Perhaps you've heard of the Binance platform. As one of the top financial technology companies, Binance has established itself in more than 180 nations worldwide. In addition, it allows customers to leverage the exchange of over 600 different currencies.

You may now be curious about the Binance business plan. You'll have many questions, such as how Binance operates, how it generates revenue, and which other mobile app development are doing very well. This blog will provide you with detailed information about the Binance business strategy and answer any queries you may have.

Now, let's set out to investigate the Binance Business Model.

What is Binance- A Leading Digital Asset Trading Platform?

Binance is the largest digital asset trading platform globally in terms of trade volume. This platform was designed specifically to safely acquire, dispose of, or exchange different cryptocurrency assets.

Trades between fiat currencies and other cryptocurrencies are highly valued on Binance, a centralized cryptocurrency exchange platform. In the global market, Binance's native coin is referred to as BNB, and the company has its blockchain, called BNB chain.

Although BNB was first introduced as a utility token in 2017, CoinMarketCap currently ranks it as one of the top cryptocurrencies. And as of right now, it offers many benefits to both holders and traders. BNB coins can be used as a gas fee when users exchange tokens on the BNB chain in the DeFi exchange, such as Pancakeswap, Bakeryswap, etc.

A Brief History Of Binance

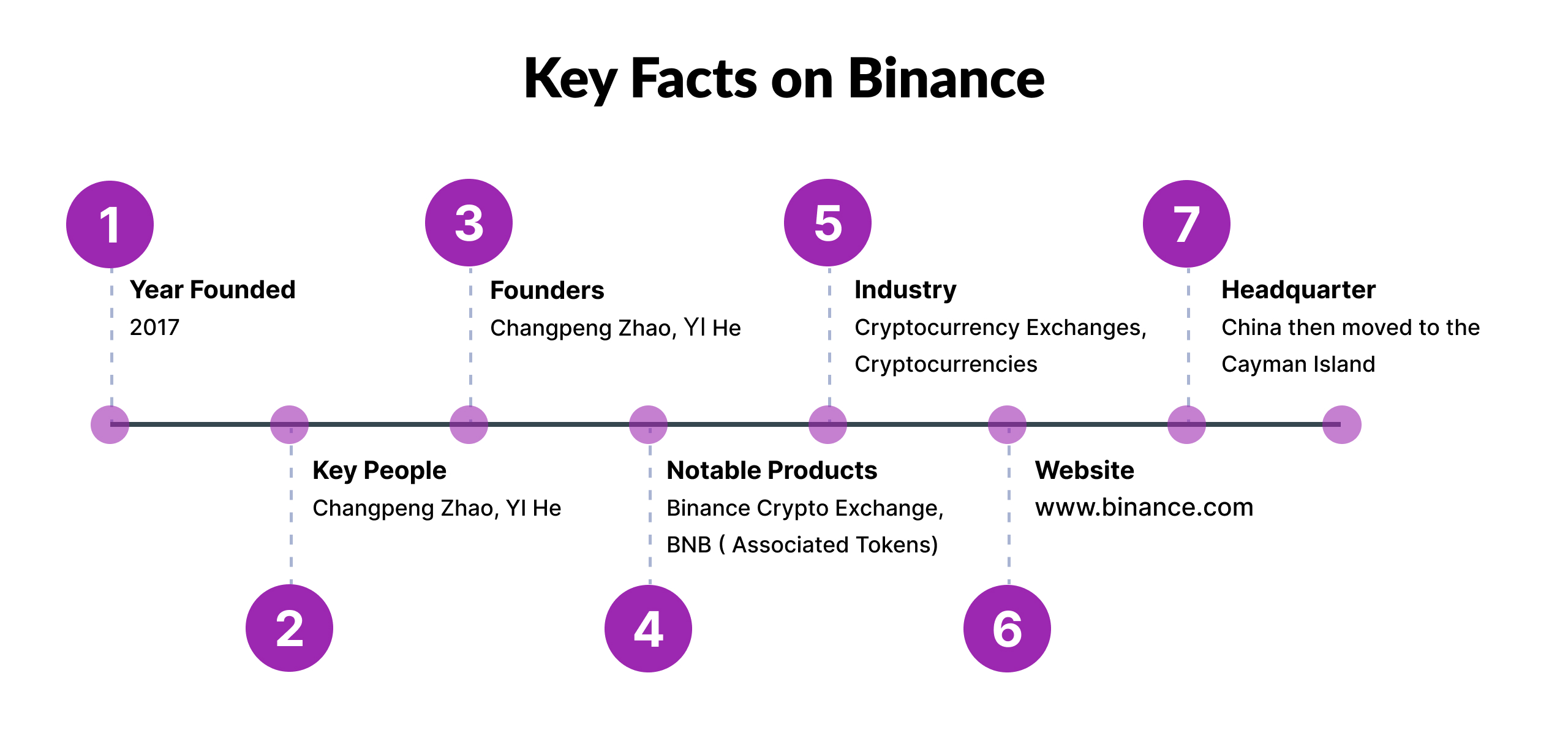

Changpeng Zhao, also called "CZ," founded Binance in China in 2017, and it has since become the leading cryptocurrency company.

Before Changpeng Zhao entered the emerging cryptocurrency market and became well-known, he had experience developing high-frequency trading algorithms for stockbrokers by top app developers.

By January 2018, Binance was even the biggest cryptocurrency exchange globally, with daily trading volume reaching billions of dollars. In 2021, the company surpassed all competitors and achieved a peak 24-hour volume of almost $76 billion.

Let's look at how Binance has changed over time to understand better how it came to be known.

2017:

Changpeng Zhao, the current CEO of Binance, founded the company. It was founded in China, but by September 2017, it had moved its servers to Japan due to the Chinese government's stringent regulation of the cryptocurrency industry. In June, the company unveiled BNB, its token. Subsequently, it ascended to become the third-most traded token worldwide.

