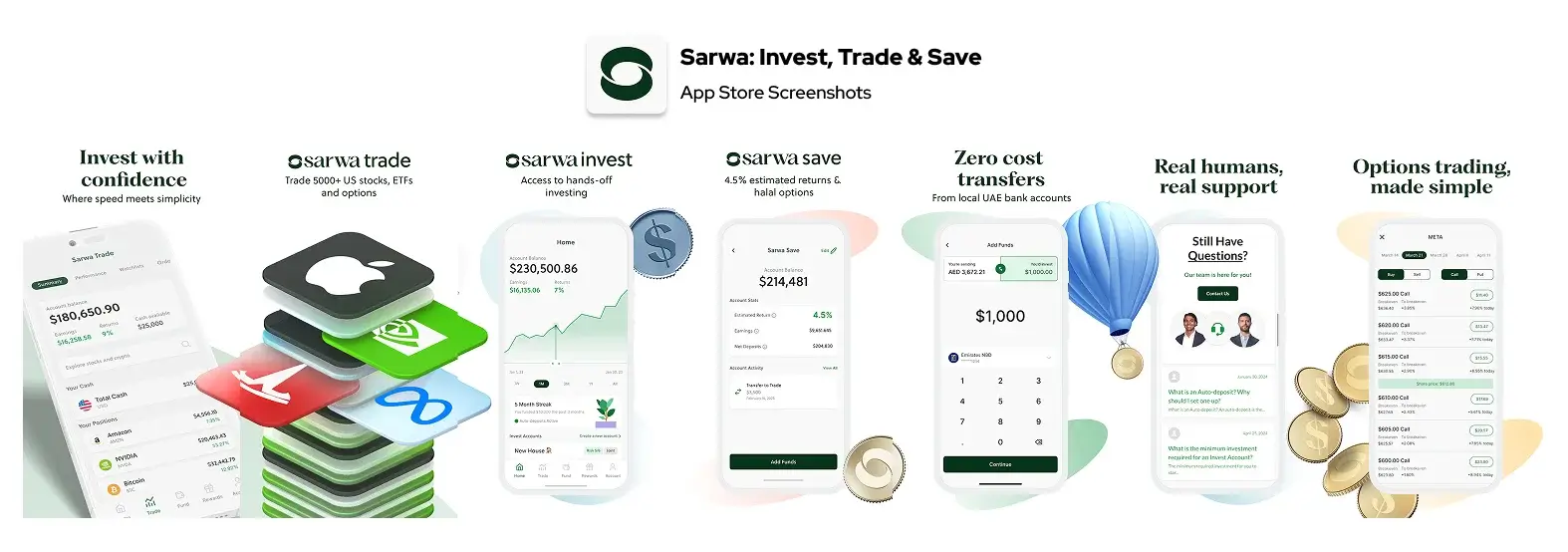

What is Sarwa?

Sarwa has become the most popular digital wealth management platform in the UAE offering robo-advisory service and human touch. Sarwa was founded to facilitate easy wealth management that delivers three key services, such as Sarwa Trade, which is an investment in long-term portfolio management, Stock trading in goal-based saving, which is Sarwa Save.

The platform operates under the full regulatory oversight of the DFSA to international standards. Unlike traditional brokers requiring enormous minimum investments, Sarwa Investment allows users to start with as little as $500 and benefit from enhanced portfolio management techniques.

What distinguishes Sarwa is its hybrid model combining algorithmic efficiency with human monitoring. The robo-advisory section comprises complex algorithms that produce diversified portfolios according to the individual risk profiles, which are managed by professional investment personnel that review the portfolios on an ongoing basis.

The Sarwa App will offer ruthless clarity, live track of the portfolio, performance analysis, fee sharing and education options that one can view on an easy to use platform that can accommodate both first time and experienced investors.

Three Core Services:

Sarwa Invest

Long-term portfolio management using robo-advisory technology that creates diversified ETF portfolios based on individual risk tolerance and financial goals.

Sarwa Trade

Independent research-only brokerage (commission-free) trading apps that offers access to thousands of stocks and ETFs in the US and includes market data and other advanced charting capabilities.

Sarwa Save

Goal-based saving option assisting users to set their financial goals with personal saving plans, time projections, and monthly contribution proposals.

