Today, money transaction systems are experiencing revolutionary changes. The modern world has seen the introduction of mobile wallets and other related digital transactions that allow users to keep their finances in their palms. Among numerous digital payment solutions, STC Pay has become the most trusted and used mobile wallet for many millions worldwide in Saudi Arabia. Established by Saudi Telecom Company (STC) into a system, it has changed all money ways for people in Saudi Arabia into much easier, faster, and more secure financial transactions.

The STC pay Kuwait wallet is more than a personal tool; it has also grown for businesses and provides a platform for seamless financial transactions for companies, merchants, and service providers. STC Pay's rapid uptake on such shores would fit into broader cleavages concerning the Kingdom's vision of financial inclusion and digital transformation, all of which conform to the Kingdom's Vision 2030. This blog will explore the reasons why STC Pay has gained the trust of millions, the differentiating features, and how it is shaping the future of the payment landscape in Saudi Arabia and the wider Middle East.

The Rise Of Digital Wallets In Saudi Arabia

As the culture continues towards eliminating the cash economy, Saudi Arabia is no exception. The adoption goes skyrocketing towards the rate for digital wallets like STC Pay. The Saudi Arabian Monetary Authority (SAMA) central bank shows through their report that mobile payment services will become normal use for more than 70% of Saudi citizens. The high rates of e-commerce growth, together with nationwide cashless transaction campaigns and rising smartphone adoption, drive this trend.

The increasing popularity of STC Pay suits the Saudi Vision 2030 goal to make Saudi Arabia cashless. Modernisation strategies from the government and financial sector, along with technological progress, strengthen the development of fintech services.STC Pay is a mere and good example of the reality that these efforts are creating.

Statistics indicate that the use of mobile wallets within Saudi Arabia has quadrupled by over 200% during the last few years. Millions of individuals now use various digital wallets for purposes ranging from paying bills to transferring money to family members overseas. It is the platform most favoured by Saudi citizens because of its convenience, speed, and security features.

Features That Make STC Pay A Trusted Wallet

There are many reasons for the stake of STC Pay in success and trustworthiness. This mobile wallet has many traits that make it very convenient, safe, and user-friendly. Here are some of the outstanding features contributing to STC Pay's success as a leader in the digital wallet market:

User-Friendly Interface:

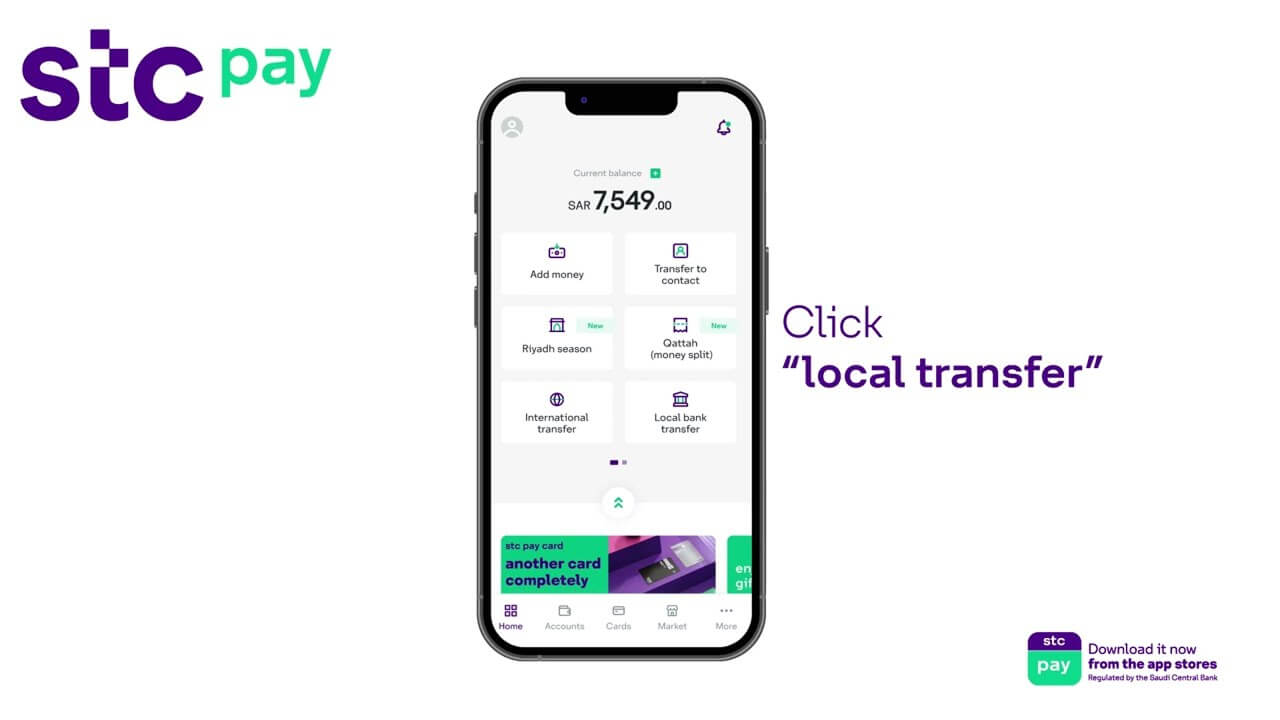

The clear and instinctive design is the best reason for Western Union STC pay popularity. It is easy to use, enabling even the least tech-savvy to navigate through the app. The interface is available in Arabic and English and caters to a larger audience in Saudi Arabia. Users can easily access all their key financial tools, from paying to money transfer, without any confusion.

Security:

Security is one major concern related to digital financial services, and STC Pay app is fully aware of that. No doubt, STC Pay has secured all possible measures for protecting user data and completing financial transactions successfully. The application uses encryptions as a means of securing the entire data transmissions involved in the processes along with multiple authentication forms like biometric recognition (fingerprint or face ID). Such measures will allow for the mental peace of users during transactions as their particularly sensitive financial information will be conditioned to such highly effective safeguards against unauthorised accesses.

Global Reach:

STC Pay login isn't just for Saudi Arabia. This mobile wallet has a unique quality that makes it useful for trans-border payments, such as sending money from here to your family abroad or even shopping internationally. Thus, the man may send money to more than 40 countries, Kuwait, Egypt, the UAE, and hundreds more, which should consider STC Pay for international transactions. In other words, it shapes the financial world as a financial solution for Saudi nationals and expatriates alike.

Integration with Other Financial Systems:

STC Pay integrates well with other financial systems, allowing connections between bank accounts, debit and credit cards, and even more digital wallets. This integration enables the user to manage his or her finances under just one umbrella, eliminating the clumsiness of switching between numerous applications or websites. Such an offer makes the entire experience highly appealing to those wanting the convenience of a one-stop shop for their financial needs.

Business-Friendly Features: Apart from services targeting individuals, STC Pay has also come up with a unique set of instruments for businesses. The STC Pay for Business allows merchants to receive payments using QR technology, manage invoices, and handle financial transactions all in one place. This type of service is best suited for small to medium-sized businesses (SMBs) that want to digitise processes and streamline cash flow control. As more and more businesses in Saudi Arabia turn towards solutions for digital payments, STC Pay positions itself as a credible partner with all the companies in the region.

STC Pay's Role In The Fintech Ecosystem Of Saudi Arabia

STC Pay functions as a vital instrument to shape Saudi Arabia's fintech environment because this Arabian nation actively promotes technological economic advancements. Saudi Arabia fosters an ideal setting for its developing fintech sector because public and private institutions work together on shared goals.

For the current case, the STC Pay wallet is very important. It is not simply a case whereby the STC Pay wallet facilitates cashless payments; it goes beyond that to ensure financial inclusion by providing a possible way for individuals without traditional banking access to manage their finances digitally. This is particularly relevant for a country where most individuals, especially in rural areas, live without bank accounts.