2018:

By 2018, Binance has already eclipsed all other cryptocurrency exchanges to become the largest globally, with a market worth over $1.3 billion. The company attempted to move its headquarters to Japan in March as the country began to enact stricter cryptocurrency regulations.

2019:

In January 2019, Binance partnered with Simplex to make it possible to purchase cryptocurrencies with a debit or credit card. It was disclosed in May that the corporation was the victim of an attack that resulted in the theft of $40 million. In September, the company began offering perpetual futures contracts, enabling a 125x leverage on the deals.

2020:

Changpeng Zhao had created a structure to deceive US regulators and profit from investors there, according to documents that Forbes staff members disclosed in October of that year. The company unveiled the Binance Smart Chain, or BSC, blockchain ecosystem in September.

2021:

In May 2021, the US Department of Justice and the IRS started investigating Binance for potential tax evasion and money laundering. These investigations would continue and have already begun.

2022:

In February 2022, Binance purchased a substantial $200 million stake in Forbes, a company that had just released legal documents. The company also said that year that it would not be ceasing operations in Russia, a stark contrast to the rest of the world. Their stance would change when they began prohibiting Russians with more than 10,000 Euros from trading on the platform.

Here are some important Binance statistics as of July 2023:

Binance Exchange trading volume in a day- 38 billion USD

Digital Money 350+ are listed

140 million users are registered as of now

Transaction Fees at the Lowest: <0.10%

Well-known cryptocurrency: BNB

Binance Business Model - How Does Binance Work?

You may wonder what value Binance brings to its clients and how its business strategy has contributed to its extraordinary success.

Now, let's examine Binance's business plan to see how it generates revenue.

Segmenting Customers

Two groups of Binance customers can be distinguished:

- Traders: Those seeking a rapid and secure venue for exchanging or swapping digital assets.

- Innovators: People who persistently desire to publish their concepts are innovators in the Bitcoin sector.

Channels on Binance

Binance is a well-known cryptocurrency platform with iOS and Android app development and a website.