Core Features Of the Sarwa App

The Sarwa App has robust features that suit the needs of different types of investors:

Robo-Advisory Portfolio Management

Sophisticated algorithms build and regularly rebalance globally diversified portfolios. Customers complete a risk questionnaire, and Sarwa creates a tailored portfolio of low-cost ETFs in different asset classes.

Self-Directed Trading

Sarwa Trade provides access to thousands of US equities and ETFs with commission-free trading apps functionality, including real-time market data, more advanced charting tools, and research reports.

Goal-Based Saving

The users can set their financial goals and Sarwa helps in designing personalized plans of saving with estimated timeframes and monthly payments.

Fractional Shares

Sarwa provides investment in expensive stocks via fractional shares, making access to Amazon and other large companies more equal without requiring thousands of dollars in deposits.

Cryptocurrency Investment

Through its regulated platform, Sarwa Crypto offers the opportunity to invest safely in digital assets with the ability to invest in the leading cryptocurrencies of Bitcoin and Ethereum.

Educational Materials

In-depth education materials offer investing fundamentals by way of video lessons, articles, and webinars.

Automated Rebalancing

As market changes shift allocations, Sarwa automatically rebalances to maintain the desired risk profile.

Multi-Asset Portfolio Access

Users gain exposure to thousands of global stocks, bonds, and alternative investments through carefully curated ETF portfolios.

Low Minimum Investment

Starting with just $500, Sarwa investment app makes professional wealth management accessible to middle-income investors.

Transparent Fee Structure

Clear, upfront pricing with management fees starting at 0.85% annually, significantly lower than traditional wealth managers.

Sarwa App Architecture & Technology Stack

The Sarwa App is built on robust, scalable technology architecture appropriate for complex financial operations with security and performance, best practice requirements for trading app development.

Frontend Development

iOS and Android mobile apps use React Native, with code reusability and native performance. The web application utilizes React.js with Redux for state management, ensuring smooth Sarwa app download experiences.

Backend Infrastructure

Node.js based on Express.js framework is the backbone behind it, chosen considering scalability and real-time capabilities needed for trading app development. Microservices-based architecture provides independent scaling of individual components.

Database Management

It is based on the PostgreSQL core relational database, high-speed caching with Redis, and unstructured data with MongoDB.

Cloud Infrastructure

It was implemented on AWS on EC2, S3 and CloudFront to deliver 99.9% uptime and worldwide presence.

Security Implementation

Two-factor authentication, biometric access, end-to-end encryption, and sophisticated fraud detection systems ensure user accounts by periodically reviewing their security applications required in the development of fintech apps.

API Integration

The ability to integrate with market providers of market data, payment gateways and verification of KYC/AML services also makes the functionality seamless.

Real-Time Processing

Real-time price updates, instant trade execution, and live portfolio tracking can be done using WebSocket connections.

Step-by-Step Sarwa App Development Process and Timeline

To construct trading apps platforms like Sarwa requires meticulous planning across a number of phases:

Phase 1: Research and Planning of the market (4-6 weeks)

Research of the competitor, user survey, regulatory advice, informative market.

Phase 2: Design and Prototyping (6-8 weeks)

Best possible user testing of the most optimal experience in Sarwa mobile app, wire framing and prototyping of the most optimal experience.

Phase 3: Core Design (16-20 weeks)

Introducing authentication controls, KYC/AML controls, portfolio management engine and trading infrastructure.

Phase 4: Security implementation (4-6 weeks)

Two factor authentication, end to end encryption and vulnerability scan.

Phase 5: Adherence to Regulations (8-10 weeks)

Acquiring DFSA/SCA licenses and enabling reporting capabilities of Sarwa Dubai Business.

Phase 6 Quality Assurance and Testing (6-8 weeks)

Performance testing, user acceptance testing and functional testing.

Phase 7: App Store Implementation and Promotion (4 weeks to 6 weeks)

The Sarwa app is downloaded on the app stores and the marketing activities.

Overall Development Schedule: 12-16 months

This rigorous process ensures the Sarwa App offers a secure, stable environment in accordance with regulatory needs.

Challenges in Developing a Fintech Investment App

Development of trading apps platforms involves certain challenges:

Compliance with Regulations

Financial applications must comply with securities regulation, data privacy legislation, and anti-money laundering legislation essential for fintech app development.

Security and Data Protection

Cyberattacks are most likely to be financial applications that need to have strong security features without compromising the ease of use.

Real-Time Data Integration

In order to have the right, real-time information of the market, it is important that the integration with more than one data supplier be done and consistency and minimal latency be ensured.