Besides that, STC Pay also contributed to the e-commerce growth in Saudi Arabia by providing a secure and simple method for online transaction payments. As Saudi Arabia's consumers' spending power increases in e-commerce markets over time, so will the need for secure digital payment methods. The simplicity of STC Pay with e-commerce platforms makes it one of the vital solutions for online shopping.

Statistics And Facts About Growth Of STC Pay:

One of the fastest-growing mobile wallet solutions today, STC Pay, has managed to grow fast ever since it was launched. Here the,n are some figures that show how much success is on the platform's side:

User Base:

STC Pay has over seven million registered users in 2024. It has become one of the five most popular digital wallets in the Kingdom. Large populations indicate reliability, security, and ease of use in the app's credibility. The app will keep growing as more Saudi citizens and residents adopt it for their daily transactions.

Payment Volume:

In the annual volume of its processing transactions, STC Pay has shown very significant growth of 50% year-on-year, and it is similarly important for the growth that is soon happening in the Kingdom regarding going digital with payments.

International Transactions:

The site now supports international money transfers to over 40 countries. This could be very useful for expatriates in Saudi Arabia who want to send cash home to their families. The global expansion clearly shows STC Pay's intention for its customers to enjoy the ease of cross-border financial services.

Why Choose DXB APPS For Fintech App Development In Saudi Arabia And The Middle East?

If you want your brand's newest fintech app to develop either as a digital wallet or any other financial solution, DXB APPS is your ultimate partner in building such a packet. Equipped with a thorough understanding of the financial sector and local regulatory norms, we excel at Mobile App Development Dubai of top-notch, safe, and user-friendly fintech apps for businesses located in Saudi Arabia, the UAE, and the rest of the Middle East.

As a leading Mobile App Development Company, we have a proven history of doing Mobile App Development Abu Dhabi for contemporary businesses and have a team of highly skilled developers working closely with clients so that we can customise applications to their precise requirements. Whether building a digital wallet such as STC Pay or other types of fintech app development company in Saudi Arabia, DXB APPS has what it takes to turn your concept into a reality.

Conclusion

Thus, STC Pay has become a powerful part of the digital payment scenario in the Kingdom of Saudi Arabia. Its rich features, easy-to-navigate interface, and strong security features have won the trust of millions of users across the Kingdom. Individual customers looking for efficient ways to keep their money secure or businesses wishing to expedite payments will find STC Pay as their one-stop solution.

Businesses wishing to develop their own fintech application can approach DXB APPS for world-class app development services in the region. Our team can build anything from mobile wallets to a fully-fledged financial platform to give your business the modern touch in terms of technology and solutions applicable to your use.

FAQS

What is STC Pay, and how does it work?

The mobile wallet service STC Pay operates under the Saudi Telecom Company (STC). Customers can digitally manage funds using the wallet and perform payments with invoice systems and money transfers. The user can conduct safe transactions after completing the app download along with an account card or bank connection.

Can I use STC Pay outside of Saudi Arabia?

STC Pay permits its users to transfer money to 40 countries all across the globe. Hence, you can carry international money transfer operations on the app, making it a fantastic choice for expatriates and those having families overseas.

How do I reach STC Pay customer care?

If you need help with STC Pay, you may contact their customer support team through the app or call the STC Pay customer care number. Their website provides an extensive FAQ section to help with many common problems.

Is STC Pay for businesses too?

Yes, STC Pay has set up its services to fulfil businesses. STC Pay for Business enables merchants to receive payments through QR codes and operate invoice management features and transaction processing together with multiple other capabilities. The solution provides excellent digital payment capabilities to companies seeking to streamline their operations.

How do I log into my STC Pay account?

To log in to your STC Pay account, open the application and enter your registered phone number. You will have to complete a security step, such as entering a PIN or biometric verification (fingerprint or face recognition) for protection. If you experience any problems, though, you can reach out to STC Pay's customer support for help.