Crucial Functions

Additional queries and searches on the Internet about Binance's primary functions and pursuits exist. Okay, so it includes

- Exchange

- Software as a service, or SaaS

- Trading Agriculture

Proposition of Value

Among the benefits offered by Binance are

Trades: Have access to a safe, well-liquid Bitcoin market with minimal transaction costs.

Crypto Innovators: It's a benefit that Binance Labs, a technology incubator, and LaunchPad, a hosting platform for new apps and API interfaces, are accessible to promote creative pre-ICO projects.

Binance's Cost Structure

Undoubtedly, Binance makes money in several ways, yet its expenses include

- Compensation for IT operations

- (Digital and Print) advertising

- Upkeep of its website and applications

- Binance's Client Connections

Binance is renowned for its operations as well as the customer service it provides over a range of channels, including

- Send an email

- Social Media Platforms

- Phones

- The Binance Community and Academy

After reading through their business plan, you should understand how Binance got its start in the cryptocurrency exchange industry. Let's now examine in detail the method Binance uses to generate revenue.

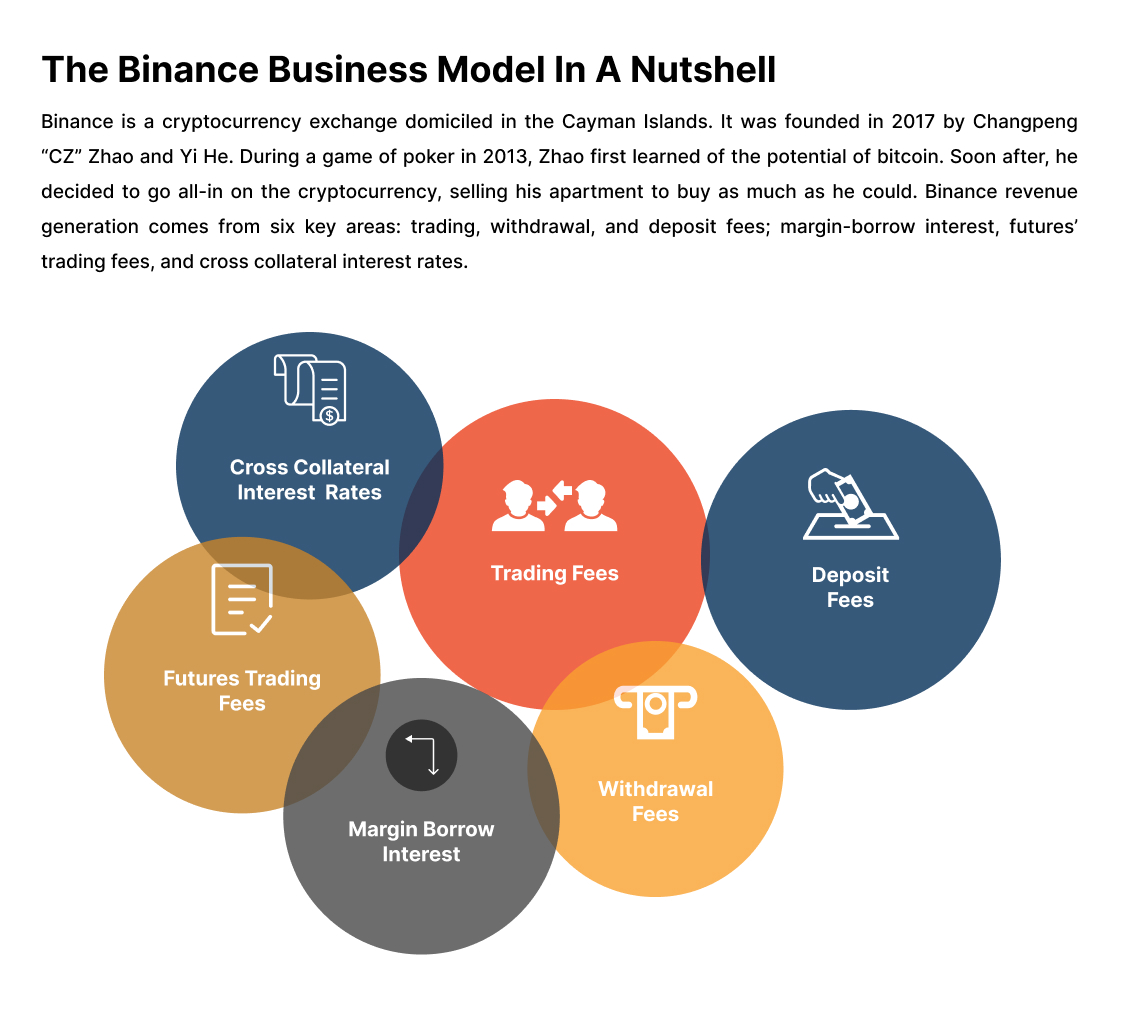

When it comes to earning money, Binance gets its money through trading commissions, margin fees, spreads, interest on cryptocurrency loans, withdrawal fees, and broker program fees. It also makes money from its investments, cloud services, mining services, and interchange fees.

Transaction Charges

To be precise, trading fees are the main source of income for Binance. There is a steep 0.5% buy/sell cryptocurrency cost and a 0.1% spot trading fee.

The problem is that if you have BNB in your trading account, your cryptocurrency investments will be deducted from this total. The cost for traders who wish to leverage this option is 25% less because BNB is already in their accounts. Isn't that incredible?

Fees For Deposit And Withdrawal

Binance doesn't impose fees for deposits made using cryptocurrencies. However, they charge a withdrawal fee, which varies according to where the wallet is received. Because withdrawal rates depend on blockchain networks, they can fluctuate quickly due to factors like network congestion.

There is a fee for both deposits and withdrawals in fiat money. Wire transfers done in USD using Signet or SWIFT are free of charge. In the US, domestic withdrawal fees for USD are $15; however, international wire transfers incur a significantly higher price of $35. It costs nothing to make deposits or withdrawals via an ACH transfer.

Margin Charges