Scalability Requirements

Investment sites must scale various loads without affecting performance.

User Trust and Onboarding

Building trust requires good communication, entrenched security, and streamlined KYC/AML verification processes.

Multi-Currency Support

Supporting multiple currencies and handling currency conversion in real-time adds complexity to trading app development.

Performance Optimization

To make sure that load times are fast, animations are smooth, and the response is instant, even when there are high rates of volatility in the market.

Nevertheless, even in the face of such difficulties, fintech app development can be successful when the knowledge and choice of technology are appropriate.

The Impact of Sarwa on UAE’s Fintech Ecosystem

Sarwa has created a splash in the MENA fintech surroundings.Through its ability to prove that sophisticated digital wealth management can work regionally, Sarwa encouraged numerous fintech startups and pushed traditional institutions to heighten digital innovation.

Democratizing Investment Access

One of its most significant contributions is evening out the playing field when it comes to investment accessibility. Previously, professional wealth management was reserved for high-net-worth individuals. With low fees, the Sarwa UAE platform has facilitated thousands of middle-class investors to experience diversified portfolios.

Enhancing Financial Literacy

The platform also made the region more financially literate through detailed learning materials. The outcome of this is better informed investors who make good financial choices which eventually brings in economic stability in the region.

Inspiring Innovation

The success of Sarwa has led to other Sarwa fintech startups joining the market which has led to healthy competition and thus constant improvement on services.

Setting Regulatory Standards

Through close collaboration with regulators, Sarwa has assisted in coming up with structures that promote innovation and investor protection.

Creating Employment

The platform has created direct and indirect employment opportunities in technology, finance, and customer service sectors.

Additional Benefits of Using Sarwa

Tax-Efficient Investing

The Sarwa designs portfolios to benefit the UAE residents in terms of taxation as it enjoys a friendly tax system in the country.

Regular Portfolio Reviews

The user portfolios are reviewed quarterly by the professional investment managers who give specific recommendations as to how to optimize their portfolios.

Family Account Management

Users can manage multiple accounts for family members from a single dashboard, simplifying family wealth management.

Retirement Planning Tools

Specialized calculators and planning tools help users estimate retirement needs and create appropriate saving strategies.

Social Responsibility Options

Access to ESG (Environmental, Social, Governance) investment options for socially conscious investors.

How DXB APPS Develops Apps like Sarwa?

DXB APPS is one of the leading mobile app development company in UAE with proficiency in innovative fintech app solutions. Our design team creates intuitive, visually spectacular interfaces that make complicated financial concepts easier. We care about user experience for new investors and experienced traders alike.

Our custom mobile app development process assures that each aspect of your investment platform is international-standard compliant and includes regional market demands. In creating trading apps, we prioritize speed and readability.

Once launched, we provide end-to-end app services like performance tracking, bug fixing, feature enhancements, and infrastructure scaling. Having experience as a top mobile app development company in the UAE and having deep insights into regional financial markets, DXB APPS is your trusted app partner to develop next-generation mobile apps.

Conclusion

The Sarwa App is a demonstration of the potential of financial technology to revolutionize the UAE. By combining sophisticated investment strategy with simplicity of design, compliance with regulations, and fair access, Sarwa has democratized wealth management for thousands of investors.

The success of the platform can be seen to prove that if fintech app development focuses on user needs, transparency, and security as it navigates complex regulatory landscapes, significant value is created. Since robo-advisory to the self-trading platform, the platform offers end-to-end services to enable individuals to manage their financial prospects

FAQs

Is Sarwa legal in the UAE?

Yes, Sarwa is completely legal and regulated in the UAE. The platform is under the supervision of Dubai Financial Services Authority (DFSA), guaranteeing adherence to global investor protection standards.

Can I use Sarwa outside the UAE?

Sarwa app download is directly aimed at UAE residents, but availability outside the country depends on multiple factors. UAE residents can view accounts and track Sarwa investment while abroad with access to the internet.

What sets Sarwa apart from other trading platforms?

Sarwa excels with its hybrid robo-advisory approach combining algorithmic efficiency with human oversight. While others depend only on automated systems, Sarwa provides tailored portfolio management at competitive rates starting from $500. The Sarwa mobile app comes with exposure to globally diversified portfolios, automatic rebalancing, and offers both passive investment through Sarwa Invest and active trading through Sarwa Trade.