Binance determines the interest rate on a margin account on an hourly basis. As a result, the cost will stay the same whether you borrow money for a minute or almost an hour.

Charges For Cryptocurrency Loans

Binance offers loans backed by cryptocurrencies with maturities ranging from 7 to 180 days. Users' cryptocurrency holdings can be pledged as security for loans on the website. Binance makes money through interest fees.

The interest rate is determined by the total amount borrowed, the amount of collateral deposited, the type of currency borrowed, and the selected return period.

Exchange Fees For Crypto Card Transactions

Transaction fees, assessed when users use their Binance crypto cards to make purchases or withdraw cash from an ATM using fiat currency, are how Binance generates revenue, much like banks that offer debit or credit cards in fiat currency.

Fees For Mining Pools

Users must pay a 2.5% pool fee for Bitcoin and a 0.5% pool cost for Ether to participate in Binance's mining pool. Coins like LTC, BCH, and others are mineable. The mining cost associated with each coin is charged when using Binance's mining pool.

High-End Web Development Solutions By DXB APPS

DXB Apps, a leading website development company Dubai, can realize your digital vision with state-of-the-art technology and unmatched experience. Improve your online visibility using custom web solutions that appeal to your target market.

Conclusion

Binance's business strategy embodies creativity and flexibility in the dynamic world of cryptocurrencies. Binance is redefining industry standards and influencing the direction of finance by putting user experience first and expanding its revenue streams. Feel the power of Binance for yourself by joining the movement today with DXB APPS, the top mobile app development company.

FAQs

How does Binance guarantee user transaction security?

Binance uses cutting-edge security methods like two-factor authentication and multi-layered encryption to protect customer cash and data.

Does Binance allow users to make passive income?

Indeed, by holding specific Cryptocurrencies on the Binance platform, users can participate in various staking schemes and receive incentives.

Does Binance provide services for customers?

Yes, Binance offers 24/7 customer service to help with any questions or issues that users may have.

Is Binance subject to any financial authorities' regulations?

Regulatory compliance varies throughout regions despite Binance's global operations. Nonetheless, Binance is still dedicated to following all applicable laws and providing a safe trading environment for its customers.